By: Russ Kamp, Managing Director, Ryan ALM, Inc.

I’d like to thank Bill Gross for his honest assessment that he just provided on the likely failure of “Total Return” bond products going forward. Here are his thoughts that were summarized in a Bloomberg Business email:

Bill Gross says his “total return” strategy—the one that revolutionized the bond market— “is dead”! Instead of just picking up steady interest payments like his peers did at the time, the co-founder of Pacific Investment Management created the firm’s Total Return Fund in 1987 to take active positions in duration, credit risk and volatility. The idea is that, more than just clipping coupons, bond investors can also benefit from capital appreciation as bond prices rise and yields fall. But in an outlook published Thursday, Gross noted what’s different now is that yields are much lower than when he first coined the concept, leaving investors with less room for price appreciation.

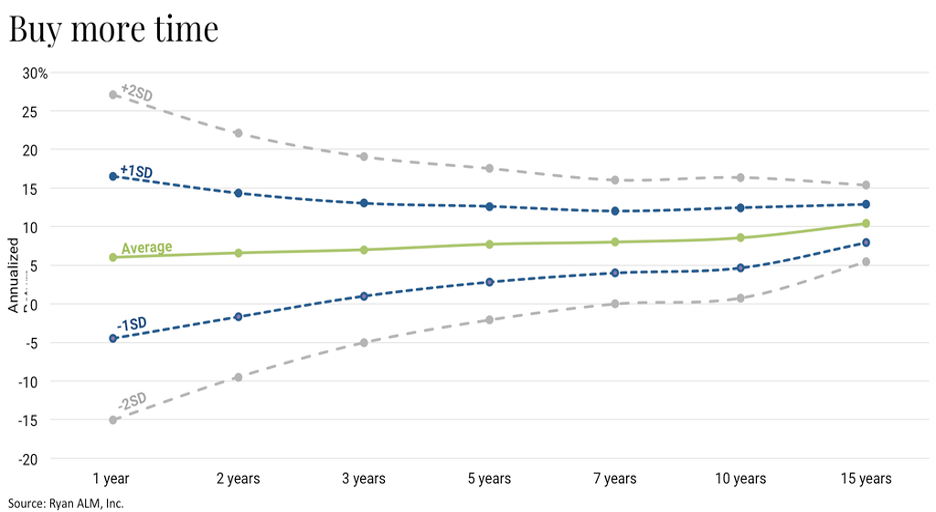

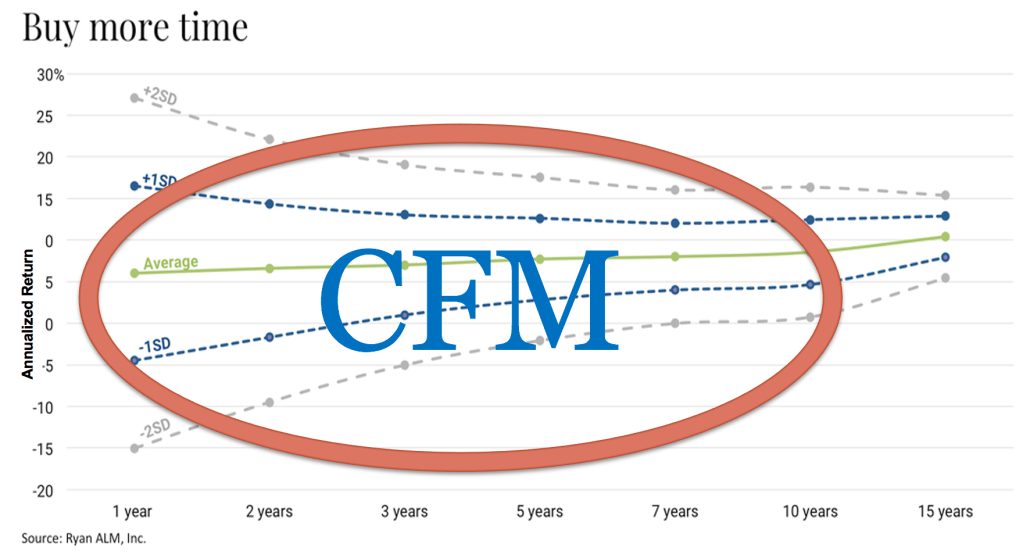

We’ve been stressing this point for a long time now. Bonds should be used for the certainty of cash flows that they produce of interest and principal. Those cash flows are known and can be modeled with certainty (barring no defaults) to meet the liability cash flows of a pension plan (benefits) or foundation (grants). As Gross rightly points out, given the current level of US interest rates and inflation, just how much appreciation can be achieved, if an investor is on the correct side of a duration bet.

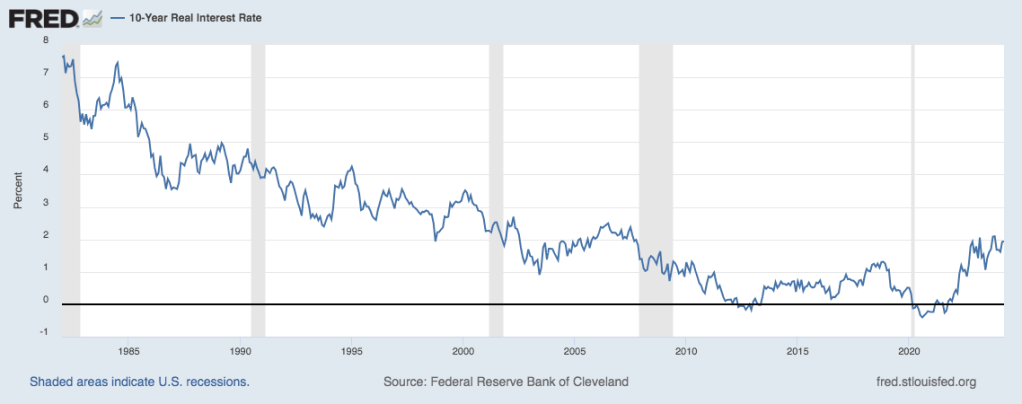

Capital market participants benefited tremendously during the nearly four decades decline in rates from 1981 to 2021. That move down in rates was certainly great for “total return” bond programs, but it also acted as rocket fuel for risk assets. What most market participants have either forgotten or don’t know is the fact that US interest rates trended higher for 28 years prior to the peak achieved in 1981. They are used to the Fed stepping into the fray every time there was a wiggle or wobble in the markets. Well, those days might be behind us.

Yes, US employment came in light this morning with 175k jobs being created in April when the forecast was for 240k, but that is one data point. We certainly witnessed an aggressive move down in rates during 2023’s fourth quarter only to see most of that move reversed to start 2024. Was your bond program able to get both directions correct or did your portfolio get whipsawed? Wouldn’t it be more comforting to know that you can install a cash flow matching portfolio that will SECURE the promises that have been made to the plan participants without having to guess the direction of rates? Even if one were to guess correctly, just how far will rates fall given that inflation remains sticky? Are you likely to see negative real yields?

The US economy remains robust. Fiscal policy remains easy with excessive Government spending and in direct competition with monetary policy. The labor market continues to be strong, as is wage growth. The stock market’s performance continues to support the economy. Given these realities, why should US rates plummet, which is what it would take to create an investing horizon that would be supportive of “total return” fixed income products.