By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Mark Twain quoted Benjamin Disraeli in his 1907 autobiography, when he stated “Lies, damned lies, and statistics” as a phrase used to describe the persuasive power of statistics to support weak arguments. Folks who regularly read my posts know that I am a frequent user of statistics to support my arguments, whether they are strong or weak. As a young man, I would study the sports section box scores and the backs of my baseball cards for every possible stat. It is just who I am. I love #s!

The investment management industry is inundated with statistics. You can’t go a day without a meaningful insight being shared in reference to our industry, the economy, interest rates, politics, companies, commodities, etc. I try to absorb as many of these stats as possible. However, it is easy to fall prey to confirmation bias, which humans are prone. Putting a series of statistics together and building an investment case is never easy. That said, we at Ryan ALM, Inc. have been saying since the onset of higher rates that the US Federal Reserve would likely be forced to keep rates higher for longer, as inflation would remain stickier than originally forecast.

We also didn’t see a recession on the horizon due to an incredibly strong US labor market, which continues to witness near historic lows for unemployment. Despite the retiring of the Baby Boomer generation, the labor participation rate is up marginally during this period of higher rates, indicating that more folks are looking for employment opportunities at this time. They are being supported by the fact that job openings remain quite elevated relative to pre-Covid-19 levels at roughly 880k. When people work, they spend! Wage growth recently surprised to the upside. Will demand for goods and services follow? It usually does.

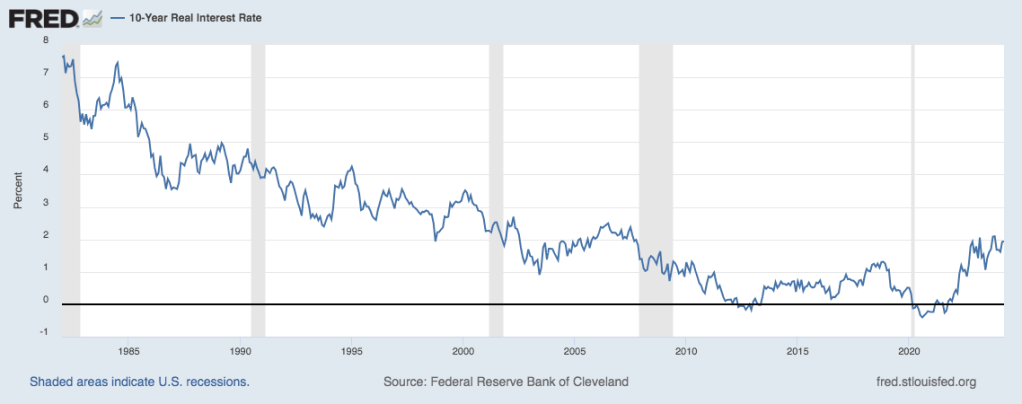

Furthermore, as we’ve disclosed on many occasions, financial conditions are NOT tight despite the rapid rise in US interest rates from the depths induced by the pandemic. Long-term US rates remain below the 50-year average, and in the case of the US 10-year Treasury note, the yield difference is roughly -2.1%. Does that give the Fed some room to possibly increase rates should inflation remain elusive?

In just the past week, we’ve had oil touch $85/barrel, the Atlanta Fed’s GDPNow model increase its forecast for Q1’24 growth from 2.3% to 2.8%, a Baltimore bridge collapse that will impact shipping and create additional expense and delays, housing that once again exceeded expectations, Fed (Powell) announcements that a recession wasn’t on the horizon, job growth (ADP) that was the highest in 8 months, manufacturing that stopped contracting for the first time since 2022 (17 months), and on and on and… Am I kidding myself that our case for higher for longer is the right call? Am I only using certain stats to “confirm” the Ryan ALM argument?

We don’t know. But here is the good news. Our investment strategy doesn’t care. As cash flow matching experts, we are agnostic as to the direction of rates. Yes, higher rates mean lower costs to defease those future benefit promises, so higher rates are good. However, once we match asset cashflows of interest and principal to the liability cash flows (benefit payments and expenses), the direction of rates becomes irrelevant, as future values are not interest rate sensitive. Building an investment case for cash flow matching was challenging when rates were at historic lows. It is much easier today, as one can invest in high quality investment-grade corporate bonds and get yields in the range of 5%-5.5%, which is a significant percent of the average return on asset assumption (ROA) with much less risk and volatility of investing in equities and other alternatives.

I don’t personally see a case for the Fed to cut rates in the near future. I think that it would be a huge mistake to once again ease monetary policy before the Fed’s objective has been achieved. I lived through the ’70s and witnessed first-hand the impact on the economy when the Fed took its collective foot off the brake. As a result, I entered this industry in 1981 when the 10-year Treasury yield was at 14.9%. The Fed can’t afford to repeat the sins of the past. I believe that they know that and as a result, they won’t act impulsively this time.