By: Russ Kamp, CEO, Ryan ALM, Inc.

Milliman released its monthly Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans. They reported that the funded ratio has now improved for nine straight months – impressive! As of December 31, 2025, the funded ratio for the index constituents is 108.1%, which is up substantially from year end 2024’s 103.6%.

The increase in the funded ratio for December (and the year) was mostly driven by the performance of the assets for the index’s constituents that saw an 11.32% average return for the year, increasing asset values by $53 billion. A rather stable interest rate environment lead to only a $1 billion decline in the PV of those FV liabilities.

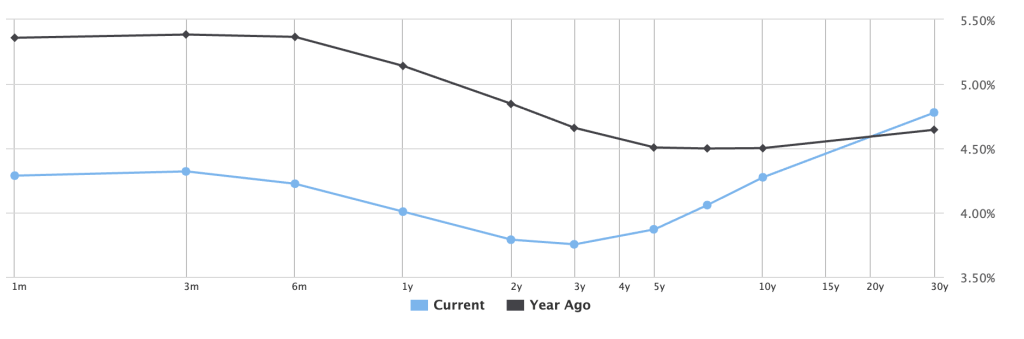

According to Zorast Wadia, author of the Milliman 100 Pension Funding Index report, “discount rates fell during the year, and this trend could extend into 2026, potentially reversing some of the recent funded status gains and underscoring the continued need for prudent asset-liability management.” We couldn’t agree more.

It was the significant decline in U.S. interest rates during a nearly four decade bull market for bonds that really crushed funding for private DB pension plans. It would be tragic to witness a deterioration in the funded ratio/status after reclaiming a strong financial footing. Secure those promises and sit back and enjoy managing surplus assets.

Here is the link to the full December report: View this month’s complete Pension Funding Index