By: Russ Kamp, CEO, Ryan ALM, Inc.

I asked an AI tool that I use the following: Asset/Liability Management (ALM) is an effective tool for pensions. What strategies are currently being deployed?

As usual, the response was nearly instantaneous, but was it correct? Here is what I got:

Overview

“Asset/liability management (ALM) remains central to pension fund sustainability, aiming to balance expected pension liabilities with optimal asset growth. In 2025, pension funds deploy a range of strategies to ensure their ability to meet long-term obligations while managing risk efficiently.” No argument there. However, here is a list of the strategies. This is where I have an issue.

Key ALM Strategies Currently in Use

1. Liability-Driven Investing (LDI)

- Matching Asset Duration to Liabilities: Many corporate pension plans invest in high-quality bonds with durations closely matching those of plan liabilities to mitigate interest rate risk. This ensures that both assets and liabilities react similarly to interest rate changes, stabilizing the funded status from year to year.

- Glidepath Strategies: Plans gradually shift the asset mix towards more fixed-income securities as funded status improves or as the plan matures, further reducing risk and aligning assets with near-term liabilities.

2. Dynamic Asset Allocation

- Strategic Shifts in Asset Mix: Pension funds adjust allocations based on changing liabilities, market conditions, and funding status. For instance, U.S. public pension plans have recently shifted asset allocations to maintain return expectations and recover from volatility.

- Scenario-Based Modeling: Funds use forward-looking models to stress-test outcomes under varying economic scenarios, reviewing assumptions about returns, inflation, and participant demographics.

3. Risk Transfer Solutions

- Pension Risk Transfer (PRT): Many sponsors employ annuity purchases and lump-sum windows to reduce long-term liability, transferring obligations to insurers. In 2024, settlement payouts (such as annuity buyouts) remained a significant tool for risk management among major pension plans.

4. Liability Modeling Innovations

- Member-Level Simulation: Advanced models project individual participant cash flows, account for currency exposure, and enable granular liability projections. Such approaches allow more precise matching of assets to future obligations, improving ALM decision-making.

- Regular Reviews and Assumption Updates: ALM programs, such as those at CalPERS, involve systematic reviews of demographic and financial assumptions (e.g., life expectancy, inflation), with revisions made every four years to incorporate emerging trends.

5. Use of Custom Benchmarks

- Liability-Mimicking Portfolios: Funds create tailored portfolios (“benchmark” portfolios) that track the liability profile as closely as possible, often blending nominal bonds, inflation-linked bonds, and equities according to the plan’s specifics (such as maturity and inflation sensitivity).

That’s it? Where is Cash Flow Matching (CFM)? In each of these scenarios, liquidity needed to fund benefits and expenses is missing. Duration strategies minimize interest rate risk, but don’t produce timely liquidity to fully fund B+E. Furthermore, duration strategies that use an “average” duration or a few key rates don’t duration match as well as CFM that duration matches EVERY month of the assignment.

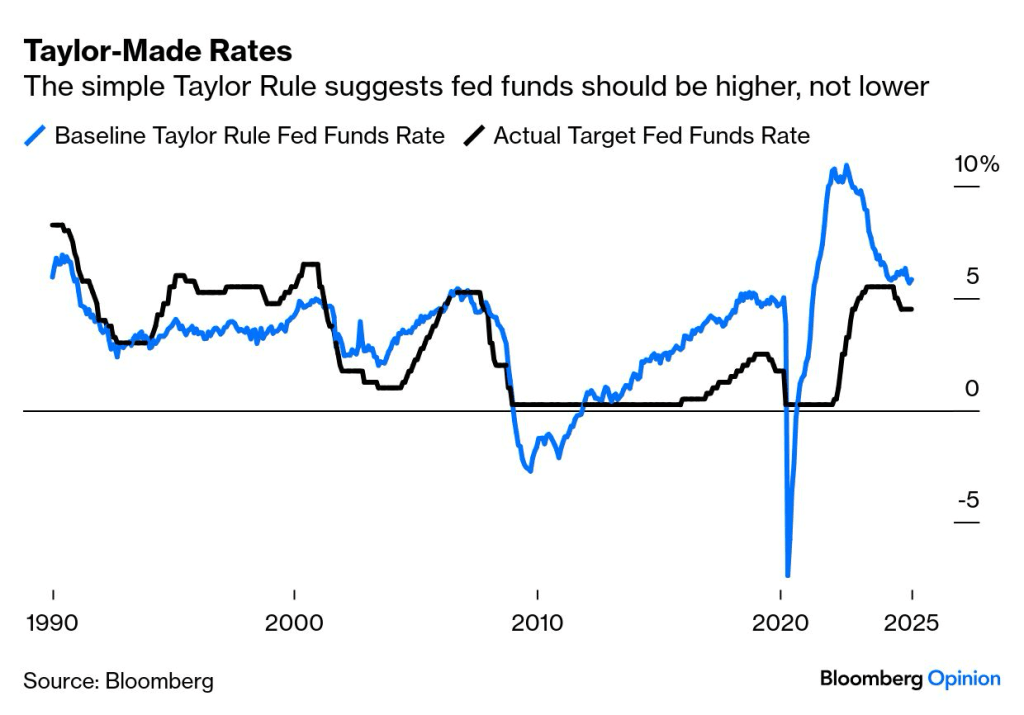

In the second set of products – dynamic asset allocation – what is being secured? Forecasts related to future economic scenarios come with a lot of volatility. If anyone had a crystal ball to accomplish this objective with precision, they’d be minting $ billions!

A PRT or risk transfer solution is fine if you don’t want to sustain the plan for future workers, but it can be very expensive to implement depending on the insurance premium, current market conditions (interest rates), and the plan’s funded status

In the liability modeling category, I guess the first example might be a tip of the hat to cash flow matching, but there is no description of how one actually matches assets to those “granular” liability projections. As for part two, updating projections every four years seems like a LONG TIME. In a Ryan ALM CFM portfolio, we use a dynamic process that reconfigures the portfolio every time the actuary updates their liability projections, which are usually annually.

Lastly, the use of Custom benchmarks as described once again uses instruments that have significant volatility associated with them, especially the reference to equities. What is the price of Amazon going to be in 10-years? Given the fact that no one knows, how do you secure cash flow needs? You can’t! Moreover, inflation-linked bonds are not appropriate since the actuary includes an inflation assumption in their projections which is usually different than the CPI.

Cash Flow Matching is the only ALM strategy that absolutely SECURES the promised benefits and expenses chronologically from the first month as far out as the allocation will go. It accomplishes this objective through maturing principal and interest income. No forced selling to meet those promises. Furthermore, CFM buys time for the residual assets to grow unencumbered. This is particularly important at this time given the plethora of assets that have been migrated to alternative and definitely less liquid instruments.

As mentioned earlier, CFM is a dynamic process that adapts to changes in the pension plan’s funded status. As the Funded ratio improves, allocate more assets from the growth bucket to the CFM portfolio. In the process, the funded status becomes less volatility and contribution expenses are more manageable.

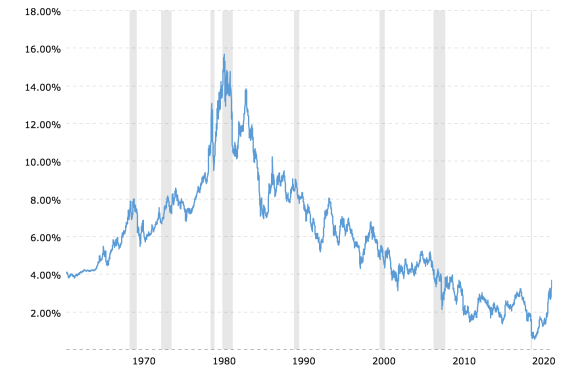

I’m not sure why CFM isn’t the #1 strategy highlighted by this AI tool given its long and successful history in SECURING the benefits and expenses (B&E). Once known as dedication, CFM is the ONLY strategy that truly matches and fully funds asset cash flows (bonds) with liability cash flows (B&E). Again, it is the ONLY strategy that provides the necessary liquidity without having to sell assets to meet ongoing obligations. It doesn’t use instruments that are highly volatile to accomplish the objective. Given that investment-grade defaults are an extremely rare occurrence (2/1,000 bonds), CFM is the closest thing to a sure bet that you can find in our industry with proven performance since the 1970s.

So, if you are using an AI tool to provide you with some perspective on ALM strategies, know that CFM may not be highlighted, but it is by far the most important risk reducing tool in your ALM toolbox.