By: Russ Kamp, CEO, Ryan ALM, Inc.

Yes, today’s ugliness in the markets is only one day and how many times have we heard or read that you can’t market time or if you miss just the best performing 25-, 50-, or 100-days in the stock market, your return will resemble that of cash or bonds? Those facts are mostly correct. We may not be able to market time, but we can certainly put in place an asset allocation framework that gets DB pension plans off the rollercoaster of performance. We can construct an asset allocation that provides the necessary liquidity when markets may not be able to naturally. An asset allocation that buys time for the growth asset to wade through troubled markets. A framework that secures the promised benefits and stabilizes both funded ratios and contribution expenses for that portion of the fund that has adopted a new strategy.

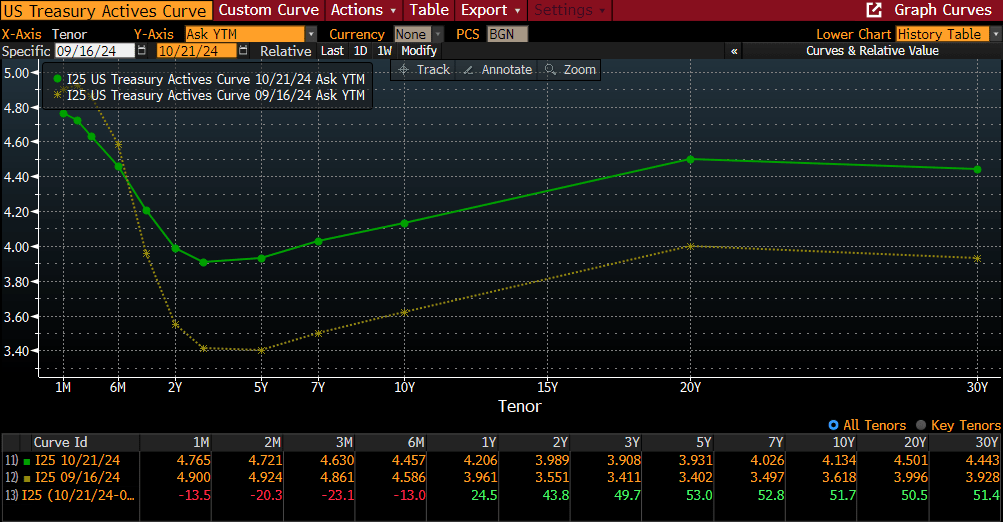

Yes, today is only one day, but the impact can be significantly negative. See, it isn’t just the loss that has to be made up, as pension plans are counting on a roughly 7% return (ROA) for the year. Every negative event pushes that target further away. Equity values are getting whacked and today’s market activity is just exacerbating the already weak start to the year. While equity markets are falling, U.S. interest rates are down precipitously. The U.S. 10-year Treasury note’s yield is down just about 0.8% since early in January. As a reminder, the average duration of a DB pension is about 12 years or twice the duration of the Bloomberg Barclays Aggregate Index, which is the benchmark for most core fixed income mandates. So, your bond portfolios may be seeing some appreciation today and since the start of 2025, but those portfolios are not growing nearly as fast as your plan’s liabilities, which have grown by about 10.6% (12 year duration x 0.8% + income of 1.0% = 10.6%). As a result, funded ratios are taking a hit.

I wrote this piece back on March 4th reminding everyone that the uncertainty around tariffs and other factors should inspire a course change, an asset allocation rethink. I suspect that it didn’t. So, one can just assume that markets will come back and the underperformance will not have impacted the pension plan, but that just isn’t true. In many cases, equity market corrections take years to recover from and in the process contribution expenses rise, and in some cases dramatically so.

Adopting a new asset allocation framework doesn’t mean changing the entire portfolio. A restructuring can be as simple as converting your highly interest rate sensitive core bond portfolio into a cash flow matching (CFM) portfolio that secures the promised benefits from next month out as far as the allocation can go. In the process you will have improved the plan’s liquidity, extended the investing horizon for the alpha assets, stabilized the funded status for that segment of your plan, and mitigated interest rate risk, as those benefit payments are future values which aren’t interest rate sensitive. You’ll sleep very well once adopted.