By: Russ Kamp, CEO, Ryan ALM, Inc.

There has been some debate within the investment industry related to National Institute on Retirement Security’s (NIRS) recent release of their report titled, “Retirement in America: An Analysis of Retirement Preparedness Among Working-Age Americans”. A report that claimed that “across all workers (21-64), including those with no savings, the median amount saved was only $955.”

Those complaining about the findings cited as issues the inclusion of young workers, while also citing that the information used in the analysis was self-reported. Furthermore, there was mention of the fact that there is an impending massive wealth transfer from both the Silent and Baby Boomer generations to Millennials that will act to mitigate retirement savings shortfalls. Really? Let’s explore.

Including young workers will skew the results, as most haven’t had the chance to establish households and begin to save. Let’s focus on more mature workers, such as those age 55-64. How are they doing? According to Vanguard, the median (I hate averages) 401(k) balance for participants in that age cohort is only $95,642, as reported in Vanguard’s How America Saves 2025 report. That certainly doesn’t seem like a significant sum to carry one through a 20+ year retirement.

Furthermore, >30% of eligible DC participants are not contributing at all, while only 2% (according to Fidelity) have account balances exceeding $1 million. If one applies the 4% rule to an account balance with only $95,642, that participant can “safely” withdraw $3,826 per year to fund their retirement. That coupled with an average Social Security payout ($24.8k annually) is not going to get you too far. Heck, my property taxes in Midland Park are >$32k per year.

How about the impact of the great wealth transfer? Millennials must be set to receive a significant windfall – right? Not so fast, as the typical millennial can expect little or nothing from the “great wealth transfer”. For those who do receive something, amounts in the low five figures are a reasonable estimation: that certainly is not a life‑changing windfall. But aren’t the estimates regarding the transfer ranging from $84-$90 trillion with some estimates as significant as $100 trillion? Where is all that wealth going?

- Fewer than one‑third of U.S. households receive any inheritance at all; 70–80% inherit nothing.

- Inheritances are disproportionately a feature of affluent families: in one analysis, inheritances are passed in about half of top‑5% households versus only 12% in the bottom 50%.

- Wealthier boomers are more than twice as likely to leave inheritances as poorer Americans, implying the transfer will largely reinforce existing inequalities.

- Across all households that receive something, the average inheritance is about $46,000, but this is heavily skewed by very large bequests at the top.

- For the bottom 50% of households that receive an inheritance, the average is around $9,700.

- For those in the broad “middle” (roughly the next 40% by wealth), the average inheritance is around $45,900.

So, in terms of expectation for the typical millennial, a large share will receive nothing, as their parents lack assets, too. Unfortunately, the “headline” trillions mostly reflect very large transfers to a relatively small share of already‑wealthy households. In short, the great wealth transfer is real in aggregate, but for the median millennial it looks less like a solution to a retirement shortfall!

The demise of defined benefit plans and the nearly exclusive use of defined contribution plans is creating a crisis. The current situation may not be as scary as the headline that the median amount saved is only $955, but $95,642 (or <$4k/year) is not going to help one navigate through a long retirement, especially as inflation associated with healthcare costs continues to rise rapidly.

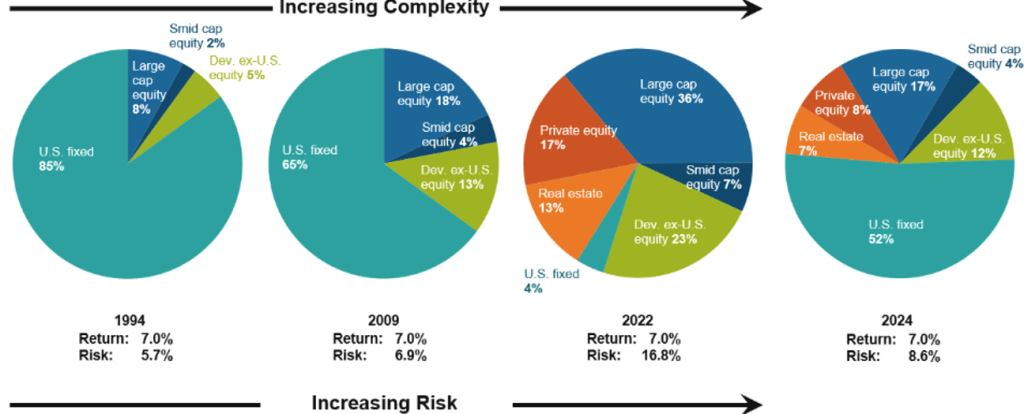

Again, asking individuals to fund, manage, and then disburse a retirement benefit without the necessary disposable income, investment acumen, and NO crystal ball to help with longevity issues, is poor policy, at best. Everyday expenses are overwhelming family finances. The prospect of a dignified retirement is evaporating. Debating whether to include private/alternative investments and cryptos in 401(k) offerings is certainly not the answer. We need real solutions to this crisis. Where are the adults in the room?