By: Russ Kamp, CEO, Ryan ALM, Inc.

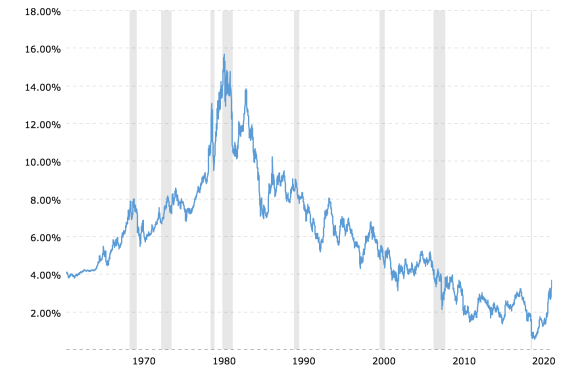

As we’ve discussed in this blog on many occasions, the U.S. interest rate decline from 1982 to 2022 fueled risk assets well beyond their fundamentals. During the rate decline, investors became accustomed to the US Federal Reserve stepping in when markets and the economy looked dicey. There seems to be a massive expectation that the “Fed” will once again support those same risk assets by initiating another rally through a rate decline perhaps as soon as September. Is that action justified? I think not!

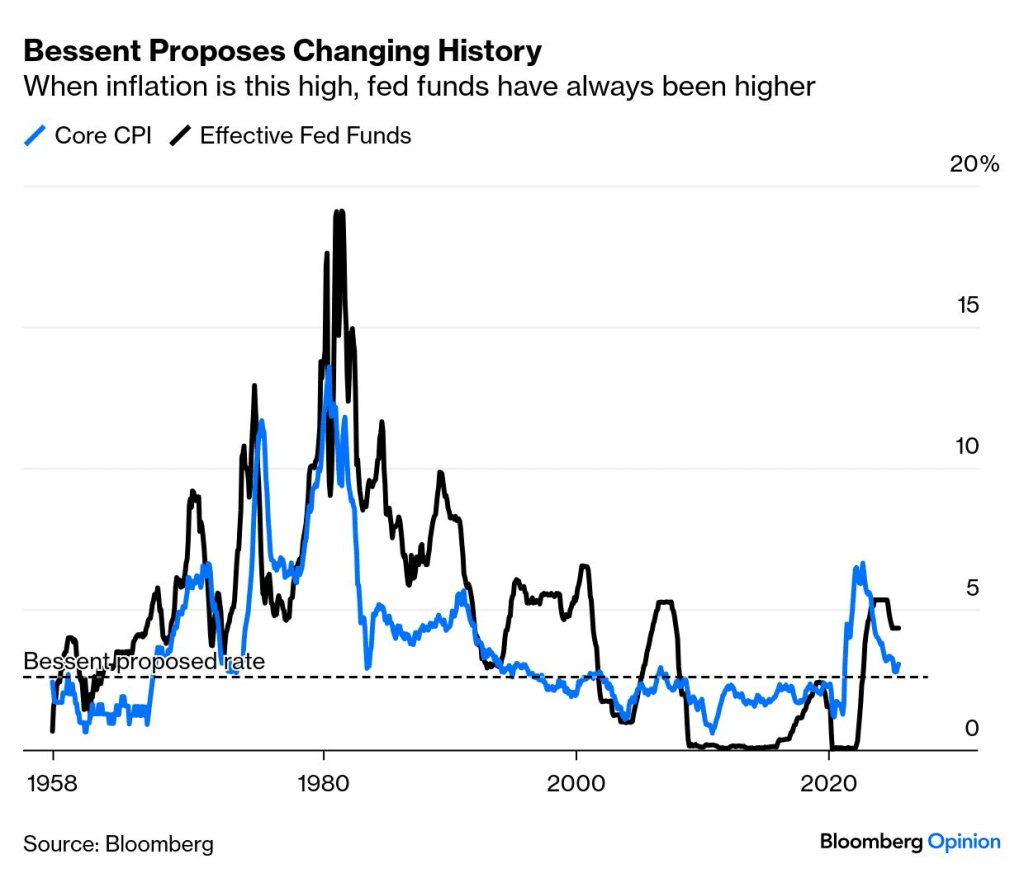

Recent inflation data, including today’s PPI that came in at 0.9% vs. 0.2% expected, should give pause to the crowd screaming for lower rates. Yes, employment #s published last week were very weak, and they got weaker when Erika McEntarfer, the commissioner of the Bureau of Labor Statistics, was fired after releasing a jobs report that angered President Donald Trump. In addition, we have Secretary of the Treasury, Scott Bessent, demanding rates be cut by as much as 150-175 bps, claiming that all forecasting “models” suggest the same direction for rates. Is that true? Again, I think not.

You may recall that I published a blog post on July 10, 2025 titled “Taylor-Made”, in which I wrote that the Taylor Rule is an economic formula that provides guidance on how central banks, such as the Federal Reserve, should set interest rates in response to changes in inflation and economic output. The rule is designed to help stabilize an economy by systematically adjusting the central bank’s key policy rate based on current economic conditions. It is designed to take the “guess work” out of establishing interest rate policy.

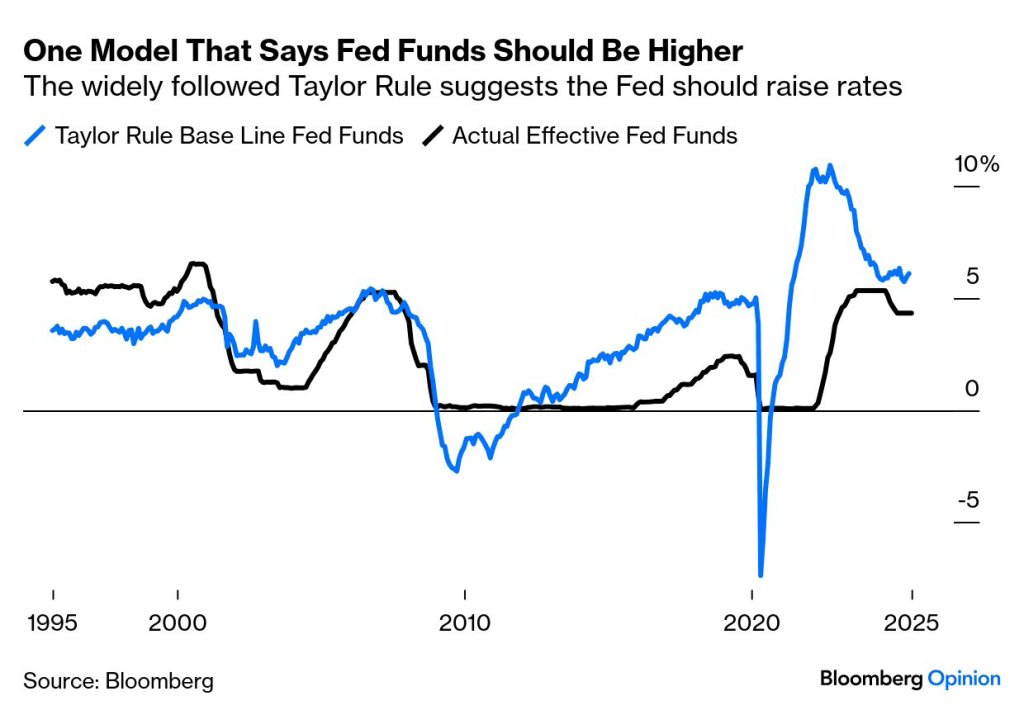

In John Authers (Bloomberg) blog post today, he shared the following chart:

Calling for a roughly 2.6% Fed Funds rate in an environment of 3% or more core and sticky inflation is not prudent, and it is not supported by history. Furthermore, the potential impact from tariffs will only begin to be felt as most went into effect as of August 1, 2025.

Getting back to the Taylor Rule, Authers also provided an updated graph suggesting that the Fed Funds rate should be higher today. In fact, it should be at a level about 100 bps above the current 4.3% and more than 270 bps above the level that Bessent desires.

Investors would be wise to exit the lower interest rate train before it fuels a significant increase in U.S. rates as inflation once again rises. The impact of higher rates will negatively impact all risk assets. Given that a Cash Flow Matching (CFM) strategy eliminates interest rate risk through the defeasement of benefits and expenses that are future values and thus not interest rate sensitive, one could bring an element of certainty to this very uncertain economic environment before investors get their comeuppance! Don’t wait for the greater inflation to appear, as it might just be too late at that point to get off the lower interest rate train before it plummets into a ravine.