By: Russ Kamp, CEO, Ryan ALM, Inc.

As I recently reported in a blog post titled “Another Cockroach!”, BlackRock TCP Capital, a business-development company (BDC), reported that it would be slashing the net asset value of its shares by 19% for the Q4’25. I wrote this post because I’ve been concerned about the incredible growth in AUM committed to this asset class. Adding to my concerns is the use of financial leverage to “boost” returns, but as we all know, the impact of leverage can be a double-edged sword.

Recently, Eric Jacobson, Morningstar, wrote an article highlighting the recent travails of the BlackRock BDC with an emphasis on financial leverage. He pointed out that as of September 2025, borrowing within the BDC had increased the market exposure of TCPC’s portfolio to more than 230% of what it would have been without leverage. By Eric’s calculations, the leverage translated into roughly $740 million of net assets alongside nearly $1 billion of borrowed money—a practice that turns uncomfortable valuation adjustments into a painful net asset value drop. According to Jacobson, had the same portfolio been unlevered, its NAV write-down might have a more modest 8% loss. Not great but not nearly as damaging.

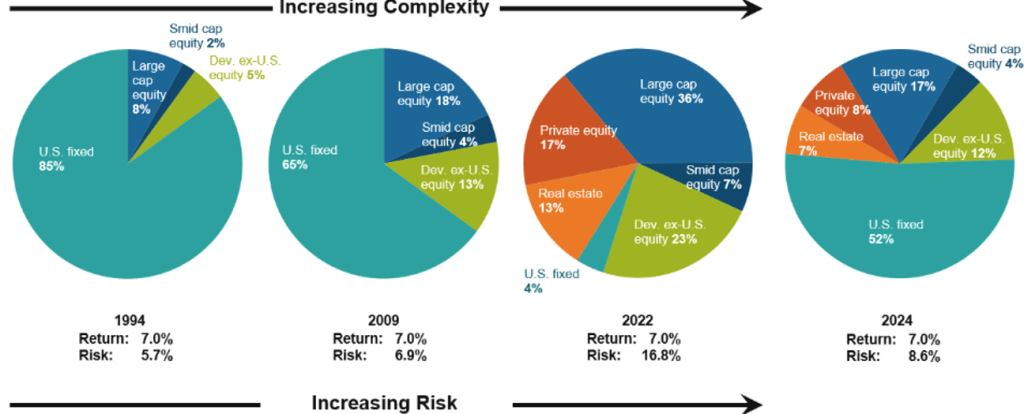

Importantly, Jacobson highlights that private direct lending is not a natural substitute for a conventional bond portfolio. We couldn’t agree more. Use investment-grade bonds for their cash flows, as managing a pension plan is all about cash flows. The careful matching of asset cash flows (principal and interest) with benefits and expenses (liability cash flows) SECURES the promised benefits for the period that the allocated assets cover. How comforting!