By: Russ Kamp, CEO, Ryan ALM, Inc.

In 1938, journalist Walter Morrow, Scripps-Howard newspaper chain, wrote the phrase “there ain’t no such thing as a free lunch”. The pension community would be well-served by remembering what Mr. Morrow produced more than eight decades ago. Morrow’s story is a fable about a king who asks his economists to articulate their economic theory in the fewest words. The last of the king’s economists utters the famous phrase above. There have been subsequent uses of the phrase, including Milton Friedman in his 1975 essay collection, titled “There’s No Such Thing as a Free Lunch”, in which he used it to describe the principle of opportunity cost.

I mention this idea today in the context of private credit and its burgeoning forms. I wrote about capacity concerns in private credit and private equity last year. I continue to believe that as an industry we have a tendency to overwhelm good ideas by not understanding the natural capacity of an asset class in general and a manager’s particular capability more specifically. Every insight that a manager brings to a process has a natural capacity. Many managers, if not most, will eventually overwhelm their own ideas through asset growth. Those ideas can, and should be, measured to assess their continuing viability. It is not unusual that good insights get arbitraged away just through sheer assets being managed in the strategy.

Now, we are beginning to see some cracks in the facade of private credit. We have witnessed a significant bankruptcy in First Brands, a major U.S. auto parts manufacturer. Is this event related to having too much money in an asset class, which is now estimated at >$4 trillion.? I don’t know, but it does highlight the fact that there are more significant risks investing in private deals than through public, investment-grade bond offerings. Again, there is no free lunch. Chasing the higher yields provided by private credit and thinking that there is little risk is silly. By the way, as more money is placed into this asset class to be deployed, future returns are naturally depressed as the borrower now has many more options to help finance their business.

In addition, there is now a blurring of roles between private equity and private credit firms, which are increasingly converging into a more unified private capital ecosystem. This convergence is blurring the historic distinction between equity sponsors and debt providers, with private equity firms funding private credit vehicles. Furthermore, we see “pure” credit managers taking equity stakes in the borrowers. So much for diversification. This blurring of roles is raising concerns about valuations, interconnected exposures, and potential conflicts of interest due to a single manager holding both creditor and ownership stakes in the same issue.

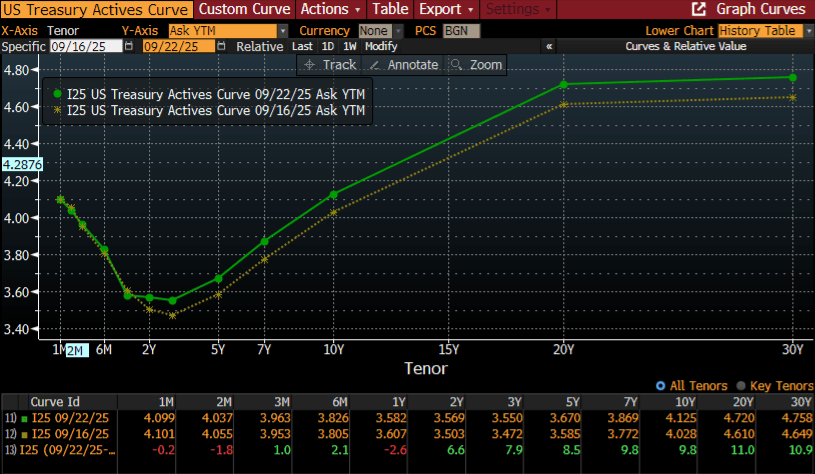

As a reminder, public debt markets are providing plan sponsors with a unique opportunity to de-risk their pension fund’s asset allocation through a cash flow matching (CFM) strategy. The defeasement of pension liabilities through the careful matching of bond cash flows of principal and interest SECURES the promised benefits while extending the investing horizon for the non-bond assets. There is little risk in this process outside of a highly unlikely IG default (2/1,000 bonds per S&P). There is no convergence of strategies, no blurring of responsibilities, no concern about valuations, capacity, etc. CFM remains one of the only, if not the only, strategies that provides an element of certainty in pension management. It isn’t a free lunch (we charge 15 bps for our services to the first breakpoint), but it is as close as one will get!