By: Russ Kamp, CEO, Ryan ALM, Inc.

A recent ruling by the 2nd Circuit has opened the door for roughly 100+ multiemployer plans to pursue Special Financial Assistance (SFA) that were originally deemed ineligible because the plans had terminated. The PBGC’s inspector general, in a “risk advisory”, has estimated that the cost to provide the SFA to these newly eligible plans could be as much as $6 billion. Is that all? Let’s not focus on the $s, but the number of American workers and their families that this additional expenditure will support.

As I reported last week in my weekly update related to ARPA’s pension reform, the PBGC had denied the application for the Bakery Drivers Local 550 and Industry Pension Fund, a New York-based terminated pension plan, because it had terminated. The plan covered 1,094 participants in 2022 and was 6.3% funded, according to their Form 5500. Regrettably, the plan terminated in 2016 by mass withdrawal after Hostess Brands, Inc., its largest contributor, went bankrupt. However, the court stated, that despite terminating in 2016, the plan “continued to perform audits, conduct valuations, file annual reports, and make payments to more than 1,100 beneficiaries.”

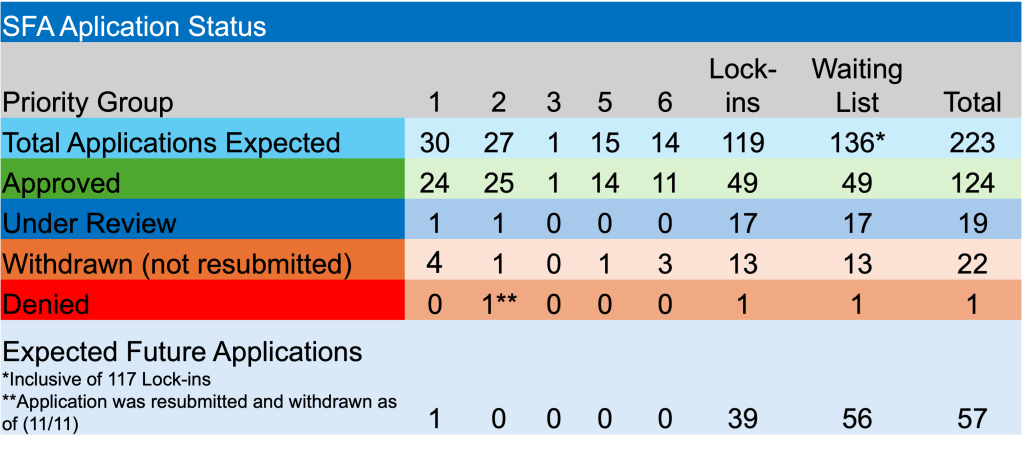

As of June 13, 2025, the PBGC had already received 223 applications for SFA with $73.0 billion approved supporting the retirements for 1.75 million American workers. What an incredible outcome! However, according to the inspector general’s letter, the potential $6 billion in added cost would include $3.5 billion to repay the PBGC’s earlier loans to approximately 91 terminated plans, which was described as a “potential waste”. He went on to state that the potential repayment to the PBGC would be a waste of taxpayer funds due to the positive current and projected financial condition of the multiemployer program. “PBGC’s multiemployer program is in the best financial condition it has been in for many years. PBGC’s 2023 Projections Report states that PBGC’s multiemployer program is projected to ‘likely remain solvent for at least 40 years.’” GREAT!

Perhaps the repayment of $3.5 billion in loans could enable the PBGC to lower the annual premiums on the cost to insure each participant, which might keep some plans from seeking termination due to excessive costs to administer the program. Something needs to be done with private DB plans, too, as those costs per participant are far greater, but that’s a story for another blog post.

As regular readers of this blog know, we’ve celebrated the success of this program since its inception (July 2021). The fact that 1.75 million American workers to date have had their promised benefits secured, and in some cases, restored, is wonderful. Think of the economic impact that receiving and spending a monthly pension check has on their communities. Furthermore, think about what the cost would have been for each of these folks had the Federal government been needed to provide social services. None of these workers/retirees did anything wrong, yet they bore the brunt.

The estimated $6 billion in additional “investment” in American workers is a drop in the bucket relative to the annual budget deficit, which has been running from $1-$2 trillion annually. Restoring and supporting the earned retirement benefits is the right thing to do.