By: Russ Kamp, CEO, Ryan ALM, Inc.

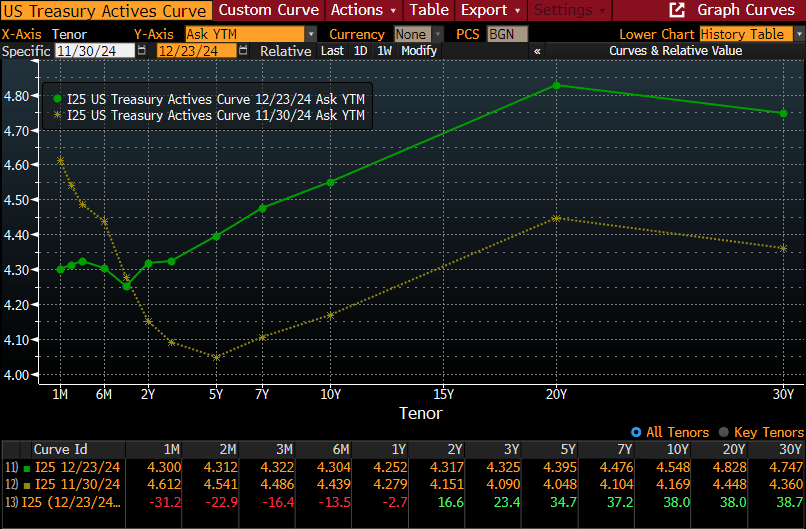

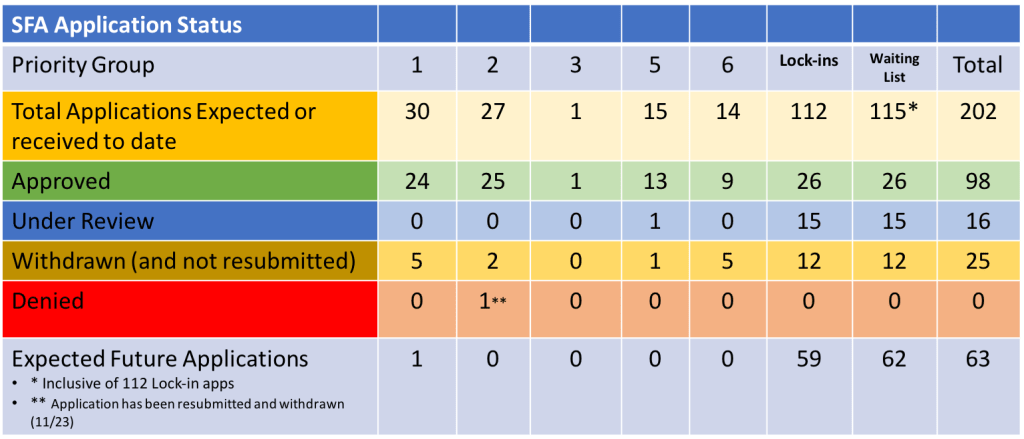

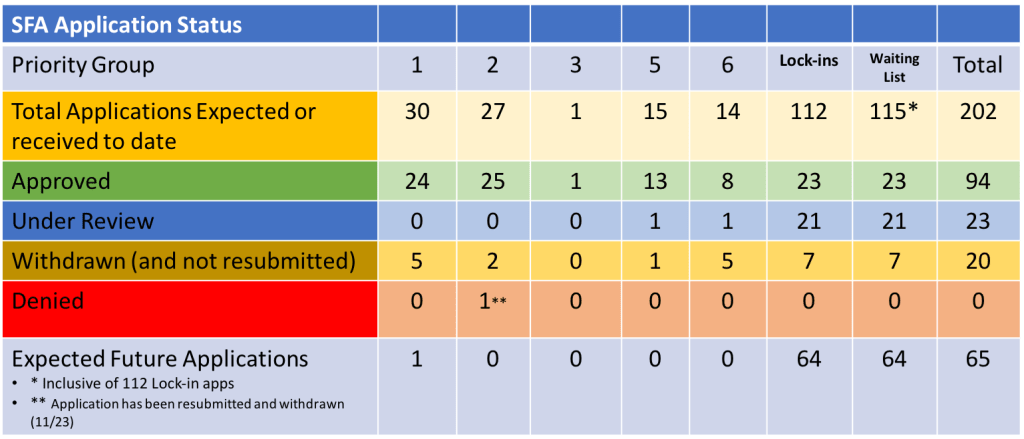

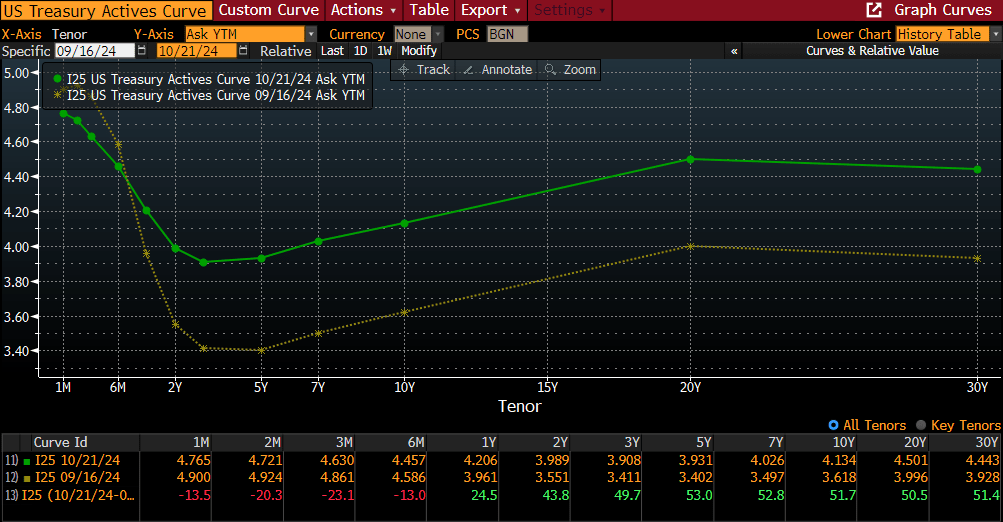

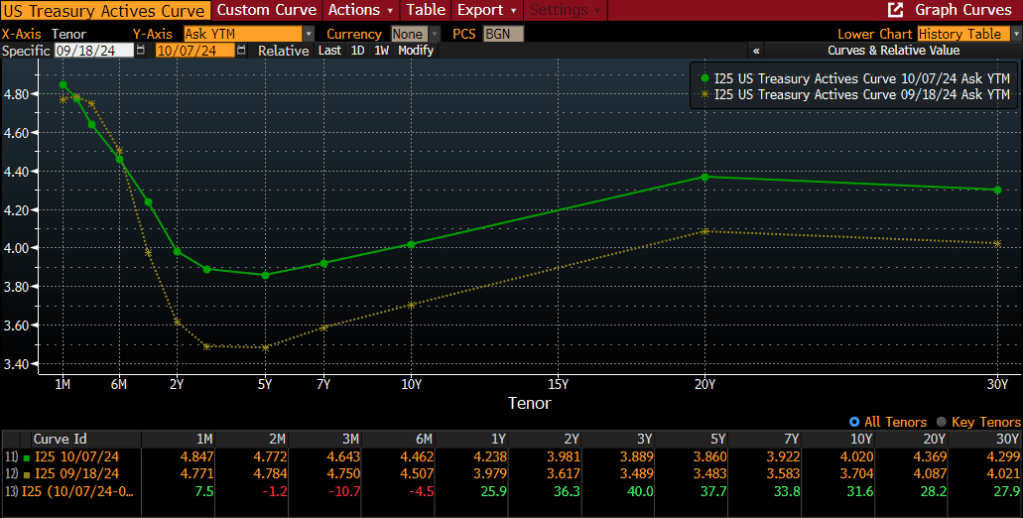

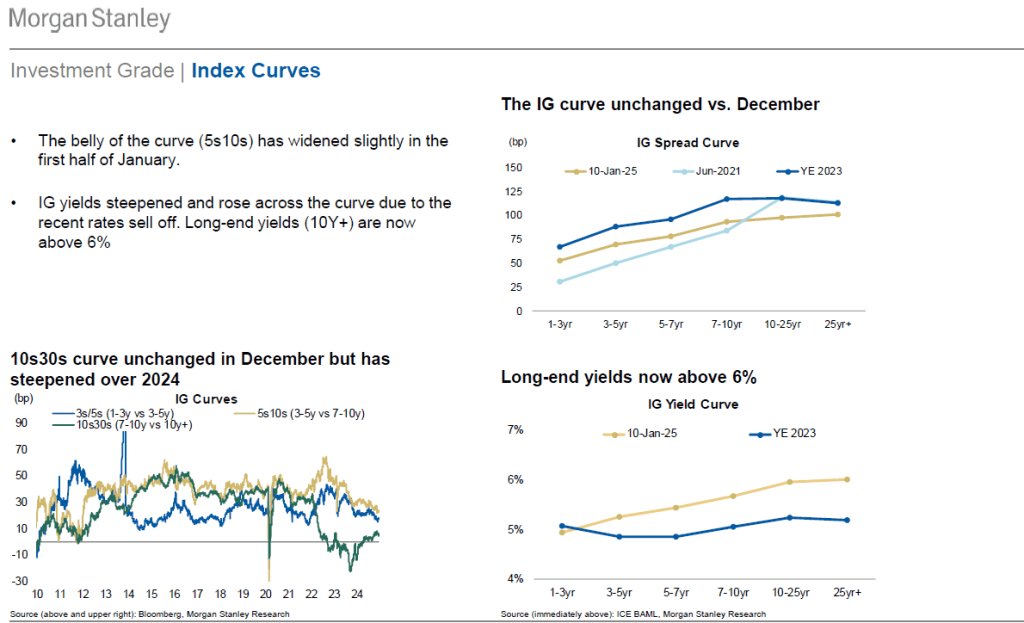

Not since October of 2023 have we seen long-dated Treasury yields at these levels. Currently, the 30-year Treasury bond yield is 5% (12:47 pm EST) and the 10-year Treasury Note’s yield has eclipsed 4.8%. Despite tight credit spreads, long-dated (25+ years) IG corporate bond yields are above 6% today (chart in the lower right corner).

Securing pension liabilities, whether your DB plan is private, public, or a multiemployer plan, should be the primary objective. All the better if that securing (defeasement strategy) can be accomplished at a reasonable cost and with prudent risk. The good news: the current rate environment is providing plan sponsors with a wonderful opportunity to accomplish all of those goals, whether you engage in a cash flow matching (CFM) for a relatively short period (5-years), intermediate, (10ish-years) or longer-term (15- or more years) your portfolio of IG corporate bonds will produce a YTM of > 5.5%. This represents a significant percentage of the target ROA.

Furthermore, as we’ve explained, pension liabilities are future values (FVs), and FVs are not interest rate sensitive. Your portfolio will lock in the cost savings on day one, and barring any defaults (about 2/1,000 in IG bonds), the YTM is what your portfolio will earn throughout the relationship. That is exciting given the fact that traditional fixed income core mandates bleed performance during rising rate regimes. In fact, the IG index is already off 1.2% YTD (<10 trading days).

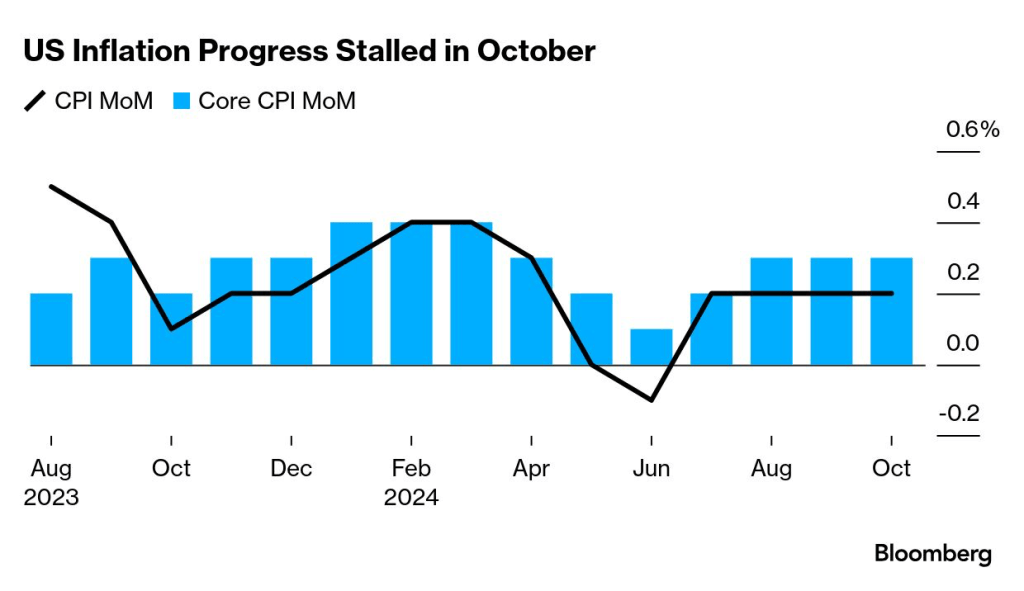

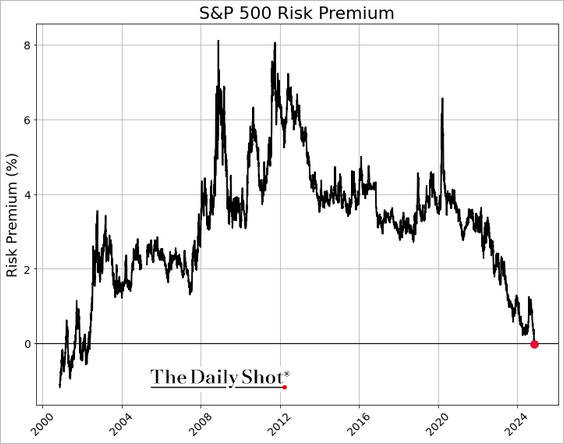

Who knows when the high equity valuations will finally lead to a repricing. Furthermore, who knows if US inflation will continue to be sticky, the Fed will raise or lower rates, geopolitical risks will escalate, and on and on. With CFM one doesn’t need a crystal ball. You can SECURE the promised benefits for a portion of your portfolio and in the process you’d be stabilizing the funded status and contribution expenses associated with those assets. Don’t let this incredibly attractive rate environment come and go without doing anything. We saw inertia keep plans from issuing POBs when rates were historically low. It is time to act.