By: Russ Kamp, CEO, Ryan ALM, Inc.

We hope that the continuing success of the ARPA pension legislation warms your heart despite ridiculously cold temperatures in New Jersey and elsewhere.

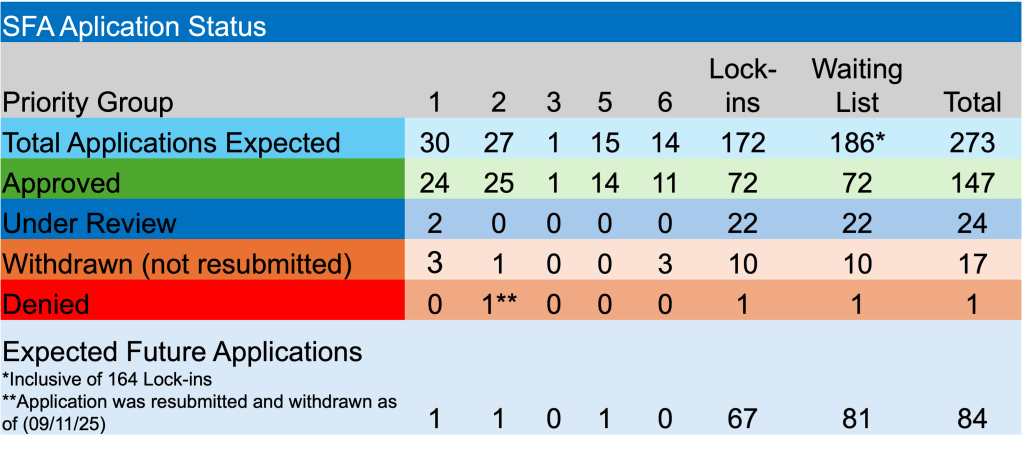

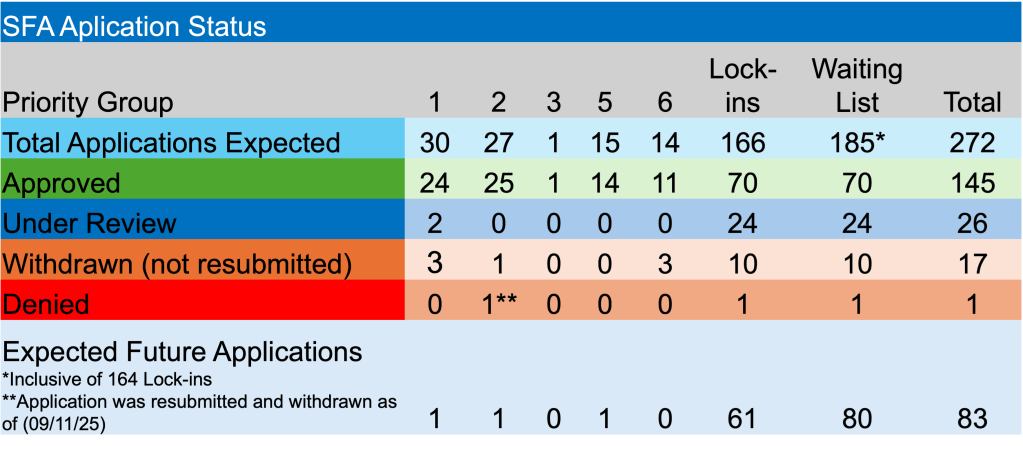

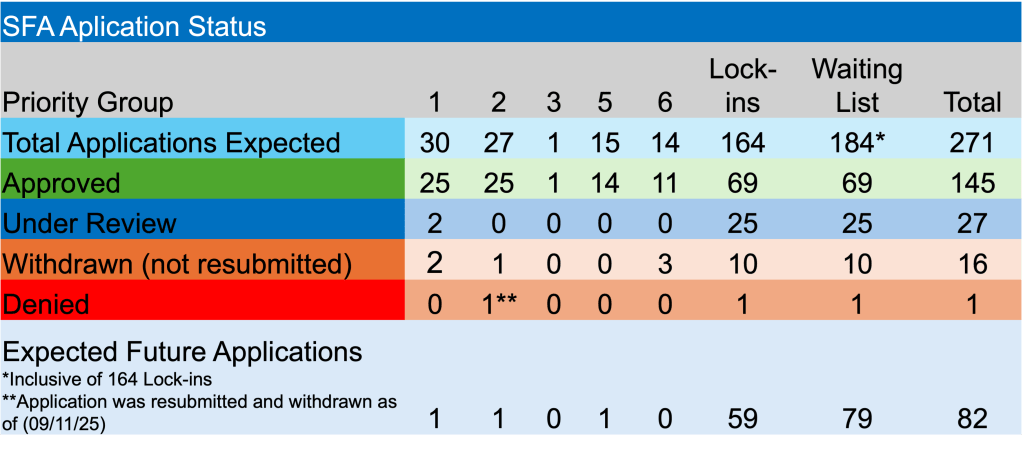

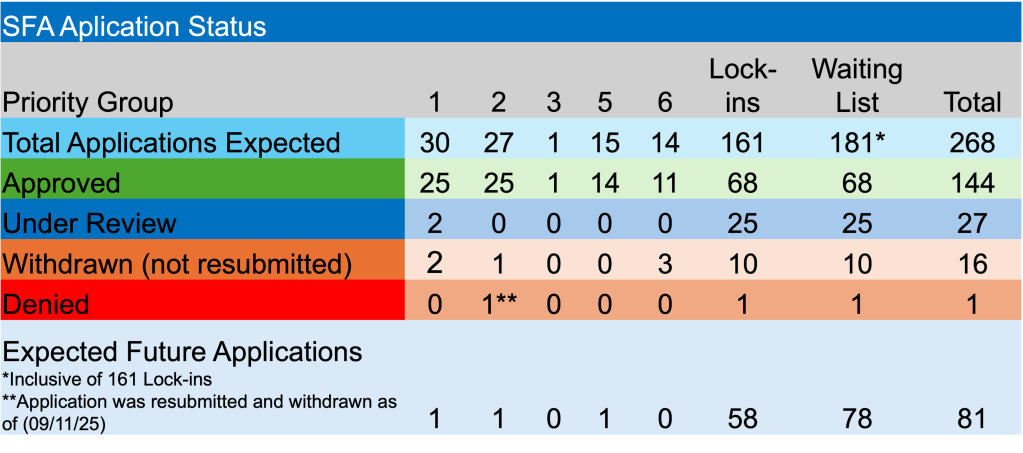

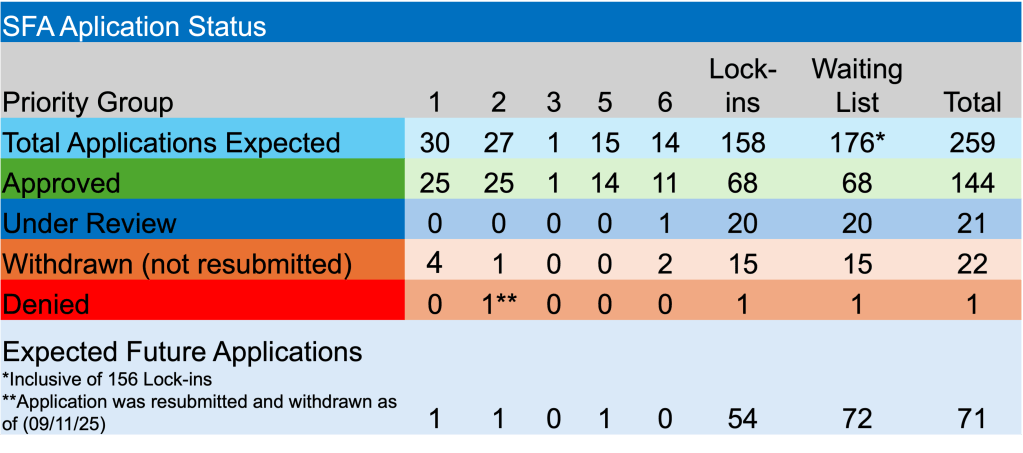

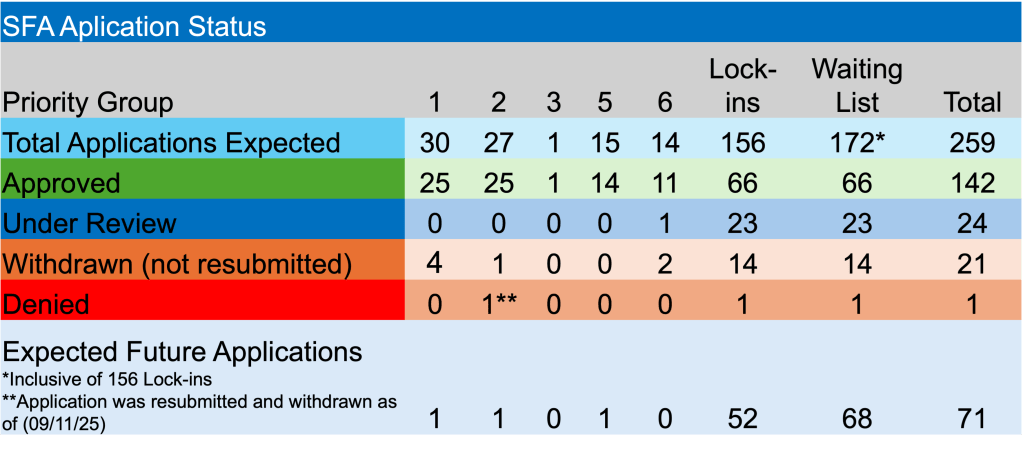

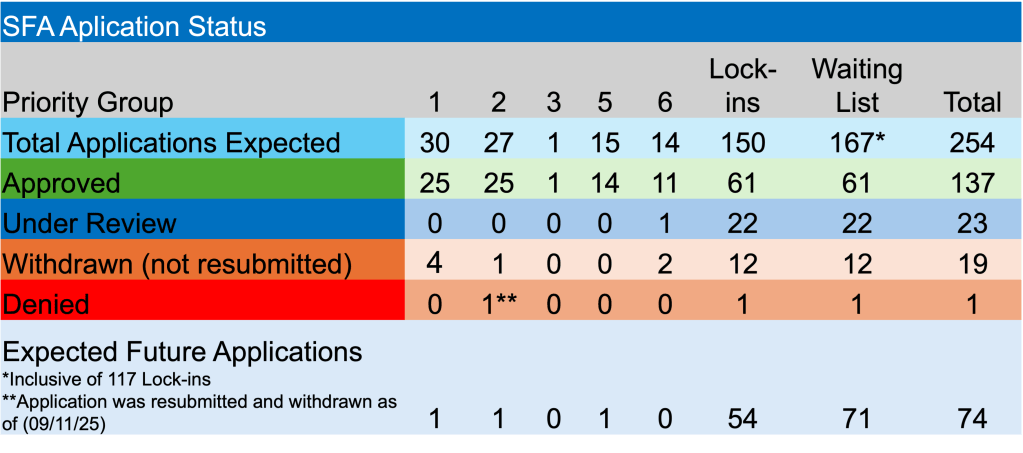

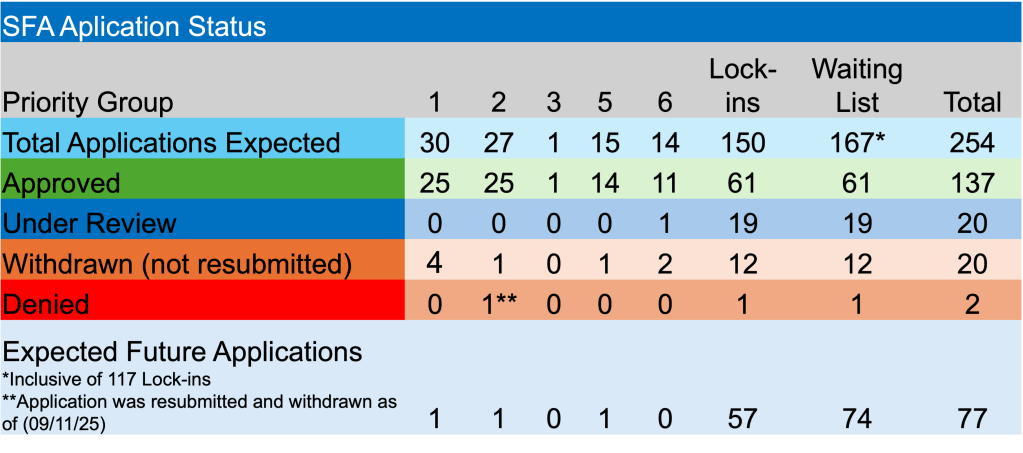

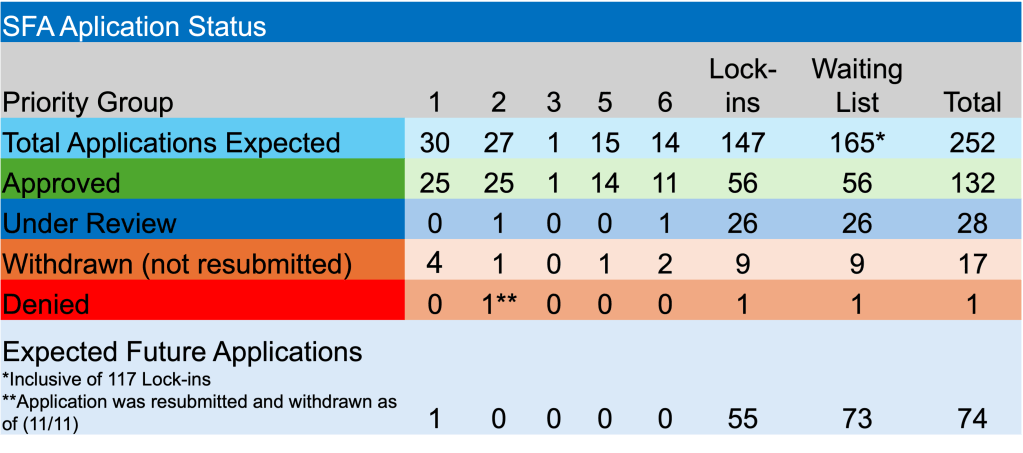

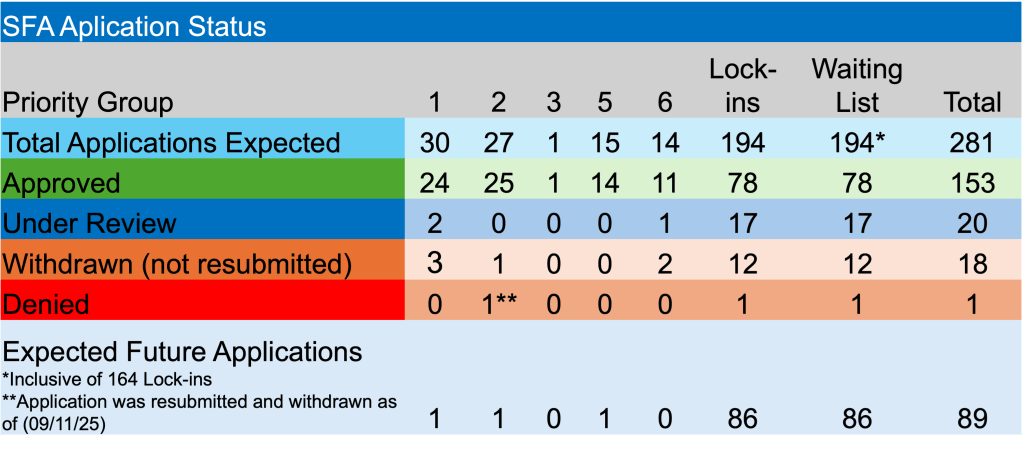

Regarding last week’s activity, pleased to report that two plans received approval for their SFA applications. Pension Trust Fund Agreement of St. Louis Motion Picture Machine Operators and Teamsters Local 837 Pension Plan, both non-priority group members, will receive a combined $19.9 million in SFA and interest for their 1,431 members. These approvals are the first for the PBGC in just under one month.

In other ARPA news, there were no new applications filed, as the e-Filing portal remains temporarily closed. In addition, as we’ve been reporting, the window for initial applications to be submitted was to close on 12/31/25. From this point forward, only revised applications should be received by the PBGC. Despite that impediment, two more funds, NMU Great Lakes Pension Fund and UFCW Pension Fund of Northeastern Pennsylvania, added their names to the extensive waitlist seeking Special Financial Assistance. These plans and the others currently on the list must believe that the current deadline in place will be amended.

There was one application withdrawn during the prior week, as the Dairy Employees Union Local #17 Pension Plan pulled their initial application seeking $3.5 million in SFA for the 633 plan participants. Under the current rules, they have until 12/31/26 to resubmit a revised application.

Lastly, there were no applications denied nor were any of the previous recipients of SFA asked to rebate a portion due to census errors.

The U.S. interest rate environment is reacting to some of the global uncertainty. As a result, longer dated Treasury yields are marching higher. As of 9:51 am, the yield on the 30-year Treasury bond is 4.93%, while the 10-year Treasury note yield is at 4.29%. These yields are quite attractive for plans receiving SFA and wanting to secure benefits and expenses with the proceeds. Don’t miss this opportunity to significantly reduce the cost of those future benefits.