By: Russ Kamp, CEO, Ryan ALM, Inc.

Good morning and welcome to the first full day of Fall. Autumn has always been my favorite season. How about you?

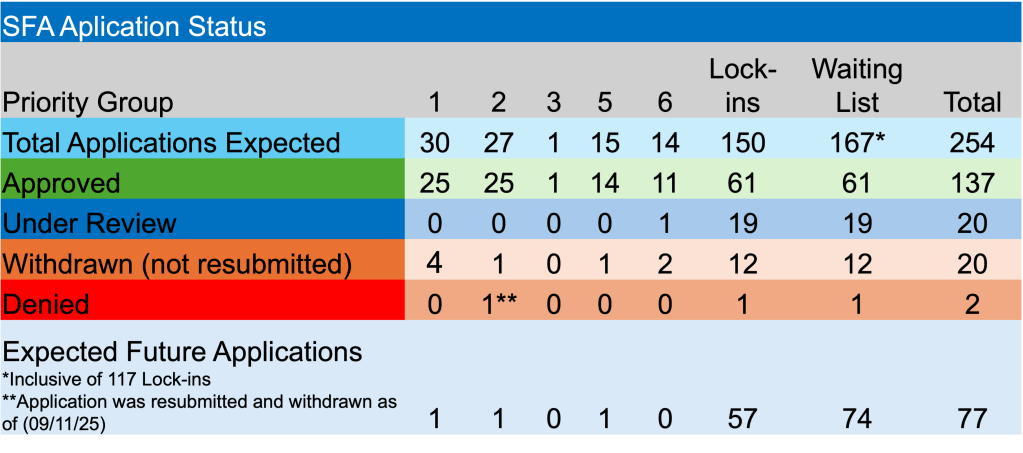

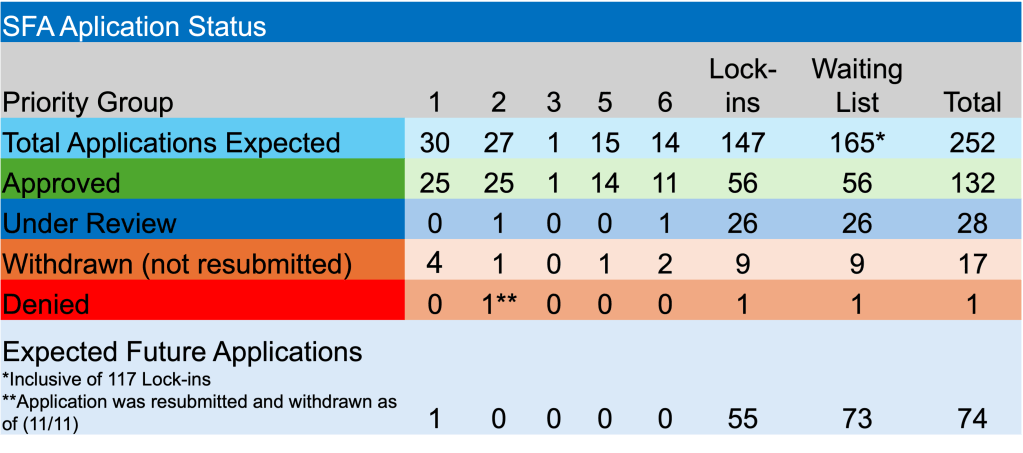

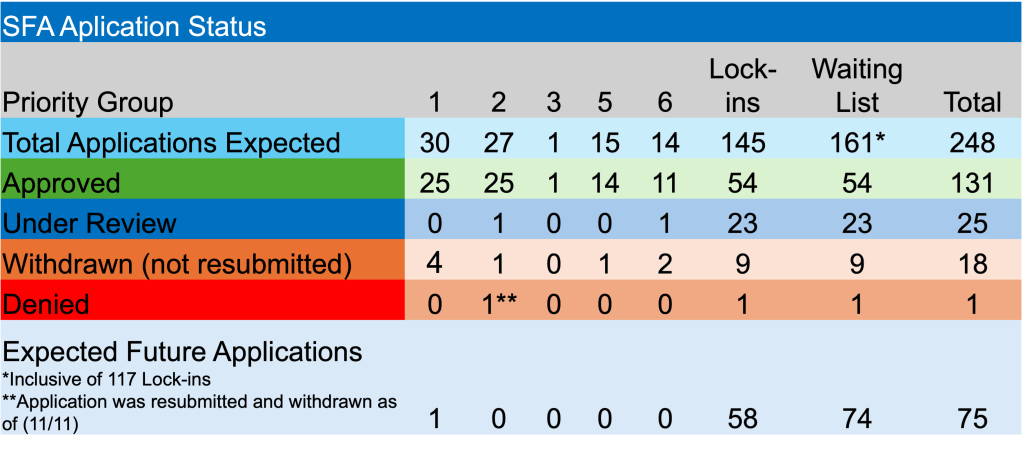

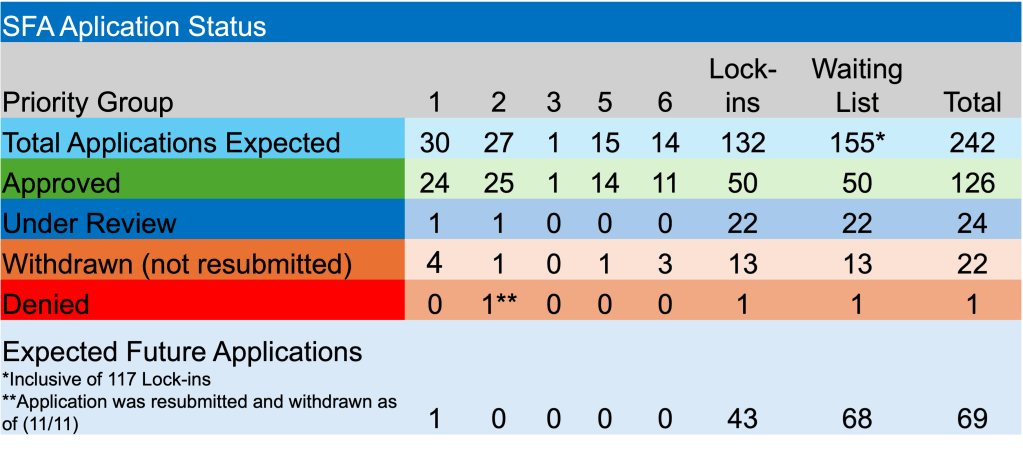

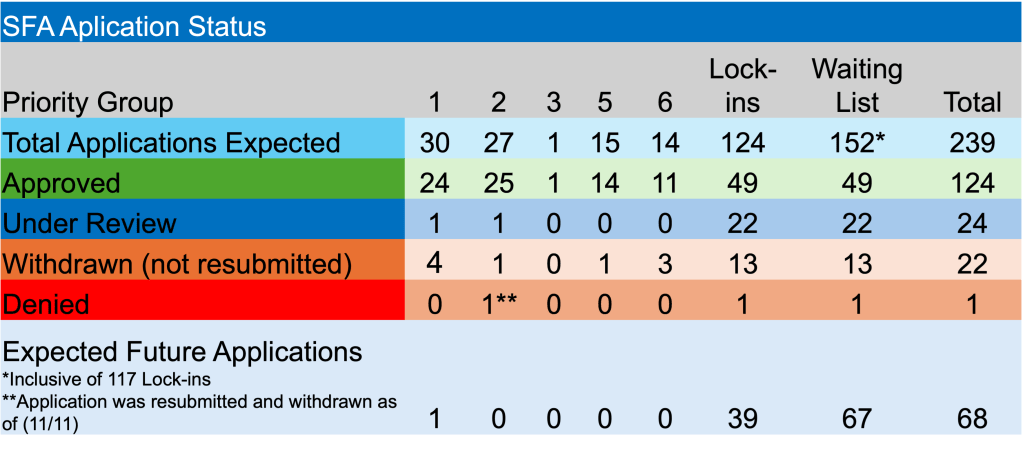

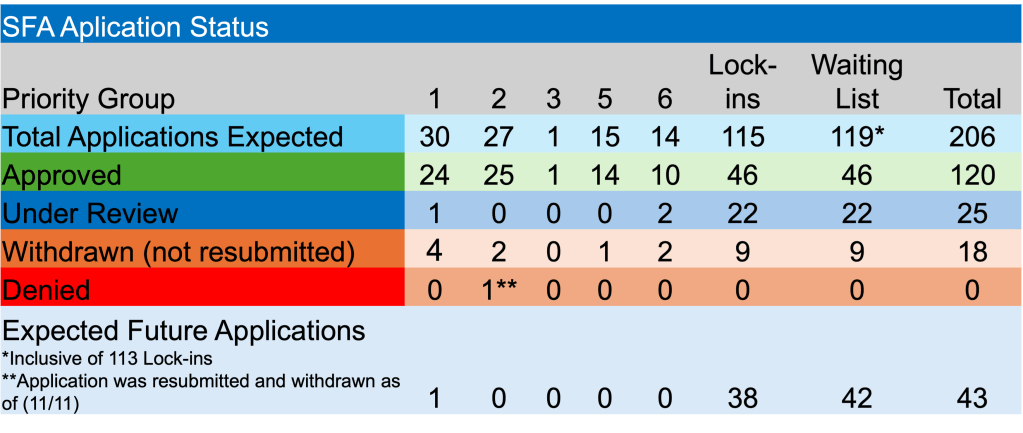

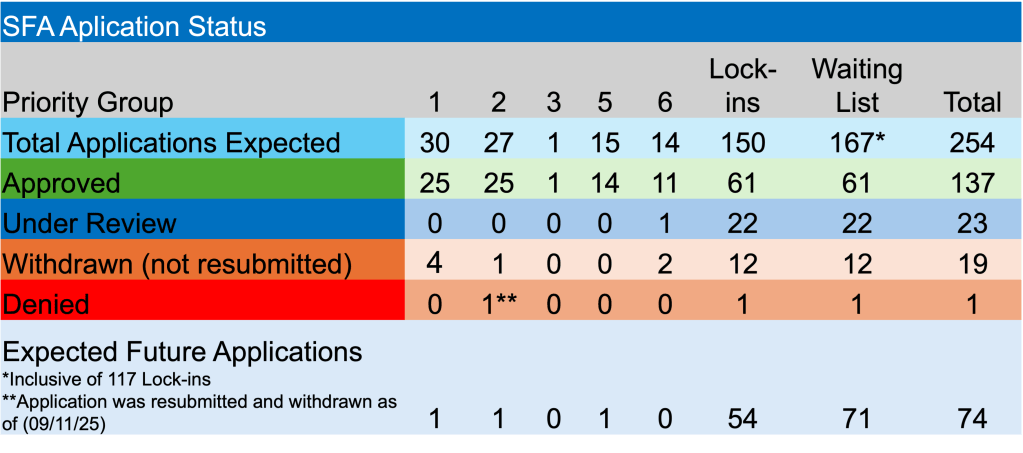

Regarding the implementation of ARPA’s pension legislation by the PBGC, we are now about 3 1/2 months away from the deadline to have all initial applications seeking Special Financial Assistance (SFA) submitted. Unfortunately, there are still dozens of multiemployer pension plans sitting on the PBGC’s waitlist.

Last week witnessed a slower pace of activity, as the PBGC is only reporting the submission of three applications and the repayment of excess SFA by one fund. There were no applications approved, denied, or withdrawn during the previous week. Furthermore, there were no pension funds seeking to be added to the waitlist and none of the plans currently sitting on that list locked-in the valuation date. We may not see any new plans being added to the list given the rapidly approaching deadline for initial application submission. As a reminder, those plans that submit an application before 12/31/25 can submit a revised application until 12/31/26 – the legislation’s deadline.

Pleased to report that Pension Trust Fund Agreement of St. Louis Motion Picture Machine Operators, Teamsters Local 837 Pension Plan, and Iron Workers’ Pension Trust Fund for Colorado each submitted an initial application seeking SFA. These non-Priority Group members are hoping to secure >$30 million for the nearly 3,200 plan participants. As a reminder, the PBGC has 120-days to act on these applications.

Finally, there was one plan asked to rebate a portion of the SFA based on a census error. Western Pennsylvania Teamsters and Employers Pension Fund, a recipient of $994.6 million has agreed to rebate $8.8 million or 0.89% of the grant. To date, 61 multiemployer pension funds have repaid $260.7 million in excess SFA on grants totaling $53.4 billion or 0.49%.

We hope that you have a great week. Check back in next Monday for the next ARPA legislation update.