By: Russ Kamp, CEO, Ryan ALM, Inc.

Milliman released the 2024 year-end results of its Multiemployer Pension Funding Study (MPFS). The MPFS analyzes the funded status of ALL U.S. multiemployer DB pension plans. As of December 31, 2024, Milliman estimated multiemployer plans have an aggregate funded ratio of 97%, up from 89% as of December 31, 2023. Impressive!

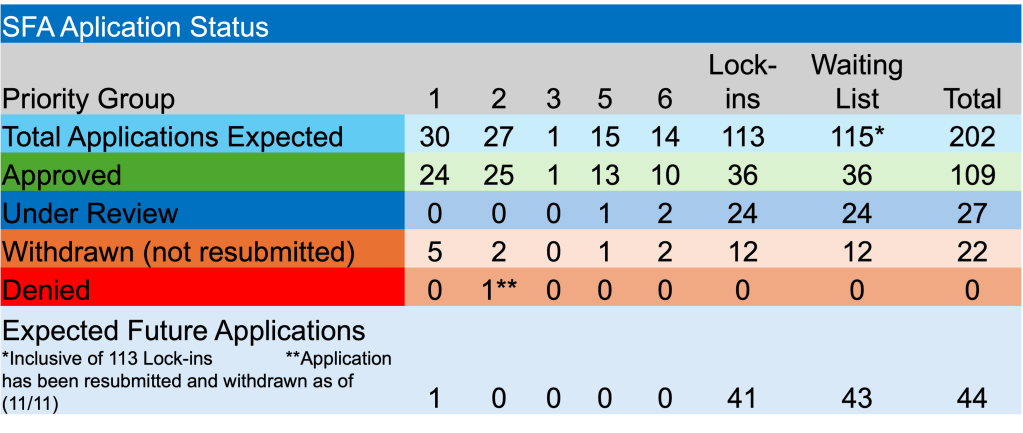

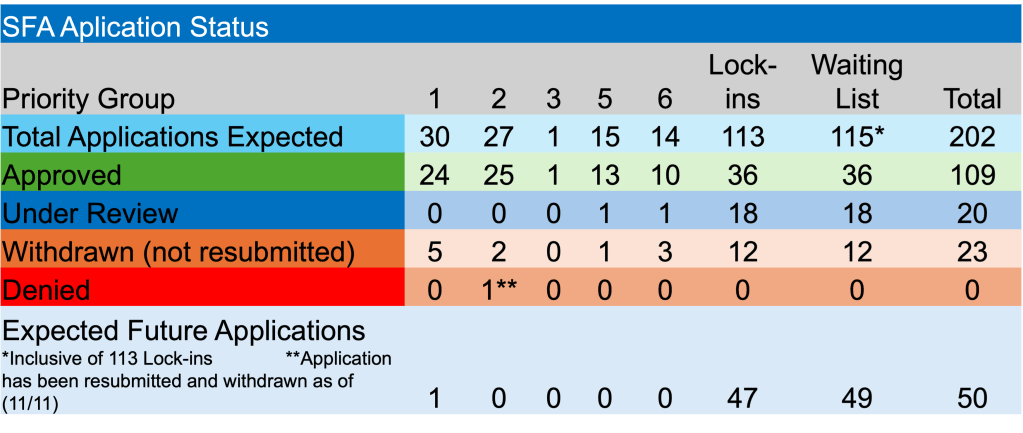

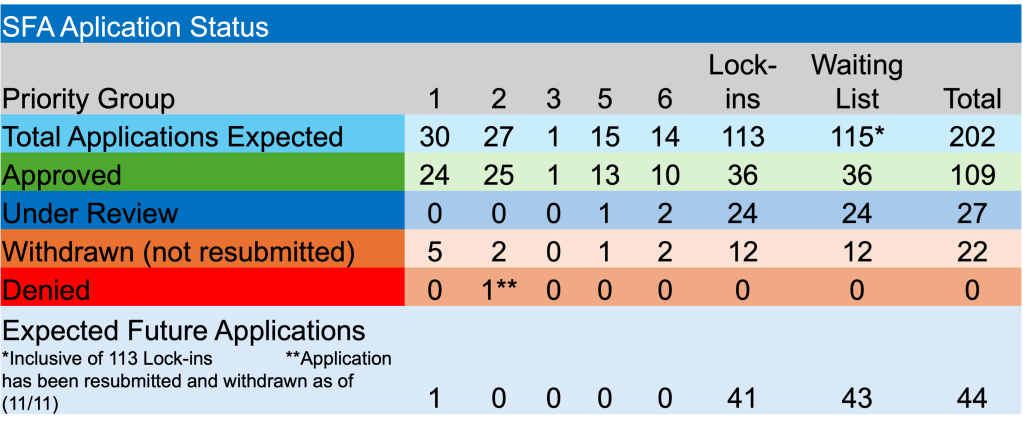

Milliman determined that the improved funded status was largely due to investment gains, but they also highlighted the critical contribution from the special financial assistance (SFA) granted under the ARPA. Milliman highlighted that as of year-end 2024, 102 plans have received nearly $70 billion in SFA funding, including $16 billion paid during 2024. Incredibly, without the support of SFA grants, the MPFS plans’ aggregate funded percentage at year-end 2024 would be approximately 89% or the same as the end of December 2023. As my chart below highlights, as of today, 109 plans have now received $71 billion in SFA grants.

Chart provided by Ryan ALM, Inc.

According to Milliman, “53% (627 of 1,193 plans) are 100% funded or more, and 84% (1,005) are 80% funded or better.” They also highlighted the more challenged members of this cohort, stating that “7% of plans (85) are below 60% funded and may be headed toward insolvency. Many are likely eligible and expected to apply for SFA in 2025.” As the chart above highlights, there still 93 plans going through the process of submitting applications with the PBGC to receive SFA support.

ARPA’s pension reform legislation has clearly been a godsend to many struggling multiemployer plans (roughly 10% of ME plans to date). That said, a review of the universe of all multiemployer plans points to terrific stewardship of the retirement assets on the part of a significant percentage of plans. My one concern is that the use of the return on Asset (ROA) assumption by most of these plans as the discount rate for plan liabilities is overstating the true funded status relative to a discount rate of a blended AA corporate rate used by the private sector. Milliman’s other DB pension plan studies have public sector plans at an 81.2% funded ratio and private plans at 105.8%.