So, Moody’s joined the party and reduced the U.S. credit rating after both S&P and Fitch had previously done so. What a silly (ridiculous) concept!

Identity: All spending = all income

If the U.S. is deficit spending, then the U.S. private sector is reaping the benefits of the income.

So, Moody’s, does the U.S. have a debt problem (NO!) or a demand problem (YES!)? However, it is only a demand problem if the U.S. economy can’t meet the extra demand created from this fiscal deficit through production. The higher inflationary environment during the Covid-19 years was brought about through both greater stimulus and the disruptions to production through the virus’s impact.

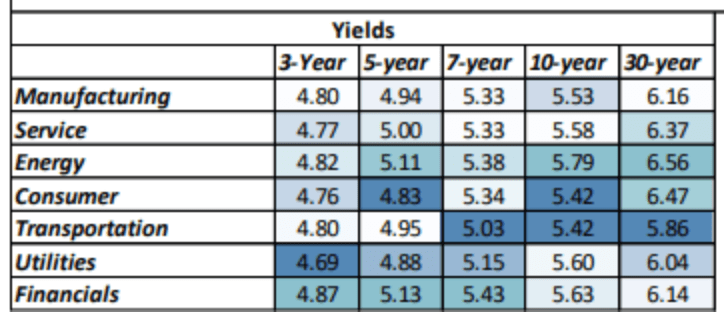

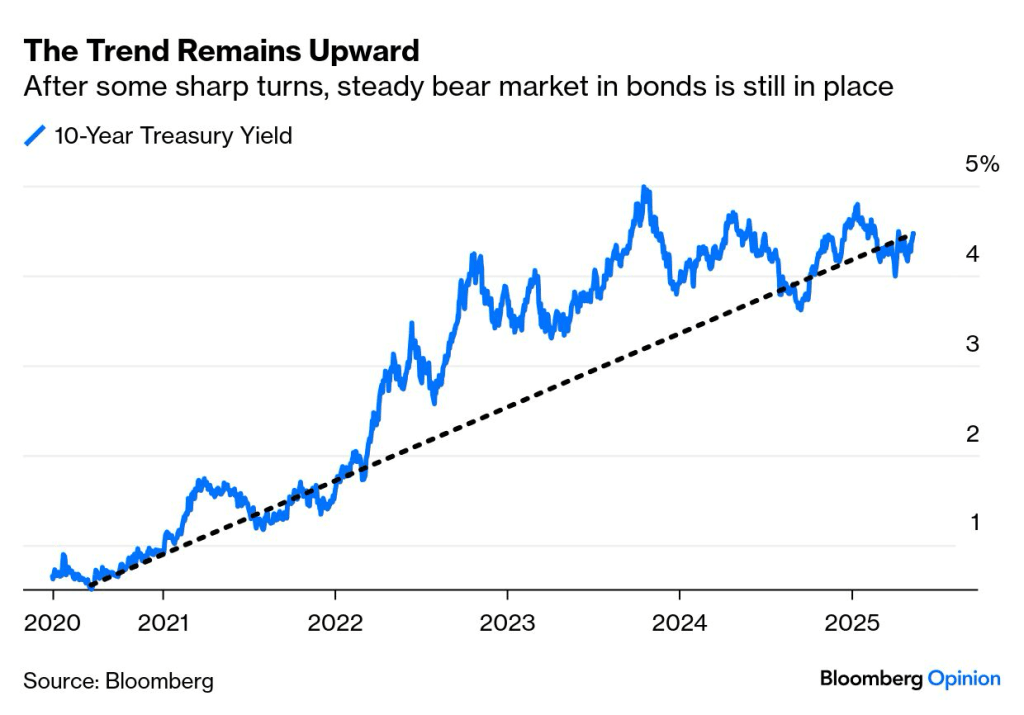

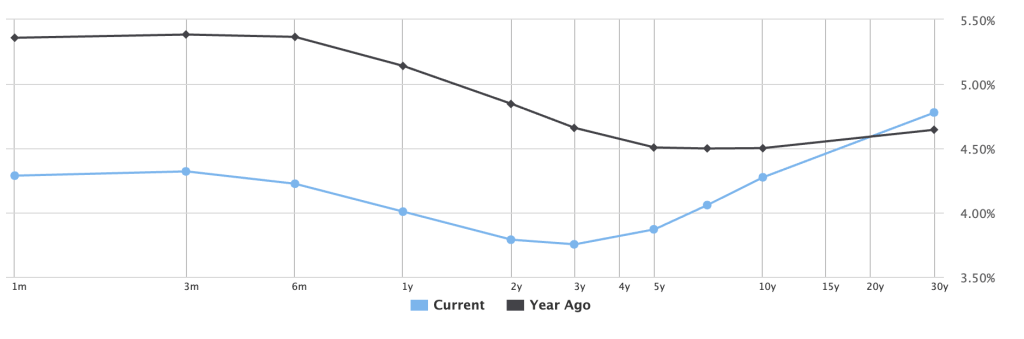

What does this mean for pension plans today? The likely scenario given the growing fiscal deficits is higher inflation leading to higher U.S. interest rates. Higher rates will provide plan sponsors with the ability to defease pension liabilities (benefits and expenses) at a much lower cost. The present value of those future payments falls as rates rise. We estimate a roughly 2% cost reduction per year through a cash flow matching (CFM) strategy. Defease liability cash flows for 10-years and you reduce costs by about 20%. Use CFM for a longer period and you can reduce the cost of future benefits by 60+% over 30-years. As a reminder, it was the nearly 40-year decline in U.S. interest rates that crippled many pension plans leading to ever growing liabilities, greater contribution expenses, and the significant reduction in the number of defined benefit pension plans in the private sector.

Secure your benefits at these loftier levels of interest rates and sleep well at night!