By: Russ Kamp, CEO, Ryan ALM, Inc.

Jason Russell and Seth Almaliah, Segal, have co-authored an article titled, “Benefits of Pension De-Risking and Why Now is the Right Time”. Yes! We, at Ryan ALM, agree that there are significant benefits to de-risking a pension plan and we absolutely agree that NOW is the right time to engage in that activity.

In their article they mention that the current interest rate environment is providing opportunities to de-risk that plan sponsors haven’t seen in more than two decades. In addition to the current rate environment, they reflect on the fact that many pension plans are now “mature” defining that stage as a point where the number of retired lives and terminated vested participants is greater than the active population. They also equate mature plans to one’s that have negative cash flow, where benefits and expenses eclipse contributions. In a negative cash flow environment, market corrections can be more painful as assets must be sold to meet ongoing payments locking in losses, as a result.

They continue by referencing four “risk reducing” strategies, including: 1) reducing Investment Volatility, 2) liability immunization, 3) short-term, cash flow matching, and 4) pension risk transfers. Not surprisingly, we have some thoughts about each.

- Reducing investment volatility – Segal suggests in this strategy that plan sponsors simply reduce risk by just shifting assets to “high-quality” fixed income. Yes, the annual standard deviation of an investment grade bond portfolio with a duration similar to that of the BB Aggregate would have a lower volatility than equities, but it continues to have great uncertainty since bond performance is driven primarily by interest rates. Who knows where rates are going in this environment?

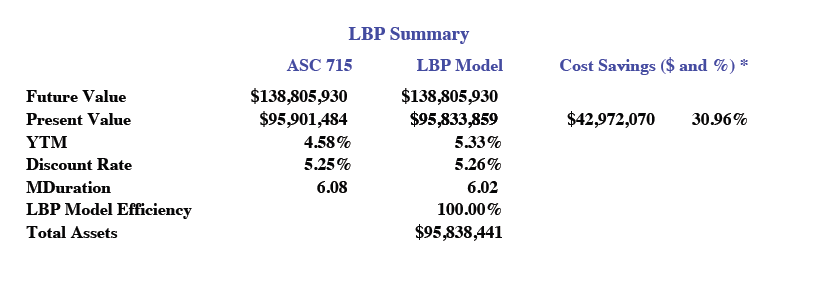

- Liability Immunization – The article mentions that some plan sponsors are taking advantage of the higher rate environment by “immunizing” a portion of the plan’s liabilities. They describe the process as a dedicated portfolio of high-quality bonds matched to cover a portion of the projected benefits. They mentioned that this strategy tends to be long-term in nature. They also mention that because it is “longer-term” it carries more default risk. Finally, they mentioned that this strategy may lose some appeal because of the inverted yield curve presently observed. Let me comment: 1) Immunization is neither a long-term strategy or a short-term strategy. The percentage of liabilities “covered” is a function of multiple factors, 2) yes, immunization or cash flow matching’s one concern when using corporate bonds is default risk. According to S&P, the default rate for IG bonds is 0.18% for the last 40-years, and 3) bond math tells us that the longer the maturity and the higher the yield, the lower the cost. Depending on the length of the assignment, the current inverted yield curve would not provide a constraint on this process. Finally, CFM is dependent on the actuary’s forecasts of contributions, benefits, and expenses. Any change in those forecasts must be reflected in the portfolio. As such, CFM is a dynamic process.

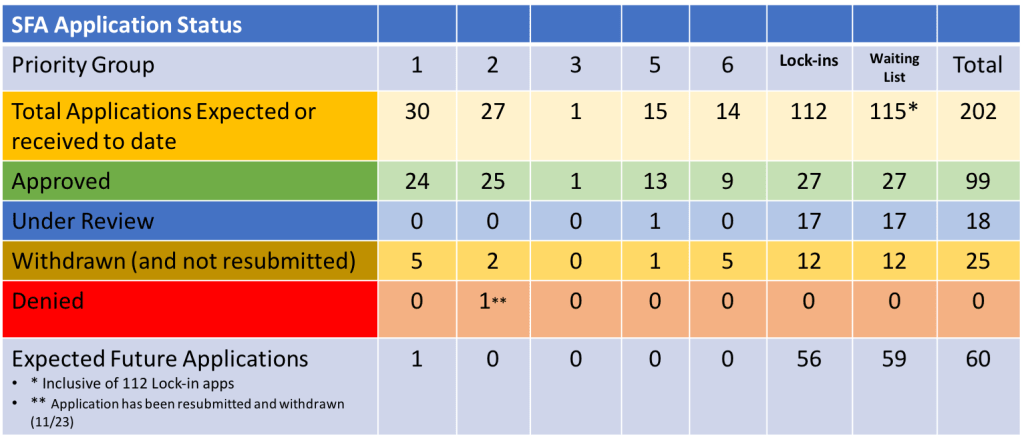

- Short-term, cash flow matching – CFM is the same as immunization, whether short-term or not. Yes, it is very popular strategy for multiemployer plans that received Special Financial Assistance (SFA) under ARPA for obvious reasons. It is a strategy that SECURES the promised benefits at both low cost and with prudent risk. It maximizes the benefit coverage period with the least uncertainty.

- Pension Risk Transfers (PRT) – In a PRT, the plan sponsor transfers a portion of the liabilities, if not all of them, to an insurance company. This is the ultimate risk reduction strategy for the plan sponsor, but is it best for the participant? They do point out that reducing a portion of the liabilities will also reduce the PBGC premiums. But, does it impact the union’s ability to retain and attract their workers?

We believe that every DB pension plan should engage in CFM. The benefits are impressive from dramatically improving liquidity, to buying time for the growth (non-CFM bonds) assets, to eliminating interest rate risk for those assets engage in CFM, to helping to stabilize contributions and more. Focusing 100% of the assets on a performance objective only guarantees volatility. It is time to adopt a new strategy before markets once again behave badly. Don’t waste this wonderful rate environment.

Thank you, Segal, for your thoughtful piece.