By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Fiducient Advisors has published its 2025 Outlook. Given the strong performance in US equity markets, future returns have been adjusted downward – rightfully so. Here are some of the highlights:

–Full valuations, concentrated U.S. large-cap indexes and the risk of reigniting inflation are shaping the key themes we believe will drive markets and portfolio positioning in 2025.

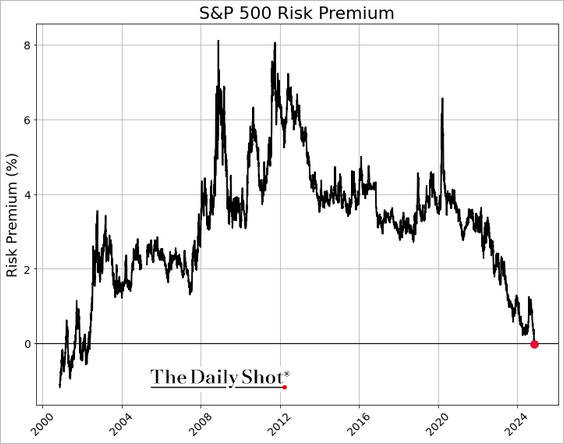

-Recent market successes have pushed our 2025 10-year forecasts lower across most major asset classes. Long-term return premium for equities over fixed income is now at its narrowest since 2007, sparking important conversations about portfolio posture and risk allocation.

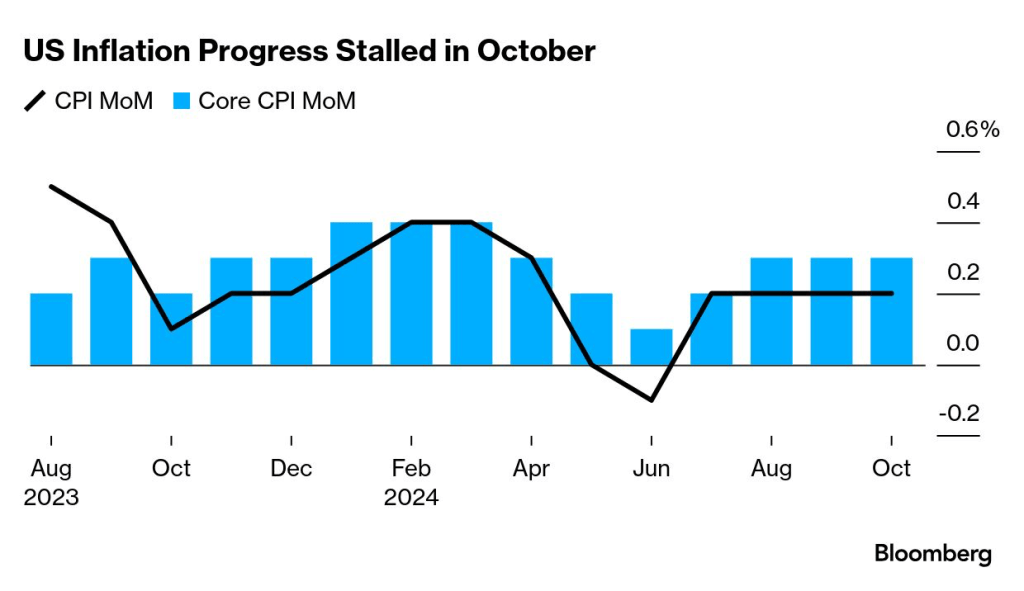

–Rising reinflation risk leads us to increase our allocation to more flexible fixed income strategies (dynamic bonds) and TIPS while eliminating our global bond allocation.

US stock market performance has been heavily influenced by the “Magnificent Seven”, creating concentration risk not seen in decades, if ever. The outperformance of US markets vis-a-vis international markets is unprecedented. As stated above, valuations are stretched. Most metrics used to measure “value” in our markets are at extreme levels, if not historical. How much more can one squeeze from this market? As a result, Fiducient is forecasting that US All-Cap (Russell 3000?) will appreciate an annualized 5.6% for the next 10-years.

Nearly as weak are the forecasts for private equity, which Fiducient believes will produce only an annualized 8.6% return through the next 10-years. What happened to the significant “premium” that investing privately would provide? Are the massive flows into these products finally catching up with this asset class? Sure seems like it.

With regard to the comment about fixed income, I’m not sure that I know what “flexible fixed income strategies” are and the reference to dynamic escapes me, too. I do know that bonds benefit from lower interest rates and get harmed when rates rise. We have been very consistent in our messaging that we don’t forecast interest rates as a firm, but we have also written extensively that the inflation fight was far from over and that US growth was more likely to surprise on the upside than reflect a recessionary environment. Today, the third and final installment of the Q3’24 GDP forecast was revised up to 3.1% annual growth. The Q4’24 estimate produced by the Atlanta Fed through its GDPNow model is forecasting 3.2% annual growth. What recession?

Given that US growth is likely to be stronger, employment and wage growth still robust, and sticky inflation just that, bonds SHOULDN’T be used as a performance instrument. Bonds should be used for their cash flows of interest and principal. BTW, one can buy an Athene Holding Ltd (ATH) bond maturing 1/15/34 with a YTW of 5.62% today. Why invest in US All-Caps with a projected 5.6% return with all of that annual standard deviation when you can buy a bond, barring a default and held to maturity, will absolutely provide you with a 5.62% return? This is the beauty in bonds! Those contractual cash flows can be used, and have been for decades, to defease liabilities (pension benefits, grants, etc.) and to SECURE the promises made to your participants.

It is time to rethink the approach to pension management and asset allocation. Use a cash flow matching strategy to secure your benefits for the next 10-years that buys time for the growth assets to GROW, as they are no longer a source of liquidity. Equity markets may not provide the same level of appreciation as they have during the last decade (+13.4% annualized for the S&P 500 for 10-years through 11/30/24), but a defeased bond portfolio will certainly provide you with the necessary liquidity, an extended investing horizon, and the security (peace of mind) of knowing that your benefits will be paid as promised and when due! Who needs “flexible and dynamic” bonds when you have the security of a defeased cash flow matching strategy?