By: Russ Kamp, CEO, Ryan ALM, Inc.

Nearly 10 years ago, before joining Ryan ALM, I wrote an article about the idea that plan sponsors need to focus on their fund’s liabilities, as much as, if not more than, their plan’s assets. It shouldn’t be a shocking statement since the only reason that the plan exists is to fund a promise (benefit) that has been granted. Yet I would often get strange looks and frowns every time that concept was mentioned.

Why? Well, for over 50 years, pension sponsors and their consultants have been under the impression that if the return on assets (ROA) objective is achieved or exceeded, then the plan’s funding needs shall be sated. Unfortunately, this is just not true. A plan can achieve the ROA and then some, only to have the Funded Ratio decline and the Funded Status deteriorate, as liability growth exceeds asset growth.

We place liabilities – and the management of plan assets versus those liabilities – at the forefront of our approach to managing DB plans. Pension America has seen a significant demise in the use of DB plans, and we would suggest it has to do, in part, with how they’ve been managed. It will only get worse if we continue to support the notion that only the asset side of the pension equation is relevant. Focusing exclusively on the asset side of the equation with little or no integration with the plan’s liabilities has created an asset allocation that can be completely mismatched versus liabilities. It is time to adopt a new approach before the remaining 23,000 or so DB plans are all gone!

Our Suggestion

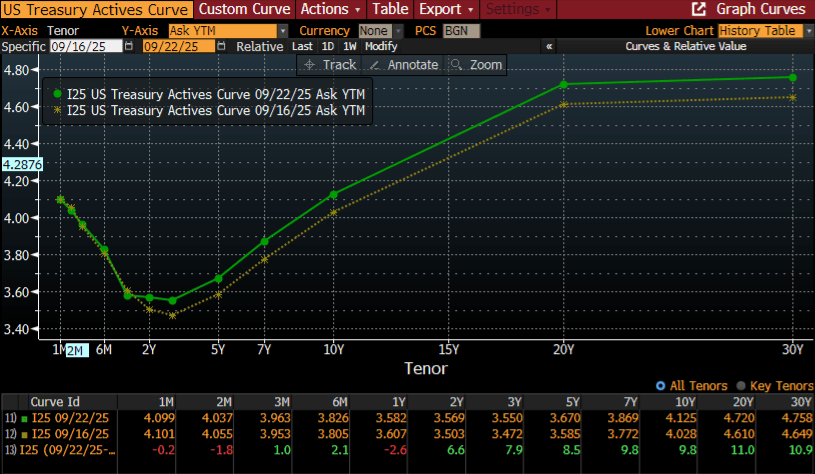

As this article’s title suggests, to manage the liability side of the equation, one needs a tool to measure and monitor the growth in liabilities, and it needs to be more frequent than the actuarial report that is an annual document usually available 3-6 months following the end of the calendar or fiscal year.

Such a tool exists – it is readily available, yet under-appreciated and certainly under-utilized! Ryan ALM has provided this tool to DB plan sponsors; namely, a Custom Liability Index (CLI), since 1991. This is a real time (available monthly or quarterly) index based on a plan’s specific projected liabilities. Furthermore, the output from this index should be the primary objective for a DB plan and not asset growth versus some hybrid index. Importantly, the CLI will provide to a plan sponsor (and their consultant) the following summary statistics on the liabilities, including:

- Term-structure, Duration and Yield to Worst

- Growth Rate of the Liabilities

- Interest Rate Sensitivity

- Present Value based on several discount rates

Different discount rates are used depending on the type of plan. GASB allows the ROA to be used as the discount rate for public pension plans, while FASB has a AA Corporate blended rate (ASC 715) as the primary discount rate for corporate plans. Having the ability (transparency) to see a plan’s liabilities at various discount rates with projected contributions is an incredible tool for both contribution management and asset allocation. Don’t hesitate to reach out to us for more information on how you can get a Custom Liability Index for your pension plan.