By: Russ Kamp, CEO, Ryan ALM, Inc.

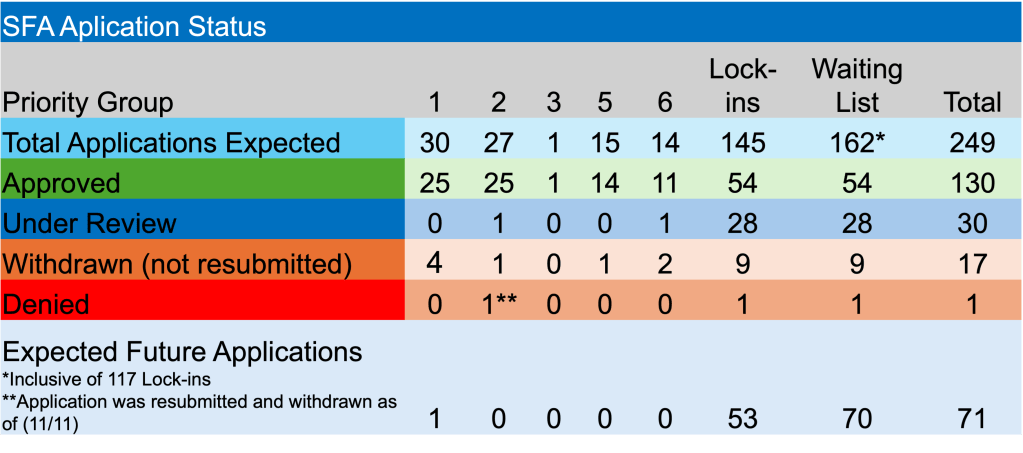

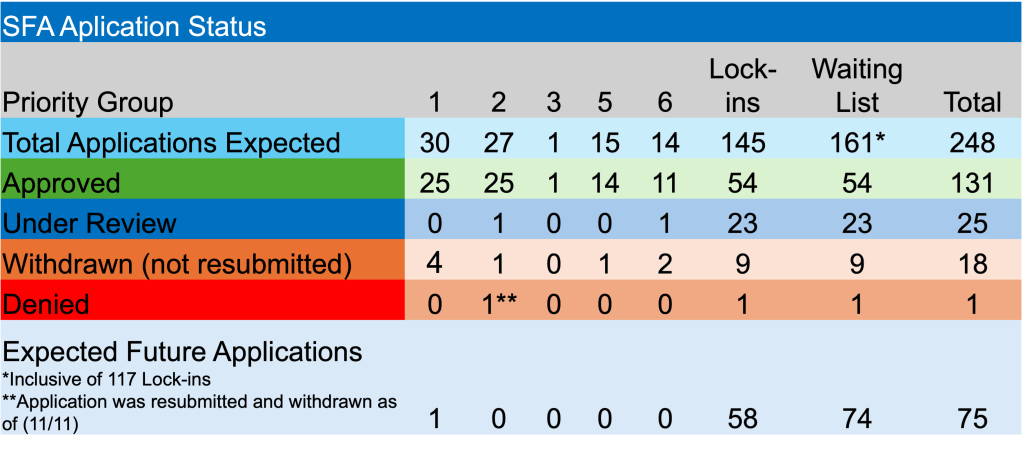

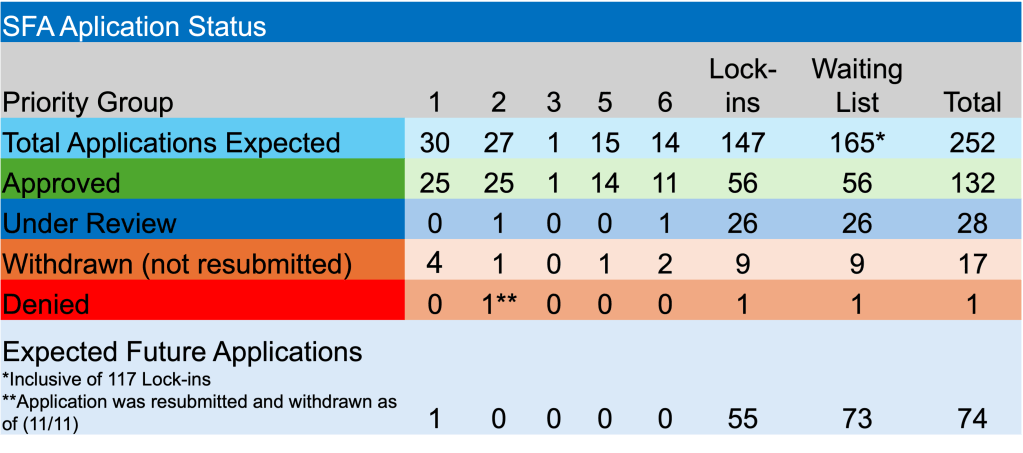

Welcome to the last week of “summer”. I don’t know about you, but I can believe that Labor Day is next weekend. I suspect that the PBGC is feeling the same way as they continue to work their way through an imposing list of applicants with a December 31, 2025, deadline for initial applications to be reviewed. As the chart below highlights, they have their work cut out for them.

Regarding last week’s activity, the PBGC did not accept any new applications as the e-Filing portal remains temporarily closed. However, they did approve the revised applications for two funds. Laborers’ Local No. 91 Pension Plan (Niagra Falls) and the Pension Plan of the Asbestos Workers Philadelphia Pension Fund have been awarded a total of $96.2 million in SFA and interest that will support 2,057. This brings the total of approved applications to 132 and total SFA to $73.5 billion – wow!

In other ARPA news, I’m pleased to announce that there were no applications denied or withdrawn during the previous week, but there were two more funds that were asked to repay a portion of the SFA received due to census errors. Sixty-four funds have been reviewed for potential census errors, with 60 having to rebate a small portion of their grants, while four funds did not have any issues. In total, $251.7 million has been repaid from a pool of $52.3 billion in SFA received or 0.48% of the grants awarded. The $251.7 relative to the $73.5 billion in total SFA grants would be only 0.34% of the total awards.

Lastly, three more funds have been added to the waitlist. There have been 165 non-Priority Group members on the waitlist including 56 that have received SFA awards, while another 26 are currently being reviewed. That means that 82 funds must still file an application reviewed and approved in a short period of time.

As stated above, pension funds sitting on the waitlist must have the initial application reviewed by the PBGC by 12/31/25. Any fund residing on the waitlist after that date loses the ability to seek SFA support. Applications that have been reviewed prior to 12/31/25 may still get approval from the PBGC provided the approval arrives before 12/31/26. I don’t see them getting through the remaining 74 waitlist funds by the end of 2025.