By: Russ Kamp, CEO, Ryan ALM, Inc.

Nearly eight years ago (2/28/18), I produced a blog post titled, “Let’s Just Cut Them Off!”, in which I took offense to an article trashing pension legislation then referred to as the “Butch Lewis Act” (BLA). The writer of the article, Rachel Greszler, The Heritage Foundation, stated that the BLA (as well as other potential solutions at that time) were nothing more than tax-payer bailouts. She estimated that these bailouts could amount to as much as $1 trillion. I stated at that time that “I don’t know where she has gotten this figure, but it is not close to reality.”

Ms. Greszler defined the potential recipients of these loans (now grants) as the entire universe of multi-employer plans totaling roughly 1,375 (at that time) with an unfunded liability of $500 billion. However, the Butch Lewis Act, and subsequently ARPA) was only designed for those plans that were designated as “Critical and Declining”. The total amount of underfunding for that cohort was roughly $70 billion. A far cry from the $1 trillion that she highlighted above.

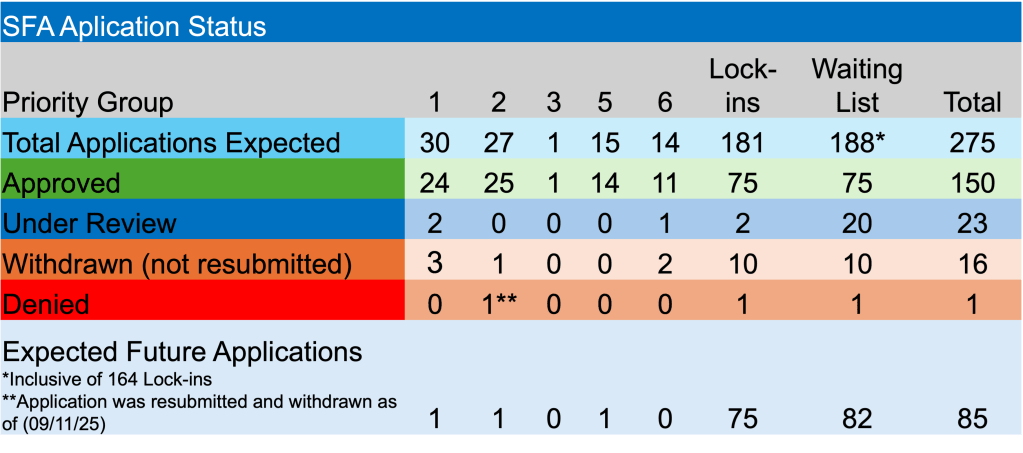

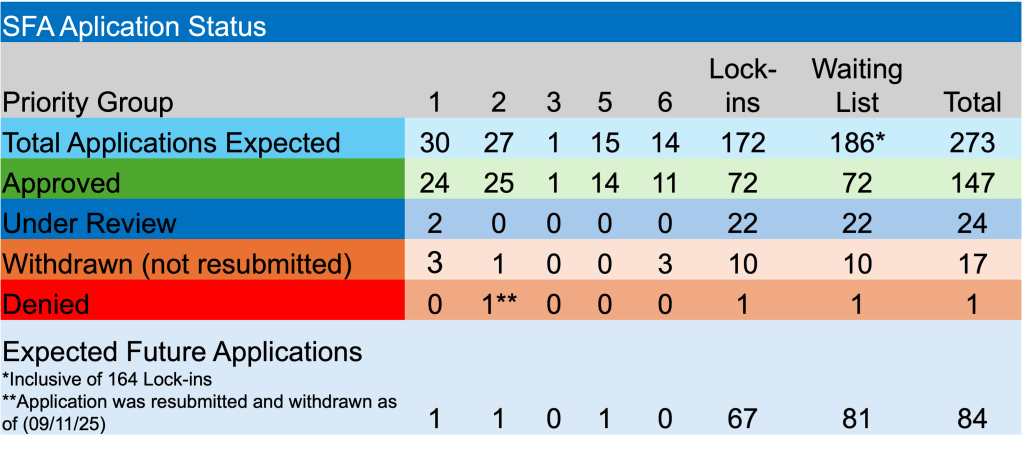

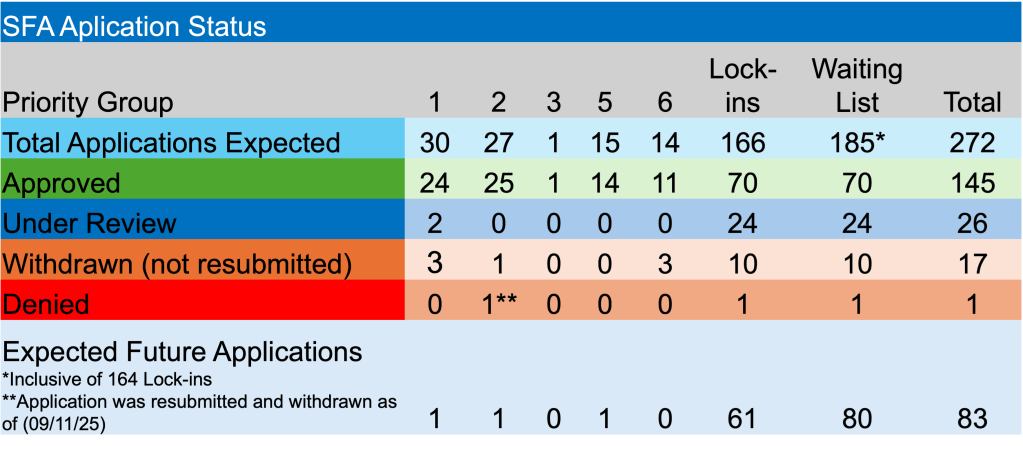

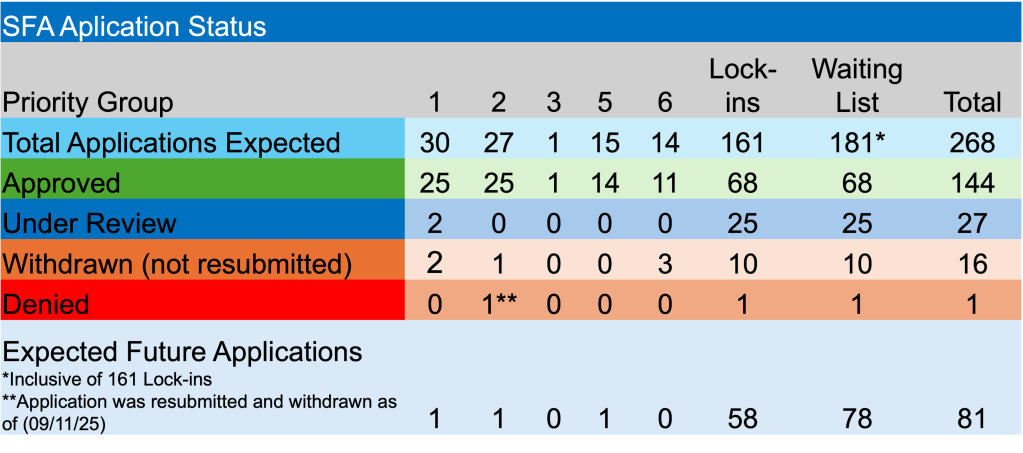

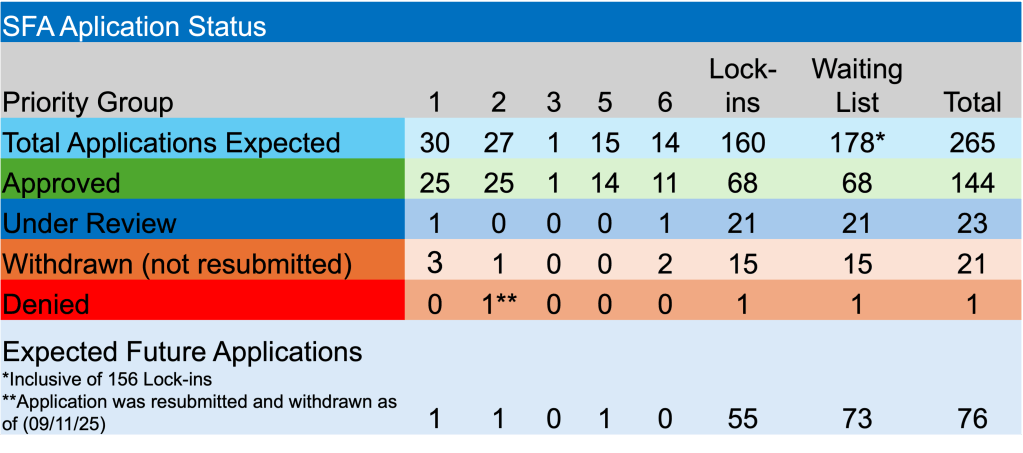

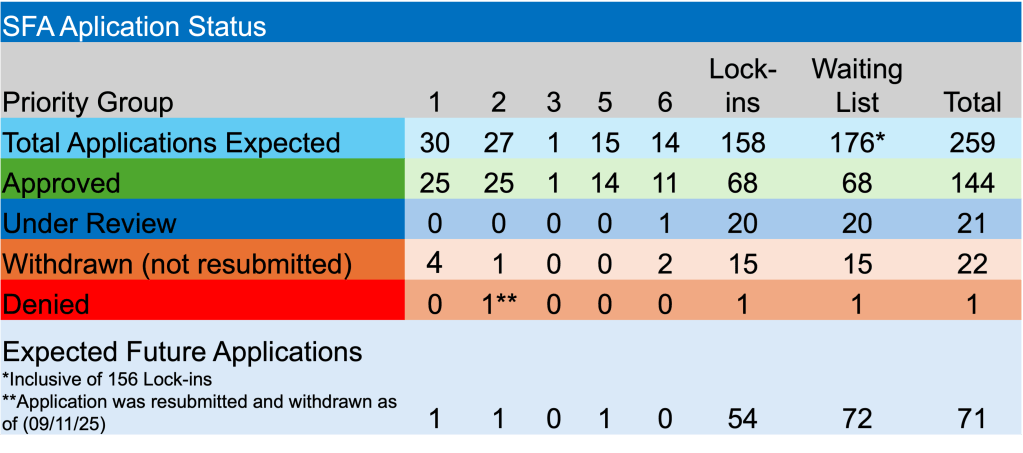

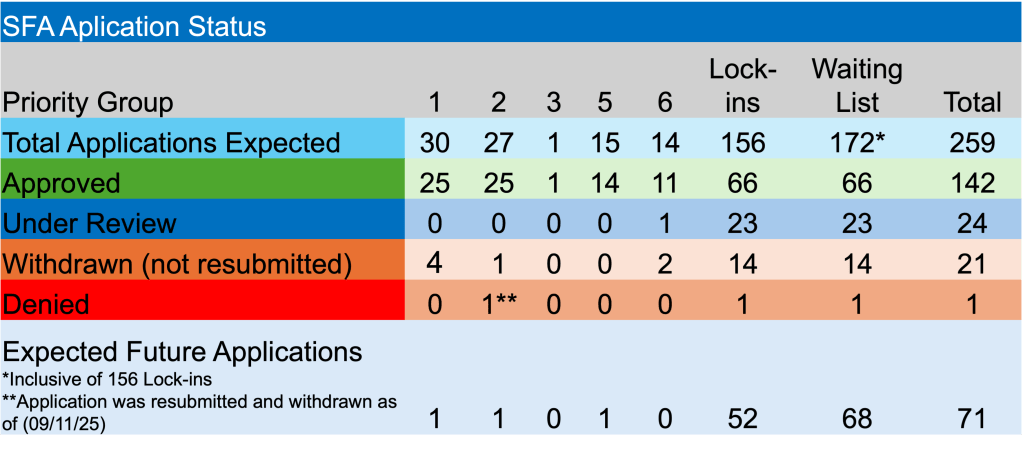

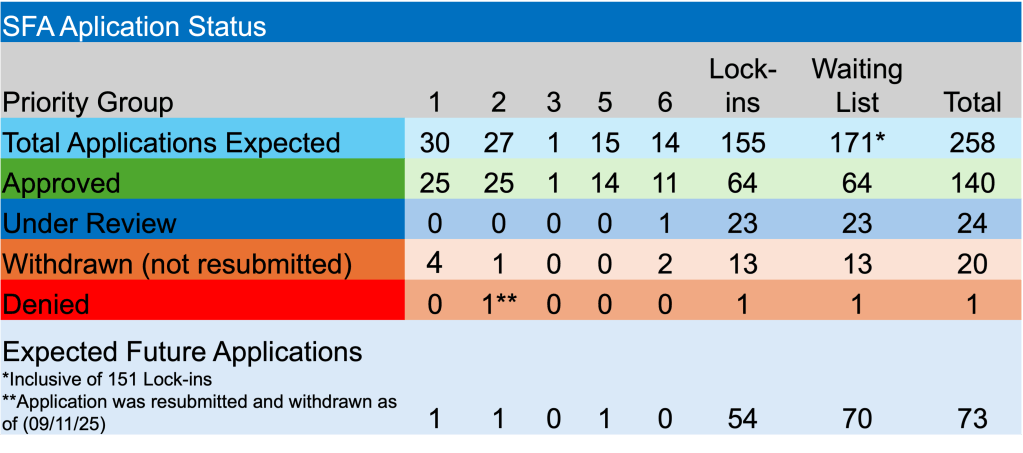

So, where are we today? I’m happy to report that as of 12/19/25, the PBGC has approved Special Financial Assistance to 151 pension plans totaling $75.2 billion. These grants are ensuring that 1,873,112 American workers will receive the retirement benefits they were promised! Amazing!

In my original post, I wrote “given the author’s concern for the million or so union workers whose benefits may be trashed, she certainly doesn’t propose any solutions other than to say that a “bailout” is a horrible way to go. If these plans don’t receive assistance, they are likely to fail, placing a greater burden on the Pension Benefit Guaranty Corporation (PBGC), which is already financially troubled.” Fortunately, through the ARPA pension legislation, the PBGC’s multiemployer insurance fund is stronger today than it has been in decades.

I finished my post with the following thoughts: “Retirement benefits stimulate economic activity, and usually on the local level. The loss of retirement benefits will have a direct impact on these economies. Also, these benefits are taxed, which helps pay for a portion of the loans (now grants). Doing nothing is not an answer. I applaud the effort of those individuals who are driving the Butch Lewis Act. I encourage everyone to reach out to your legislatures to educate them on the BLA and to gain their support. There are millions of Americans who need your support. Thank you!”

I was thrilled to work with Ron Ryan and the BLA team headed by John Murphy and David Blitzstein. It remains one of the highlights of my 44-year career. Who knew when I began working with Ron and that team it would lead me to eventually join Ryan ALM, Inc. We continue to fight to protect and preserve DB pensions for the masses. There is a ton of work remaining to do. Securing those promises through cash flow matching (CFM) is an important first step. Let us help you accomplish that objective.