By: Russ Kamp, Managing Director, Ryan ALM, Inc.

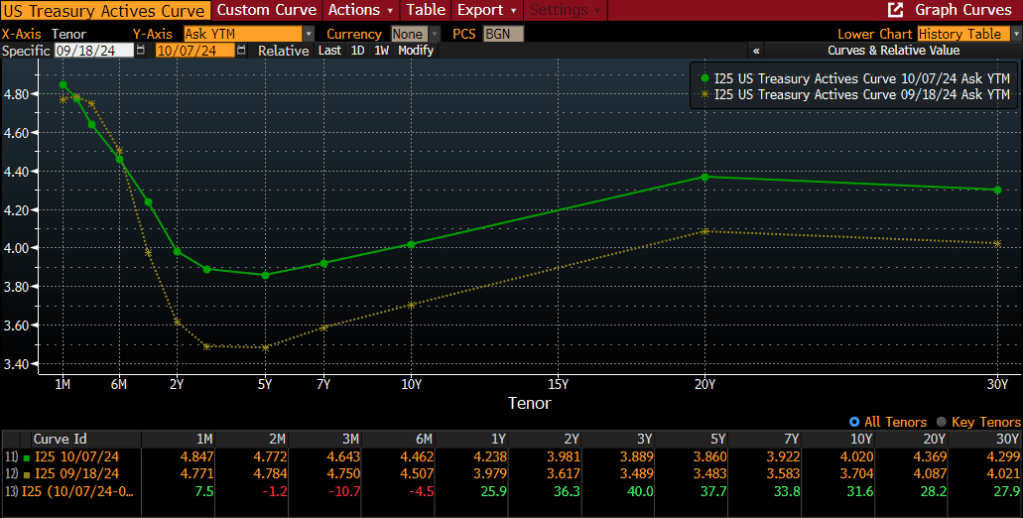

Regular readers of this blog might recall that on September 5th we produced a post titled, “Overbought?” that suggested that bond investors had gotten ahead of themselves in anticipation of the Fed’s likely next move in rates. At that time, we highlighted that rates had moved rather dramatically already without any action by the Fed. Since May 31, 2024, US Treasury yields for both 2-year and 3-year maturities had fallen by >0.9% to 9/5. By almost any measure, US rates were not high based on long-term averages or restrictive.

Sure, relative to the historically low rates during Covid, US interest rates appeared inflated, but as I’ve pointed out in previous posts, in the decade of the 1990s, the average 10-year Treasury note yield was 6.52% ranging from a peak of 8.06% at the end of 1990 to a low of 4.65% in 1998. I mention the 1990s because it also produced one of the greatest equity market environments. Given that the current yield for the US 10-year Treasury note was only 3.74% at that point, I suggested that the present environment wasn’t too constraining. In fact, I suggested that the environment was fairly loose.

Well, as we all know, the US Federal Reserve slashed the Fed Funds Rate by 0.5% on September 18th (4.75%-5.0%). Did this action lead bond investors to plow additional assets into the market driving rates further down? NO! In fact, since the Fed’s initial rate cut, Treasury yields have risen across the yield curve with the exceptions being ultra-short Treasury bills. Furthermore, the yield curve is positively sloping from 5s to 20s.

Again, managing cash flow matching portfolios means that we don’t have to be in the interest rate guessing game, but we are all students of the markets. It was out thinking in early September that markets had gotten too far ahead of the Fed given that the US economy remained on steady footing, the labor market continued to be resilient, and inflation, at least sticky inflation, remained stubbornly high relative to the Fed’s target of 2%. Nothing has changed since then except that the US labor market seems to be gaining momentum, as jobs growth is at a nearly 6-month high and the unemployment rate has retreated to 4.1%.

There will be more gyrations in the movement of US interest rates. But anyone believing that the Fed and market participants were going to drive rates back to ridiculously low levels should probably reconsider that stance at this time.