By: Russ Kamp, CEO, Ryan ALM, Inc.

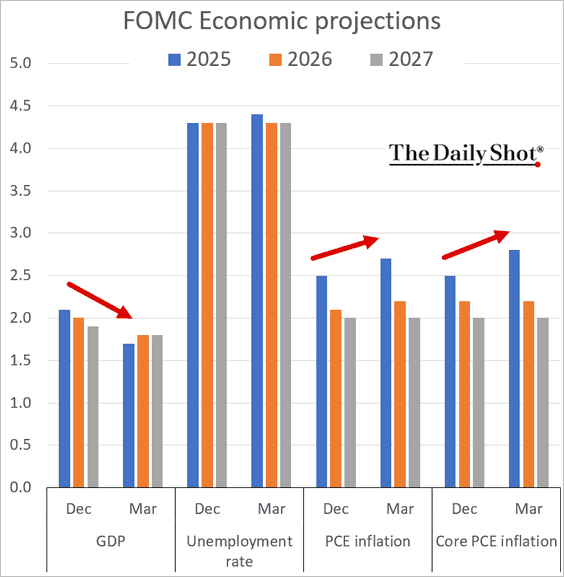

In addition to publishing my thoughts through this blog, I frequently put sound bites out through LinkedIn.com. The following is an example of such a comment: Given Powell’s statement about “balancing dual mandates”, it seems premature to assume that the Fed’s next move on rates is downward. Tariffs have only recently kicked in and their presence could create a very challenging situation for the Fed should inflation continue on its path upward. Market reaction seems overblown. September’s CPI/PPI numbers could be very interesting.

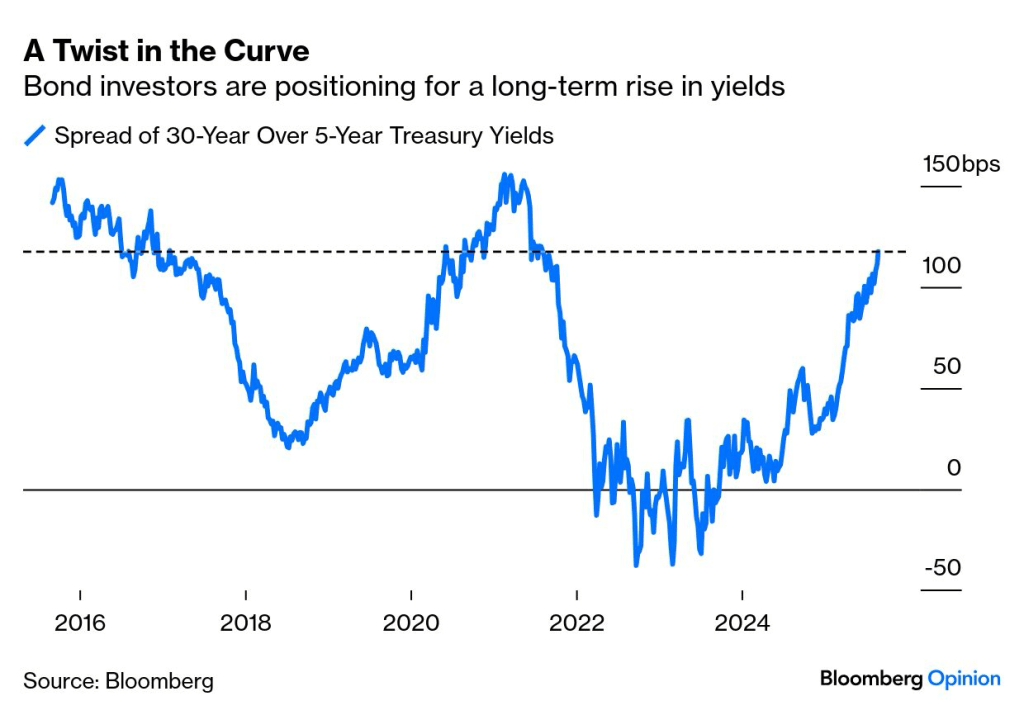

As a follow-up to that comment, here is a graph from Bloomberg highlighting the recent widening in the spread between 5-year and 30-year Treasuries, which is at its widest point in the last 4 years. This steeping of the yield curve would suggest that inflation is being more heavily anticipated on the long end.

As I mentioned above, the reaction to Powell’s comments from Wyoming last Friday seemed overblown given the rethinking about “dual mandates”. Inflation has recently reversed the downward trajectory and with the impact of tariffs yet to be truly felt, it is doubtful that we’ll see inflation fall to levels that would provide comfort to the U.S. Federal Reserve policy makers. Yes, there may be a small (25 bps) cut in September, but should inflation continue to be a concern the spread in Treasury yields referenced above could continue to widen. President Trump’s goal of jumpstarting the housing market through lower mortgage rates would not likely occur.

From a pension perspective, higher rates reduce the present value of those future promised benefits. They also provide implementers of cash flow matching (CFM) strategies, such as Ryan ALM Advisers, LLC, the opportunity to defease those pension liabilities at a lower cost (greater cost savings). Bond math is very straight forward. The higher the yield and the longer the maturity, the greater the cost savings. Although higher rates might not be good for U.S. equities, especially given their current valuations, the ability to reduce risk at this time through a CFM strategy should be comforting.

Bifurcate your asset allocation into two buckets – liquidity and growth. The liquidity bucket will house the CFM strategy, providing all the necessary liquidity to meet ongoing monthly obligations as far into the future as the allocation will cover. The remaining assets (all non-core bonds) in the growth or alpha portfolio will now have more time to just grow unencumbered, as they are no longer a source of liquidity. Time is a critical investment tenet, and with more time, the probability of meeting the expected return is enhanced.

There is tremendous uncertainty in our markets and economy currently. One can bring an element of certainty to the management of pensions, live with great uncertainty.