By: Russ Kamp, CEO, Ryan ALM, Inc.

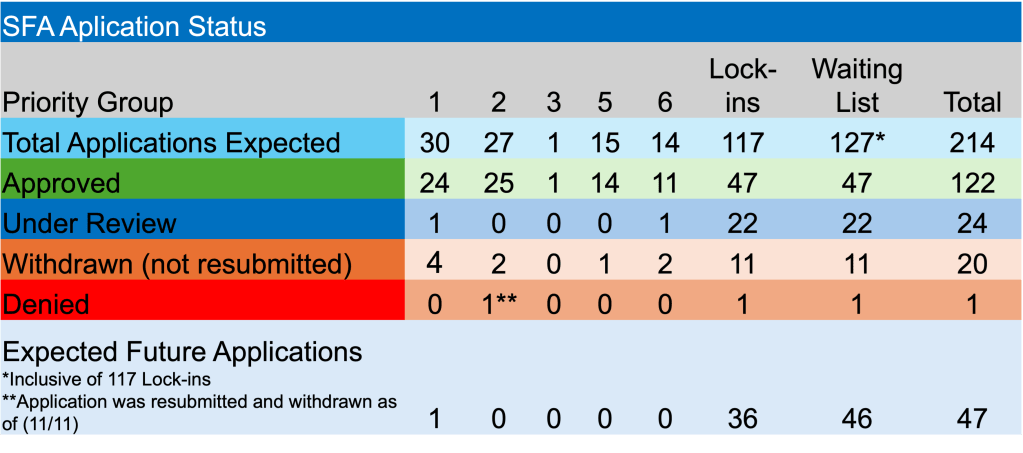

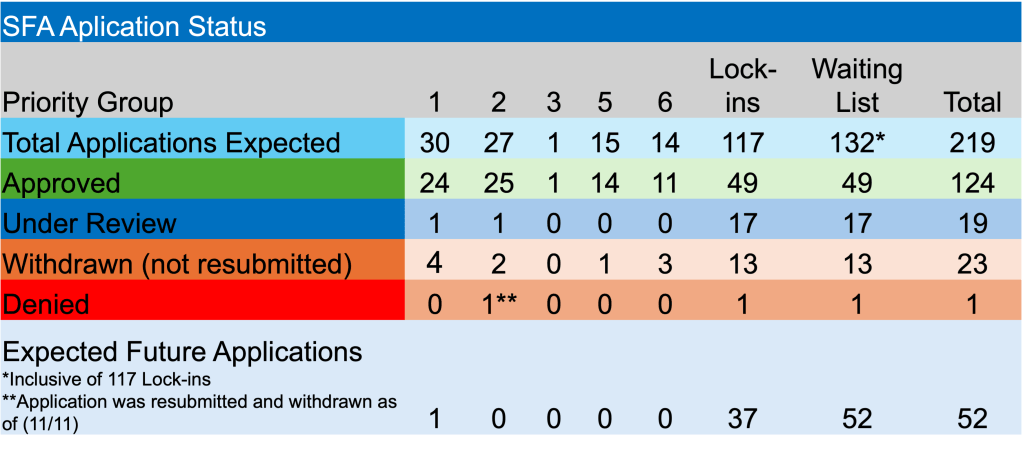

Pleased to provide you with another weekly update on the PBGC’s implementation of the critically important ARPA pension legislation. We are roughly 1 1/2 years from the completion of this program and yet, more pension funds are seeking to be added to the waitlist. In just the past week, another six funds were added to the list, including Bakery and Sales Drivers’ Local 33 Partitioned Pension Fund, Oregon Printing Industry Pension Trust, Local No. 171 Pension Plan, Licensed Tugmen’s and Pilots’ Pension Fund, San Diego Plasterers Pension Trust, and the Ironworkers Local No. 6 Pension Plan. In total 132 funds sought SFA that weren’t part of the original six priority groups that became five after further review.

There were no new applications submitted during the prior 7-day period, as the PBGC’s eFiling portal remains temporarily closed. There are currently 19 applications with the PBGC, including one Priority Group 1 member and a recently submitted Priority Group 2 application. There remains one application with a June 2025 deadline for action. Happy to report that two funds received approval for their applications, including New Bedford Longshoremen’s Pension Plan and Cement Masons Local No. 524 Pension Plan, both of which are non-priority group members. In total, they will receive just under $6 million in SFA plus interest for the 280 plan participants.

There were no plans asked to repay a portion of the SFA due to census errors and no plans had their applications denied. There were two plans running up against the PBGC’s 120-day window that withdrew applications, including Teamsters Local 277 Pension Fund and Laborers National Pension Fund.

Given uncertainty related to the impact of the tariffs on consumption, jobs, earnings, etc. The Federal Reserve remains cautious in its approach to future rate movements. As a result, U.S. interest rates have migrated higher providing plan sponsors with a wonderful opportunity to defease the promised benefit payments and in the process extend the potential coverage period. As always, we are willing to provide a free analysis to help any SFA recipient think through an appropriate asset allocation framework.