By: Russ Kamp, Managing Director, Ryan ALM, Inc.

You may recall in the 1970s Heinz Ketchup used Carly Simon’s song, “Anticipation” as a jingle for several of its commercials. US bond investors might just want to adopt that song once more as they wait for the anticipated rate cuts from the Federal Reserve’s FOMC. As you may recall, investors pounced early on the perceived likelihood of rate cuts, forecasting multiple cuts and a substantial move down in rates given the expectation of a less than soft landing. As a result, US rates, as measured by the Treasury yields, fell precipitously during a good chunk of the summer, bottoming out on September 16th, which was two days prior to the Fed’s first cut (0.5%).

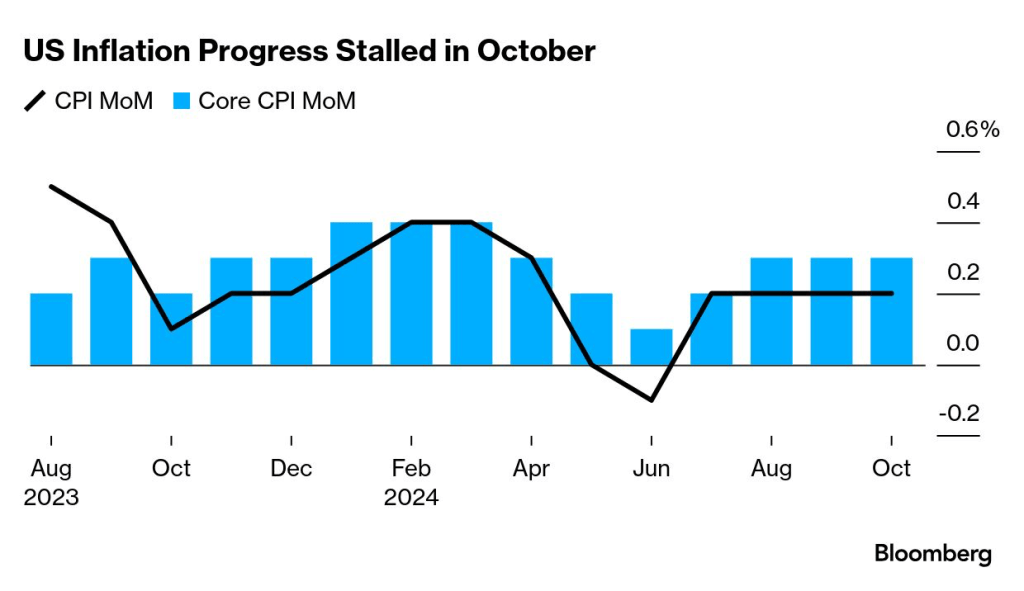

However, economic and inflationary news has been mixed leading some to believe that the Fed may just take a more cautionary path regarding cuts. Those sentiments were echoed by Federal Reserve Chairman Powell just yesterday, who stated during a speech in Dallas, “The economy is not sending any signals that we need to be in a hurry to lower rates.” Not surprising, bond investors did not look favorably on this pronouncement and quickly drove Treasury yields upward and stocks down. If the prospect of lower rates is the only thing propping up equities at this time, investors of all ilk better be wary.

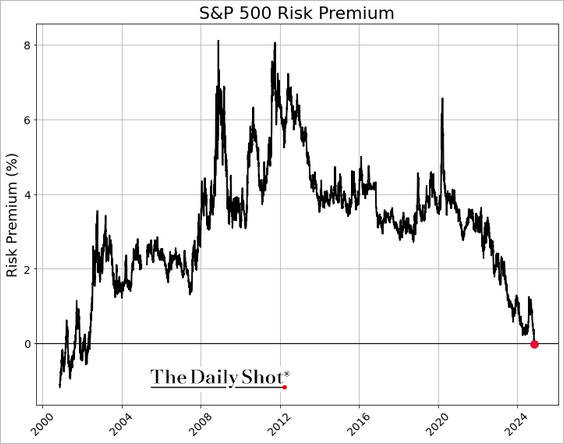

As the above graph highlights, inflation’s move to the Fed’s 2% target has been halted (temporarily?), as Core CPI has risen by 0.3% in each of the last three months. As I wrote above, the prospect of lower rates has certainly helped to prop up US equities. However, rising rates impacts the relationship of equities and bonds. According to a post by the Daily Shot, “the S&P 500 risk premium (forward earnings yield minus the 10-year Treasury yield) has turned negative for the first time since 2002, indicating frothy valuations in the US stock market.”

As a result of these recent moves in the capital markets, US pension plan sponsors would be well-served to use the elevated bond yields to SECURE the promised benefits through a cash flow matching defeasement strategy. As we’ve discussed on many occasions, not only is the liquidity to meet the promised benefits available when needed, this process buys time for the remaining assets to grow unencumbered, as they are no longer a source of liquidity. It is a win-win!