By: Russ Kamp, CEO, Ryan ALM, Inc.

I was introduced to the brilliance of Warren Mosler through my friend and former colleague, Chuck DuBois. It was Chuck who encouraged me to read Mosler’s book, “The 7 Deadly Innocent Frauds of Economic Policy”. I would highly recommend that you take a few hours to dive into what Mosler presents. As I mentioned, I think that his insights are brilliant.

The 7 frauds, innocent or not, cover a variety of subjects including trade, the federal deficit, Social Security, government spending, taxes, etc. Regarding trade and specifically the “deficit”, Mosler would tell you that a trade deficit inures to the benefit of the United States. The general perception is that a trade deficit takes away jobs and reduces output, but Mosler will tell you that imports are “real benefits and exports are real costs”.

Unlike what I was taught as a young Catholic that it is better to give than to receive, Mosler would tell you that in Economics, it is much better to receive than to give. According to Mosler, the “real wealth of a nation is all it produces and keeps for itself, plus all it imports, minus what it exports”. So, with that logic, running a trade deficit enhances the real wealth of the U.S.

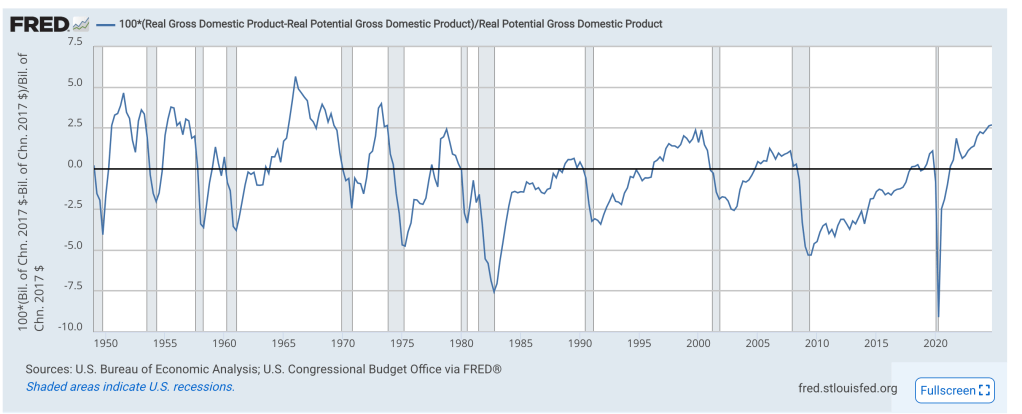

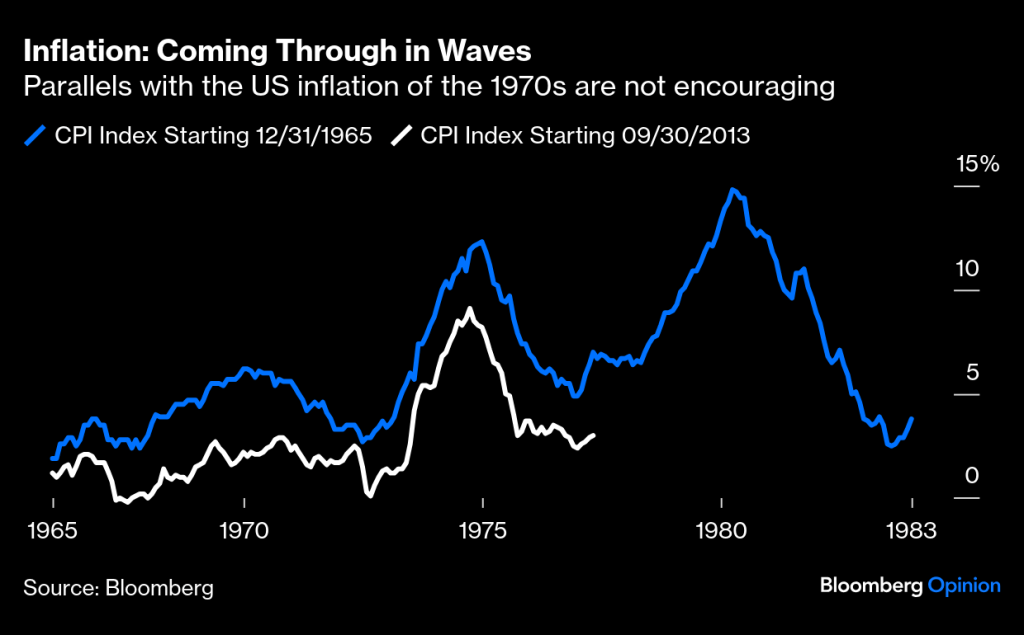

Earlier this year, the Atlanta Fed was forecasting GDP annual growth in Q1’25 of 3.9%, today that forecast has plummeted to -2.4%. We had been enjoying near full employment, moderating yields, and inflation. So, what was the purpose of starting a trade war other than the fact that one of Mosler’s innocent frauds was fully embraced by this administration that clearly did not understand the potential ramifications. They should have understood that a tariff is a tax that would add cost to every item imported. Did they not understand that inflation would take a hit? In fact, a recent survey has consumers expecting a 6.7% price jump in goods and services during the next 12-months. This represents the highest level since 1981. Furthermore, Treasury yields, after initially falling in response to a flight to safety, have marched significantly higher.

Again, I ask, what was the purpose? Did they think that jobs would flow back to the U.S.? Sorry, but the folks who suffered job losses as a result of a shift in manufacturing aren’t getting those jobs back. Given the current employment picture, many have been employed in other industries. So, given our full-employment, where would we even get the workers to fill those jobs? Again, we continue to benefit from the trade “imbalance”, as we shipped inflation overseas for decades. Do we now want to import inflation?

It is through fiscal policy (tax cuts and government spending) that we can always sustain our workforce and domestic output. Our spending is not constrained by other countries sending us their goods. In fact, our quality of life is enhanced through this activity.

It is truly unfortunate that the tremendous uncertainty surrounding tariff policy is still impacting markets today. Trillions of $s in wealth have been eroded and long-standing trading alliances broken or severely damaged. All because an “innocent” fraud was allowed to drive a reckless policy initiative. I implore you to stay away from Social Security and Medicare, whose costs can always be met since U.S. federal spending is not constrained by taxes and borrowing. How would you tell the tens of millions of Americans that rely on them to survive that another innocent fraud was allowed to drive economic policy?