By: Russ Kamp, Managing Director, Ryan ALM, Inc.

I continue to be surprised by the constant droning that US interest rates are too high and financial conditions are too tight. Compared to what? If the reference point is Covid-19 induced levels then you are probably right, but if the comparison is to almost any other timeframe then those proclaiming that the sky is about to fall should refer to one of the greatest decades for equities in my lifetime – the 1990s. I think most investors would agree that the 1990s provided a nearly unprecedented investing environment. One in which the S&P 500 produced an 18.02% annualized performance.

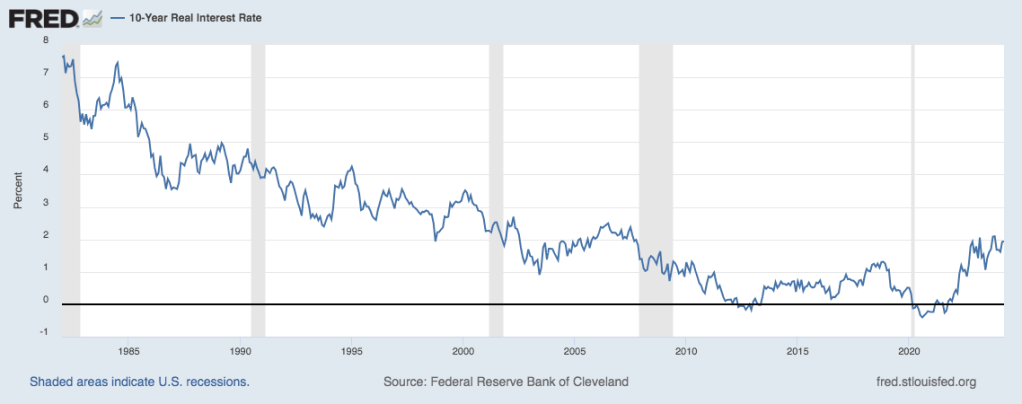

Was the economic environment of the 1990s so much better than today’s? Heck no, but let’s take a closer look. The average 10-year Treasury note yield was 6.52% ranging from a peak of 8.06% at the end of 1990 to a low of 4.65% in 1998. Given that the current yield for the US 10-year Treasury note is 4.56%, I’d suggest that the present environment isn’t too constraining. Furthermore, let’s look at the employment picture from the ’90s. If US rates aren’t high by 1990 standards, unemployment must have been very low. You’d be wrong if that was your guess. In fact, unemployment in the US ranged from 7.5% at the end of 1992 to a low of 4.2% in 1999. For the decade, we had to deal with an average of 5.75% unemployment. Today, we sit with a 3.9% unemployment rate. That level doesn’t seem too constraining, and initial unemployment claims remain quite modest.

So, current US interest rates and unemployment look attractive versus what we experienced during the ’90s. It must be that economic growth was incredibly robust to support such strong equity markets. Well, again you’d be wrong. Sure economic growth averaged 3.2% during the decade, but the Atlanta Fed’s GDPNow model is forecasting a 3.5% growth rate currently for Q2’24. This comes on the heels of a rather surprising 2023 growth rate. What else could have contributed to the 1990’s successful equity market performance that isn’t evident today? How about fiscal deficits? Perhaps the US annual deficit during the ’90s contributed significant stimulus which would have led to enhanced demand for goods and services?

I don’t think that was the case either, as the cumulative US fiscal deficit of $1.336 trillion during the 1990s, including surpluses in 1998 and 1999, is roughly $400 billion less than that which occurred in fiscal 2023 and what is predicted for 2024. Oh, my. The largest fiscal deficit during the 1990s was only $290 billion. That’s equivalent to about 2 months-worth today.

I’m confused, the 1990s produced an incredible equity market despite higher rates, higher unemployment, lower GDP growth, and little to no fiscal stimulus provided by deficit spending, yet today’s environment is constraining? Come, on. Inflation remains sticky. The American worker is enjoying (finally) some real wage growth and is gainfully employed. Rates are not too high by almost any reasonable comparison. US GDP growth is forecasted to be >3%. Where is the recession? Fiscal stimulus continues to be in direct conflict with the Fed’s monetary policy. Something that those investing during the 1990s didn’t need to worry about. Taken all together, is 2024’s environment something to be concerned about, especially relative to what transpired in the 1990s? Should the Fed be looking to reduce rates? I’ll be quite surprised if they come to that conclusion anytime soon.