By: Russ Kamp, CEO, Ryan ALM, Inc.

Anyone who has read my blogs (>1,700 to date) knows that my personal mission and that of Ryan ALM, Inc. is to protect and preserve defined benefit pension plans. How is our collective mission pursued? It is through the implementation of unique client-specific cash flow matching (CFM) assignments. Since every pension plan has liabilities unlike any other fund, a unique solution must be created unlike most investment management products sold today.

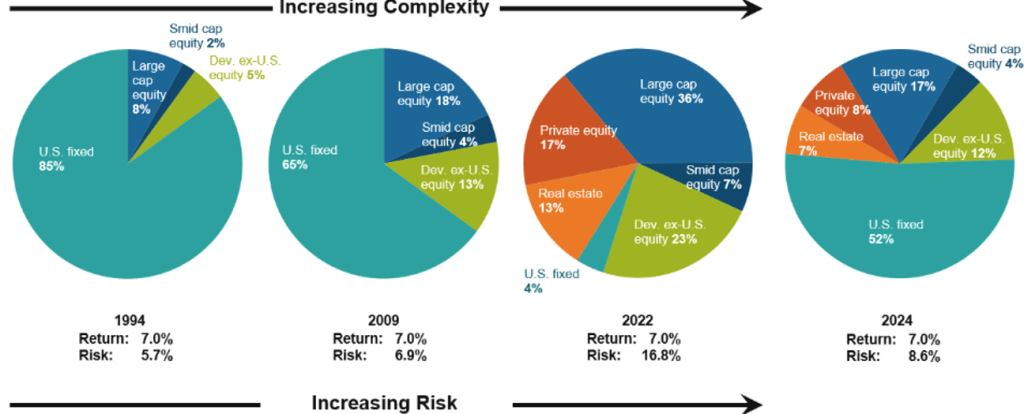

Here is the reality: There are a lot of wonderful people in our industry, representing impressive investment organizations, tasked with introducing a variety of investment products. Plan sponsor trustees, with the help of their investment consultants, must determine which products are necessary for their plan to help reach the goal of funding the promised benefits. This is an incredibly challenging exercise if the goal is to cobble together a collection of investment managers whose objective is to achieve a return on asset assumption (ROA). This exercise often places pension funds on the proverbial rollercoaster of returns. The pursuit of a return as the primary goal doesn’t guarantee success, but it does create volatility.

On the other hand, wouldn’t it be wonderful if one could invest in strategy that brings an element of certainty to the management of pension plans? What if that strategy solved the problem of producing ALL of the necessary liquidity needed to fund monthly benefits and expenses without having to sell securities or sweep cash (dividends and capital distributions) from higher earning products? Wouldn’t it be incredible if in the process of providing the liquidity for some period of time, say 10-years, you’ve now extended the investing horizon for the residual assets not needed in the liquidity bucket? Impossible! Hardly. Cash flow matching does all that and more.

I recently had the privilege of introducing CFM to someone in our industry. The individual was incredibly curious and asked many questions. Upon receiving my replies, they instinctively said “why isn’t everyone using this”? That person then said you aren’t selling a product: it is a SERVICE. How insightful. Yes, unlike most investment strategies that are sold to fill a gap in a traditional asset allocation in pursuit of the “Holy Grail” (ROA), CFM is solving many serious issues for the plan sponsor: liquidity and certainty being just two.

Substituting one small cap manager for another, or shifting 3% from one asset class or strategy to another is not going to make a meaningful impact on that pension plan. You get the beta of that asset class plus or minus some alpha. None of these actions solve the problem of providing the necessary liquidity, with certainty, when needed. None of them are creating a longer investing horizon for the residual assets to just grow and grow. None of those products are supporting the primary pension objective which is to SECURE the promised benefits at low cost and with prudent risk.

So, Ryan ALM, Inc. is providing a critical service in support of our mission which is to protect and preserve your DB pension plan. Why aren’t you and others (everyone) taking advantage of this unique service?