By: Russ Kamp, CEO, Ryan ALM, Inc.

This blog focuses most often on issues related to defined benefit pension plans or other retirement-related programs/issues. However, sometimes an issue (in this case “affordability”) captures my attention leading me to respond. As you may recall, last week the WSJ asked the question: Can “Trump Accounts” for babies change the economics of having a family? I posted a note on LinkedIn.com that seemed to get the attention of many of my connections and others, as well.

My response to that question posed by the WSJ was “are you kidding me?” A one-time $1,000 deposit into a child’s account is not even a rounding error in the annual cost of raising a child. Current estimates have the cost of raising a child at >$27k/year for a two-working-adult household and >$300k by the time that child reaches 18, excluding college!

Why would anyone think that a $1,000 contribution to a small subset of children (those born between 2025 and 2028) is going to make a difference in the affordability of having children today? How is this band-aid going to tackle the economic hardship on middle and lower wage earners? Affordability has deteriorated for most Americans because essential costs—especially housing, healthcare, education, and child care—have grown much faster than typical wages, while interest rates and structural constraints (like housing supply) magnify the squeeze on household budgets. This creates a situation in which a larger share of income is needed to absorb basic living expenses, reducing room for saving (emergency fund, retirement, education, etc.), mobility, and discretionary spending (how dare you dream of a vacation) for the majority of households.

We often read about the impact of escalating housing costs (ownership or rent), but healthcare and higher education have seen some of the most significant long‑run price increases, becoming major affordability stressors for a significant majority of American families. Studies of cost‑of‑living trends highlight that health insurance premiums, out‑of‑pocket medical costs, and public college tuition have grown multiple times faster than general inflation and median earnings, increasing debt loads and the potential for financial risk and hardship.

Other necessities—such as food, transportation (try buying a new car), and utilities—have also risen substantially over the past two decades, with food and other goods and services experiencing cumulative price increases of roughly 85% or more since 2000. While some of this price movement reflects broad inflation issues, the problem for households is that real wage growth has not kept pace, so a larger share of one’s take-home pay goes to basics.

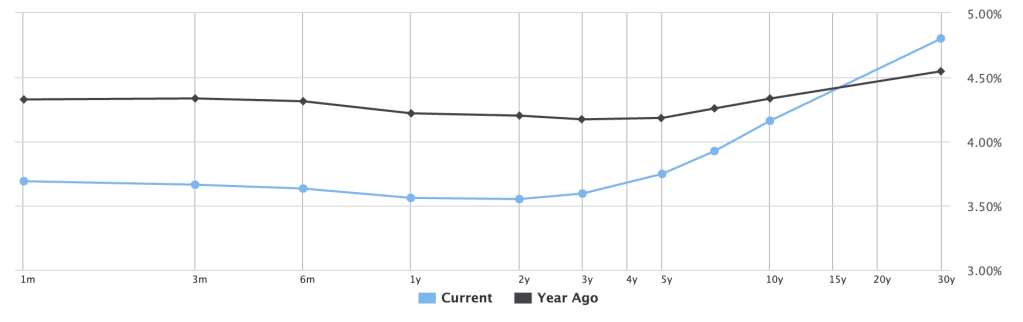

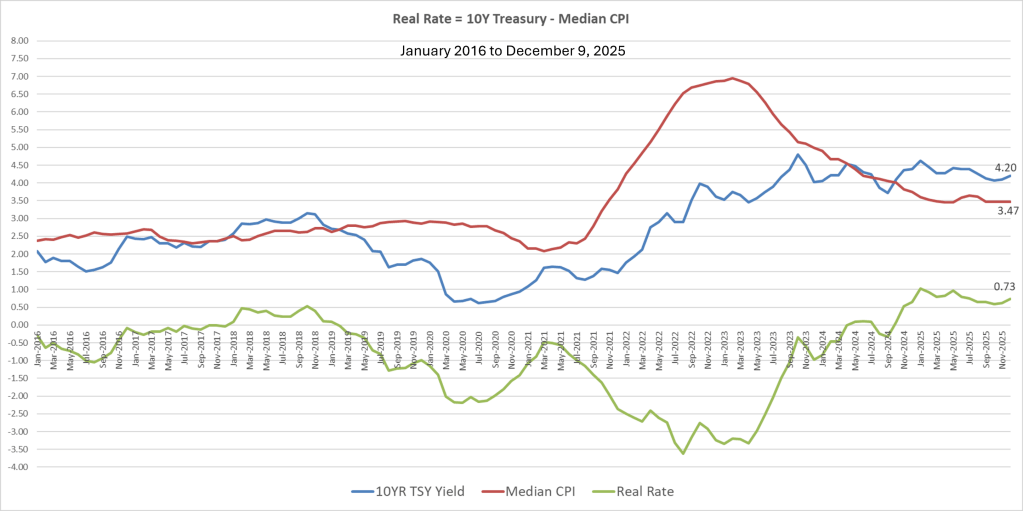

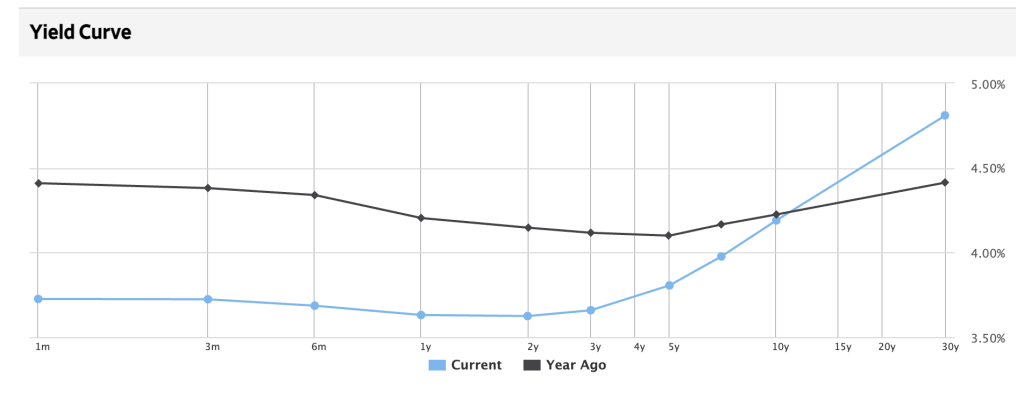

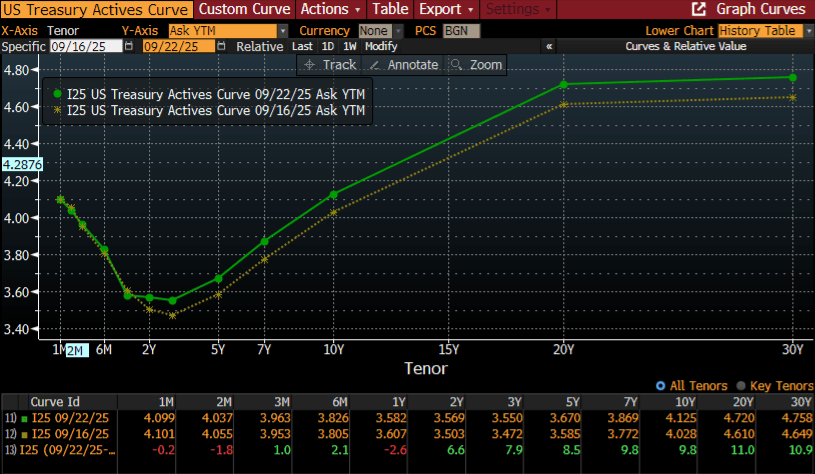

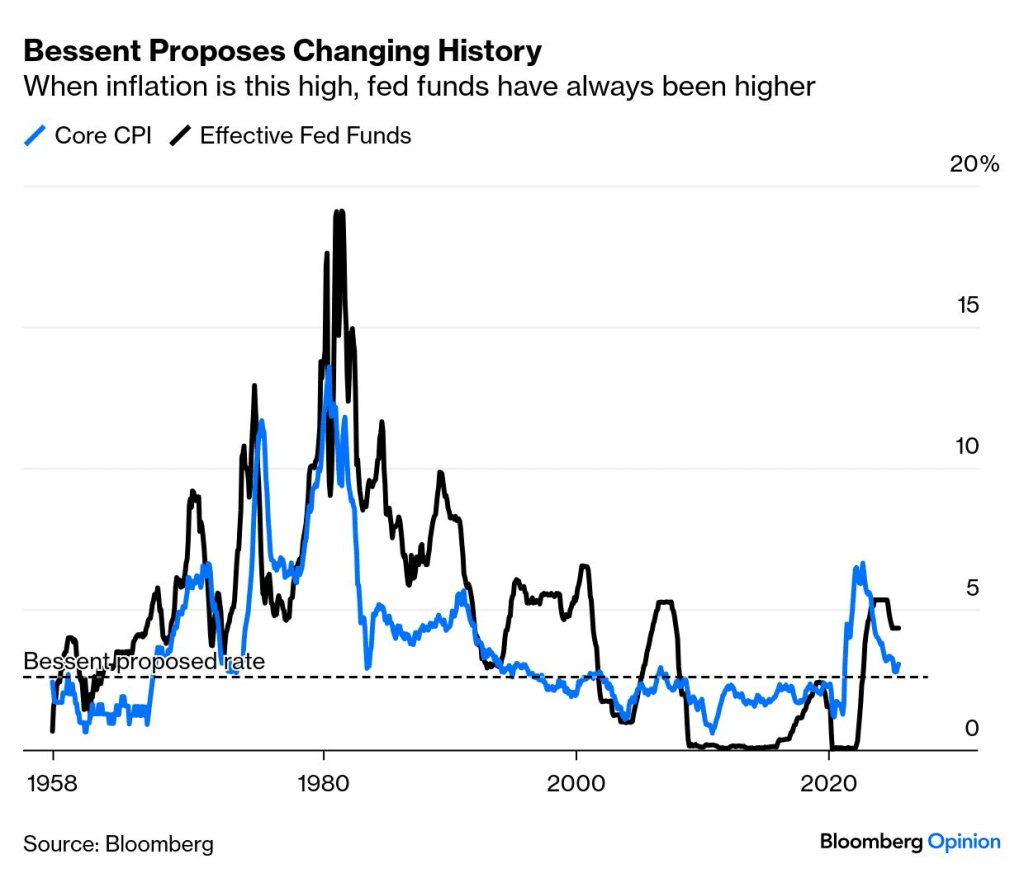

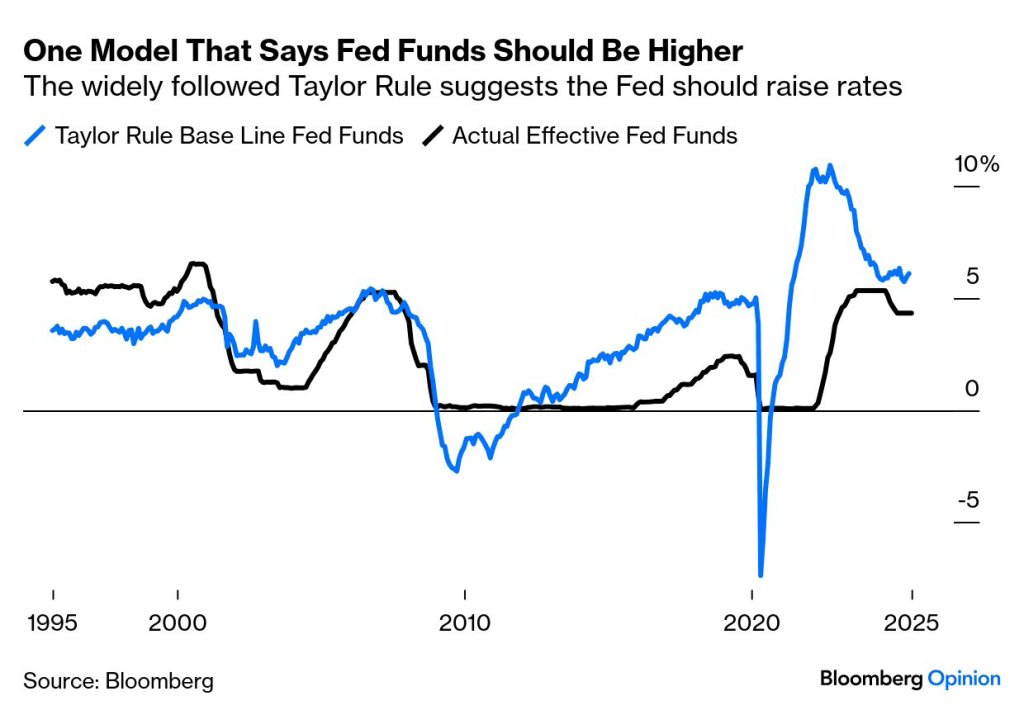

Recent high inflation (2021–2023) raised the prices of everyday items and housing costs faster than nominal wages for many workers, compressing real disposable income. In response, the Federal Reserve raised interest rates sharply, which helped moderate inflation but also increased borrowing costs for mortgages, car loans, and credit card balances.

Given that many households rely on debt to manage education, vehicles, or unexpected expenses, higher interest rates translate into heavier monthly payments and less capacity to save or invest. For younger households and those without assets, this dynamic can delay milestones like homeownership or starting a family, reinforcing a sense that the “American Dream” is receding, if not collapsing!

Less capacity to save for retirement (DC plans) and education (529 plans) is reflected in the median balances for each. I’ve railed about the failure of the defined contribution model being the primary “retirement” vehicle in many blog posts. Asking untrained individuals to fund, manage, and then disburse a benefit with limited, if no, disposable income, a lack of investment acumen, and no crystal ball to help with longevity issues is just poor policy.

Can we stop with the gimmicks, such as these child accounts, and finally get serious about the lack of affordability in this country for a significant majority of Americans! Rising inequality amplifies affordability problems because gains are concentrated among higher‑income and wealthier households while most others face flat real incomes and volatile expenses. “The Ludwig Institute’s analysis, for example, concludes that a minimal but “dignified” standard of living is now out of reach for the bottom 60 percent of households, even around $100,000 in income in some regions, due to the cumulative effect of costs.” (Truthout)

No economy can function long-term when a small sliver of the population earns most of the income, while also benefiting from lower capital gains treatment and reduced corporate taxes. Recent reports suggest that 47% of income is absorbed by the top 10% of wage earners. Other reports suggest that >60% of Americans couldn’t meet a $400 emergency related to a car repair or medical expense without taking on debt. This situation can’t continue unabated.

As the father of five and the grandfather to 11, I see these economic burdens play out everyday! It is time to get serious!