By: Russ Kamp, CEO, Ryan ALM, Inc.

Milliman released the results of its 2025 Corporate Pension Funding Study(PFS). The study analyzes pension data for the 100 U.S. public companies with the largest defined benefit (DB) pension plans. Unlike the monthly updates provided by Milliman, this study covers the 2024 fiscal years (FY) for each plan. Milliman has now produced this review for 25 consecutive years.

Here are Milliman’s Key findings from the 2025 annual study, including:

- The PFS funded percentage increased from 98.5% at the end of FY2023 to 101.1% in FY2024, with the funded status climbing from a $19.9 billion deficit to a $13.8 billion surplus.

- This is the first surplus for the Milliman 100 companies since 2007.

- As of FY2024, over half (53) of the plans in the study were funded at 100% or greater; only one plan in the study is funded below 80%. RDK note: This is a significant difference from what we witness in public pension funding studies.

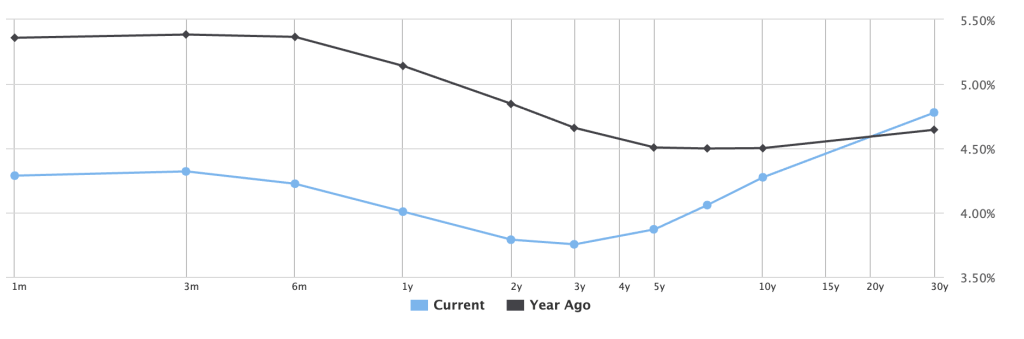

- Rising U.S. interest rates aren’t all bad, as the funding improvement was driven largely by the 42-basis point increase in the PFS discount rate (from 5.01% to 5.43%)

- Higher discount rates lowered the projected benefit obligations (PBO) of these plans from $1.34 trillion to $1.24 trillion.

- While the average return on investments was 3.6% – lower than these plans’ average long-term assumption of 6.5% – the underperformance of assets did not outstrip the PBO improvement. Only 19 of the Milliman 100 companies exceeded their expected returns.

- According to Milliman, equities outperformed fixed-income investments for the sixth year in a row. Over the last five years, plans with consistently high allocations to fixed income have underperformed other plans but experienced lower funded ratio volatility. Since 2005, pension plan asset allocations have swung more heavily toward fixed income, away from equity allocations.

“Looking ahead, the economic volatility we’ve seen in 2025 plus the potential for declining interest rates likely means corporate plan sponsors will continue with de-risking strategies – whether that’s through an investment glide-path strategy, lump-sum window, or pension risk transfer,” said Zorast Wadia, co-author of the PFS. “But with about $45 billion of surplus in frozen Milliman 100 plans, there’s also the potential for balance sheet and cash savings by incorporating new defined benefit plan designs.” One can only hope, Zorast.

Final thought: Given the unique shape of today’s Treasury yield curve, duration strategies may be challenged to reduce interest rate risk through an average duration or a few key rates. As a reminder, Cash Flow Matching (CFM) duration matches every month of the assignment. Use CFM for the next 10-years, you have 120 bespoke duration matches.