By: Russ Kamp, CEO, Ryan ALM, Inc.

As we wrote a year ago this past April, it is time to Bag the Agg. For public pension plan sponsors and their advisors who are so focused on achieving the return on asset (ROA) assumption, any exposure to a core fixed income strategy benchmarked to the Aggregate index would have been a major drag on the performance since the decades long decline in rates stopped (2020) and rates began to rise aggressively in early 2022. The table below shows the total return of the Bloomberg Aggregate for several rolling periods with returns well below the ROA target return (roughly 7%).

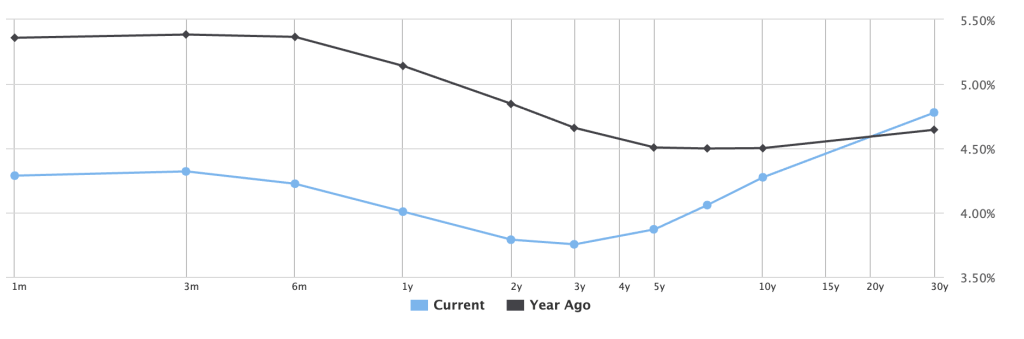

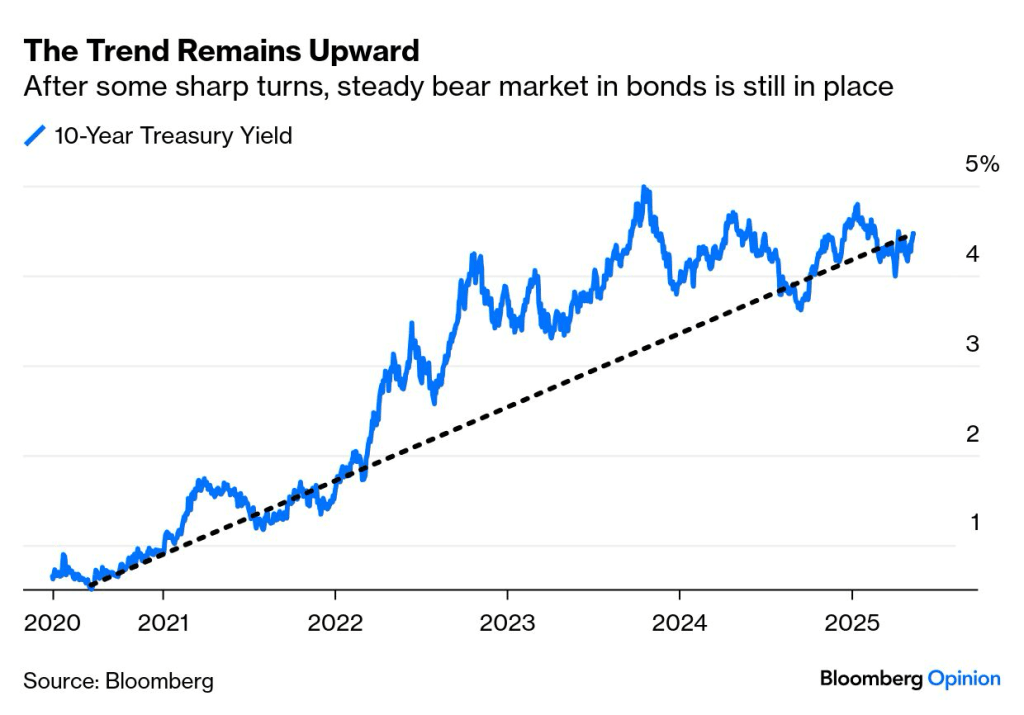

For core fixed income strategies, the YTW should be the expected return plus or minus the impact from changes in interest rates. Again, for nearly 4 decades beginning in 1981, U.S. interest rates declined providing a significant tailwind for both bonds and risk assets. What most folks might not know, from 1953 to 1981 U.S. interest rates rose. Could we be at the beginning of another secular trend of rising rates (see below)? If so, what does it mean for pension plans?

Rising rates may negatively impact the price of bonds, but importantly they reduce the present value (PV) of future benefit payments. They also provide pension funds and their advisors with the option to de-risk the plan through a cash flow matching (CFM) strategy as the absolute level of rates moves closer to the annual ROA. Active fixed income management is challenging. Who really knows where rates are going? But we know with certainty the cash flows that bonds produce (interest income and principal at maturity). Those bond cash flows can be used to match and fully fund liability cash flows (benefits and expenses). A decline in the value of a bond will be offset by the decline in the PV of the plan’s liabilities. So, a 5-year return of -0.3%, which looks horrible if bonds are viewed as performance instruments may match the growth rate of liabilities it is funding. Using bonds for their cash flows, brings certainty and liquidity to the portion of the plan that has been defeased.

Are you confident that your active fixed income will produce the YTW or better? Are you sure that U.S. interest rates are going to fall from these levels? Why bet on something that you can’t control? Convert your active core bond program into a CFM portfolio that will ensure that your plan’s liabilities and assets move in lockstep no matter which direction rates take. Moreover, CFM will provide all the liquidity needed to fund benefits and expenses thereby eliminating the need to do a cash sweep. Assume risk with your growth assets that will now have a longer investing horizon because you’ve just bought plenty of time for them to grow unencumbered.