By: Russ Kamp, CEO, Ryan ALM, Inc.

My 44-year career in the investment industry has been focused on DB pension plans, in roles as both a consultant and an investment manager (I’ve also served as a trustee). I’ve engaged in 000s of conversations related to the management of DB pension plans covering the good, the bad, and even the ugly! I’ve published more than 1,600 mostly pension-related posts on this blog with the specific goal to provide education. I hope that some of my insights have proven useful. Managing a DB pension plan, whether a private, public, or a multiemployer plan is challenging. As a result, I’ve always felt that it was important to challenge the status quo with the aim to help protect and preserve DB pensions for all.

Unfortunately, I continue to think that many aspects of pension management are wrong – sorry. Here are some of the concerns:

- Why do we have two different accounting standards (FASB and GASB) in the U.S. for valuing pension liabilities?

- Why does it make sense to value liabilities at a rate (ROA) that can’t be purchased to defease pension liabilities in this interest rate environment?

- Why do we continue to create an asset allocation framework that only guarantees volatility and not success?

- Why do we think that the pension objective is a return objective (ROA) when it is the liabilities (benefits) that need to be funded and secured?

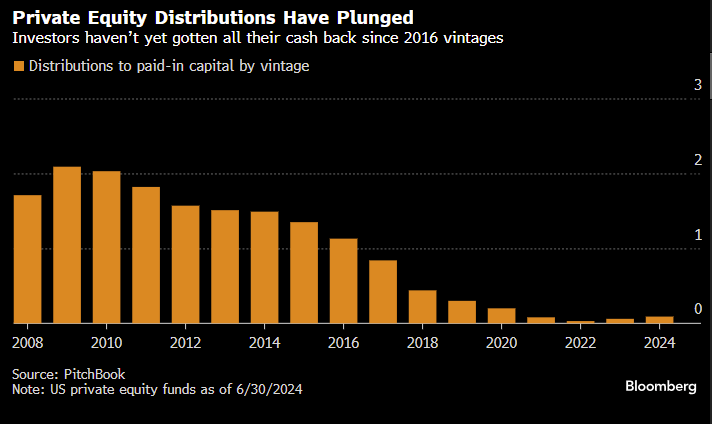

- Why haven’t we realized that plowing tons of plan assets into an asset class/strategy will negatively impact future returns?

- Why are we willing to pay ridiculous sums of money in asset management fees with no guaranteed outcome?

- Why is liquidity to meet benefits an afterthought until it becomes a major issue?

- Why does it make sense that two plans with wildly different funded ratios have the same ROA?

- Why are plan sponsors willing to live with interest rate risk in the core bond allocations?

- Why do we think that placing <5% in any asset class is going to make a difference on the long-term success of that plan?

- Why do we think that moving small percentages of assets among a variety of strategies is meaningful?

- Why do we think that having a funded ratio of 80% is a successful outcome?

- Why are we incapable of rethinking the management of pensions with the goal to bring an element of certainty to the process, especially given how humans hate uncertainty?

WHY, WHY, WHY?

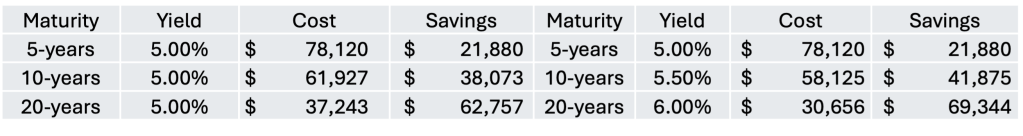

If some of these observations resonate with you, and you are as confused as I am with our current approach to DB pension management, try cash flow matching (CFM) a portion of your plan. With CFM you’ll get a product that SECURES the promised benefits at low cost and with prudent risk. You will have a carefully constructed liquidity bucket to meet benefits and expenses when needed – no forced selling in challenging market environments. Importantly, your investing horizon will be extended for the growth (alpha) assets that haven’t been used to defease liabilities. We know that by “buying time” (extending the investment horizon) one dramatically improves the probability of a successful outcome.

Furthermore, your pension plan’s funded status will be stabilized for that portion of the assets that uses CFM. This is a dynamic asset allocation process that should respond to improvement in the plan’s funded status. Lastly, you will be happy to sit back because you’ve SECURED the near-term liquidity needed to fund the promises and just watch the highly uncertain markets unfold knowing that you don’t have to do anything except sleep very well at night.