By: Russ Kamp, CEO, Ryan ALM, Inc.

Whether one is referring to public pensions or private DB plans, September was a continuation of the positive momentum experienced for most of 2025. Milliman has reported on both the Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans and its Public Pension Funding Index (PPFI), which analyzes data from the nation’s 100 largest public defined benefit plans.

Milliman estimates that public pension funds saw aggregate returns of 1.7%, while corporate plans produced an average return for the month of 2.5%. As a result of these gains (sixth consecutive gain), public pension funded ratios stand at 85.4% up from 84.2% at the end of August. Corporate plans are now showing an aggregate funded ratio of 106.5%, marking the highest level since just before the Great Financial Crisis (GFC).

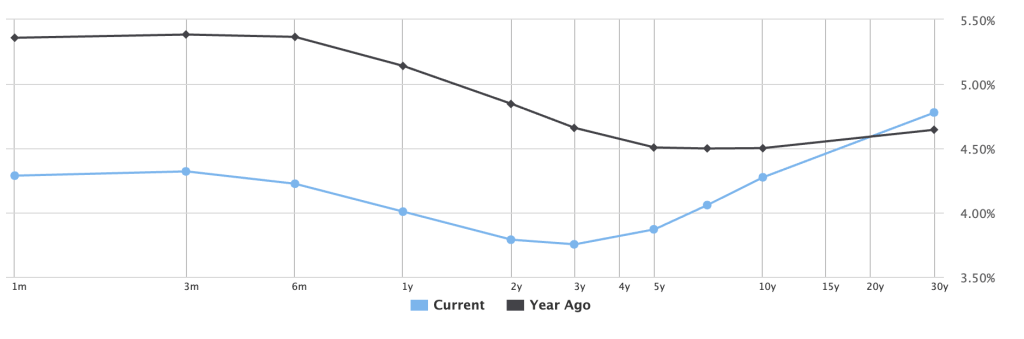

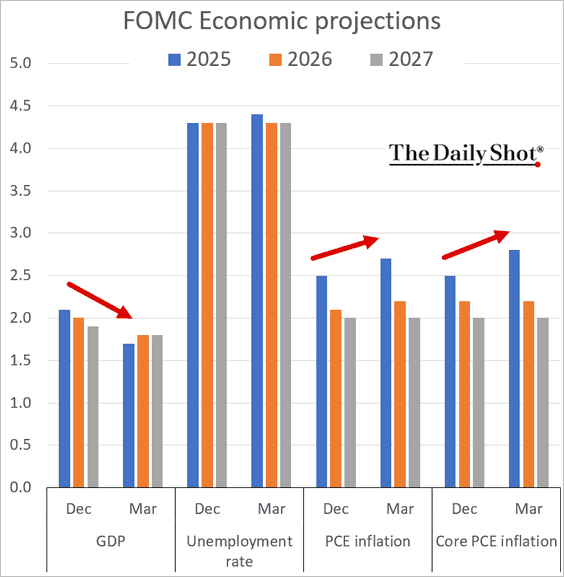

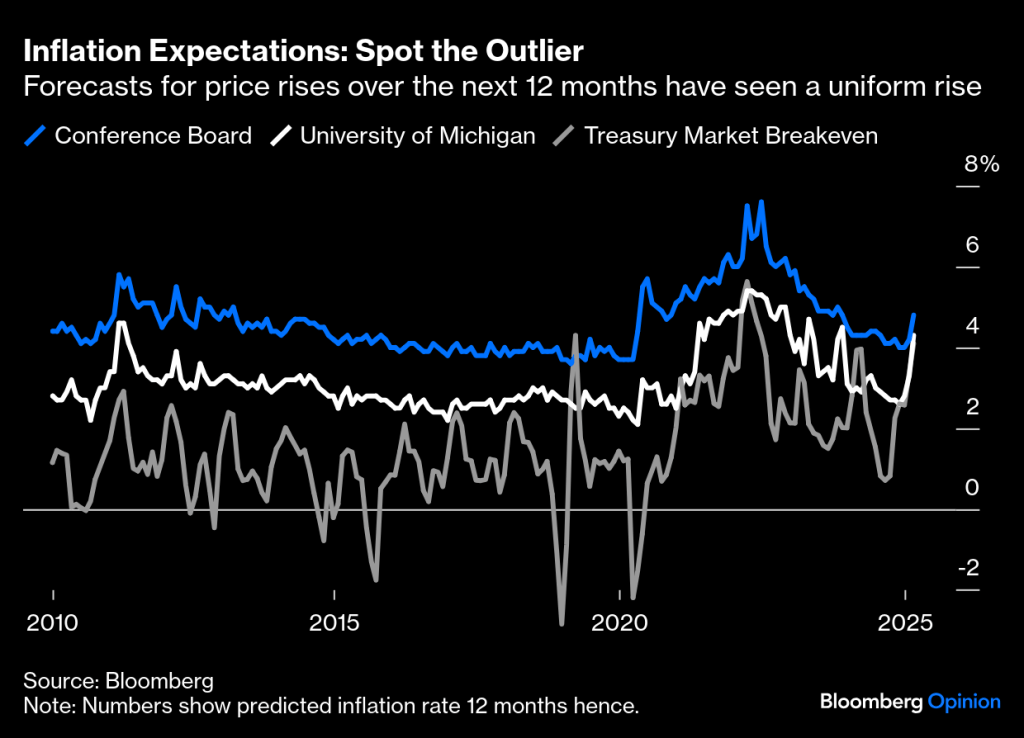

Public pension fund assets are now $5.66 trillion versus liabilities of $6.63 trillion, while corporate plans added $26 billion to their collective net assets increasing the funded status surplus to $80 billion. For corporate plans, the strong 2.5% estimated return was more than enough to overcome the decline in the discount rate to 5.36%, a pattern that has persisted for much of 2025.

“Robust returns helped corporate pension funding levels improve for the sixth straight month in September,” said Zorast Wadia, author of the Milliman PFI. “With more declines in discount rates likely ahead, funded ratios may lose ground unless plan assets move in lockstep with liabilities.”

“Thanks to continued strong investment performance, public pension funding levels continued to improve in September, and unfunded liabilities are now below the critical $1 trillion threshold for the first time since 2021,” said Becky Sielman, co-author of the Milliman PPFI. “Now, 45 of the 100 PPFI plans are more than 90% funded while only 11 are less than 60% funded, underscoring the continued health of public pensions.”

Discount rates have so far fallen in October. It will be interesting to see if returns can once again prop up funded status for corporate America. It will also be interesting to see how the different accounting standards (GASB vs. FASB) impact October’s results. A small gain for corporate plans may not be enough to overcome the potential growth in liabilities, as interest rates decline, but that small return may look just fine for public pension plans, that don’t mark liabilities to market only assets.