By: Russ Kamp, CEO, Ryan ALM, Inc.

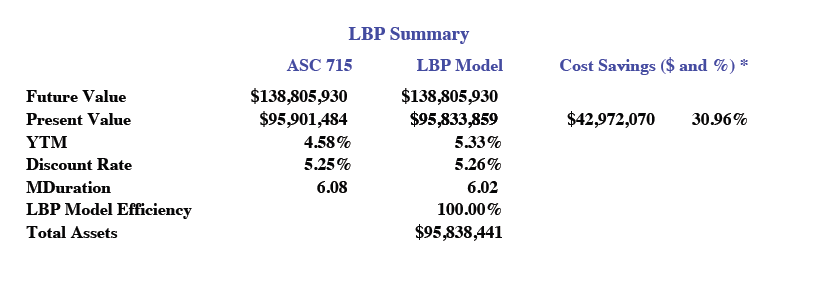

There seems to be abundant confusion within certain segments of the pension industry regarding the purpose and accounting (performance) of a Cash Flow Matching (CFM) portfolio on a monthly basis. Traditional monthly reports focus on the present value (PV) of assets in marking those assets to month-end prices. However, when utilizing a CFM strategy, one is hoping to defease (secure) promised benefits which are a future value (FV). As a reminder, FVs are not interest rate sensitive. The movement in monthly prices become irrelevant.

If pension plan A owes a participant $1,000 next month or 10-years from now, that promise is $1,000 whether interest rates are at 2% or 8%. However, when converting that FV benefit into a PV using today’s interest rates, one can “lock in” the relationship between assets and liabilities (benefit payment) no matter which way rates go. To accomplish this objective, a CFM portfolio will match those projected liabilities through an optimization process that matches principal, interest, and any reinvested income from bonds to those monthly promises. The allocation to the CFM strategy will determine the length of the mandate (coverage period).

Given the fact that the FV relationship is secured, providing plan sponsors with the only element of certainty within a pension fund, does it really make any sense to mark those bonds used to defease liabilities to market each month? Absolutely, NOT! The only concern one should have in using a CFM strategy is a bond default, which is extremely rare within the investment grade universe (from AAA to BBB-) of bonds. In fact, according to a recent study by S&P, the rate of defaults within the IG universe is only 0.18% annually for the last 40-years or roughly 2/1,000 bonds.

A CFM portfolio must reflect the actuaries latest forecast for projected benefits (and expenses), which means that perhaps once per year a small adjustment must be made to the portfolio. However, most pension plans receive annual contributions which can and should be used to make those modest adjustments minimizing turnover. As a result, most CFM strategies will purchase bonds at the inception of a mandate and hold those same issues until they mature at par. This low turnover locks in the cost reduction or difference in the PV vs. FV of the liabilities from day 1 of the mandate. There is no other strategy that can provide this level of certainty.

To get away from needing or wanting to mark all the plan’s assets to market each month, segregate the CFM assets from the balance of the plan’s assets. This segregation of assets mirrors our recommendation that a pension plan should bifurcate a plan’s asset allocation into two buckets: liquidity and growth. In this case, the CFM portfolio is the liquidity bucket and the remaining assets are the growth or alpha assets. If done correctly, the CFM portfolio will make all the necessary monthly distributions (benefits and expenses), while the alpha assets can just grow unencumbered. It is a very clean separation of the assets by function.

Yes, bond prices move every minute of every day that markets are open. If your bond allocation is being compared to a generic bond index such as the Aggregate index, then calculating a MV monthly return makes sense given that the market value of those assets changes continuously. But if a CFM strategy can secure the cost reduction to fund FVs on day 1, should a changing MV really bother you? Again, NO. You should be quite pleased that a segment of your portfolio has been secured. As the pension plan’s funded status improves, a further allocation should be made to the CFM mandate securing more of the promised benefits. This is a dynamic and responsive asset allocation approach driven by the funded status and not some arbitrary return on asset (ROA) target.

I encourage you to reach out to me, if you’d appreciate the opportunity to discuss this concept in more detail.