By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Milliman has reported that pension funding for Corporate plans declined in August. The Milliman 100 Pension Funding Index (PFI) recorded its most significant decline of 2024, as the funded ratio fell from 103.6% to 102.8% as of August 31, 2024. No, it wasn’t because markets behaved poorly, as the month’s investment gains of 1.81% lifted the combined plans’ market value by $17 billion, to $1.347 trillion at the end of the period. It was the result of falling US interest rates that impacted the liability discount rate on those future promises.

According to Milliman, the discount rate fell from 5.3% in July to 5.1% by the end of August. That 20 basis points move in rates increased the projected benefit obligations (PBO) for the index constituents by $27 billion. As a result, the $10 billion decline in funded status reduced the funded ratio by 0.8%. The index’s surplus is now at $36 billion.

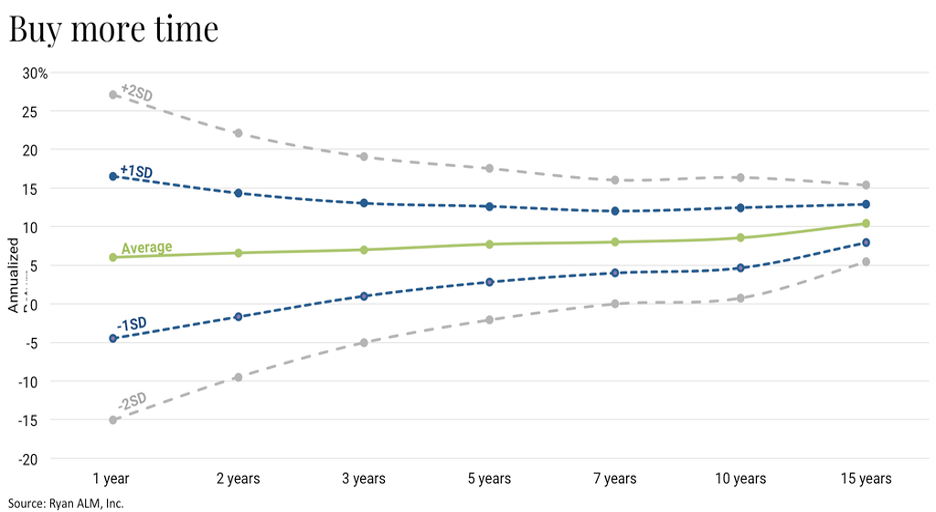

Markets seem to be cheering the prospects of lower US interest rates that may be announced as early as September 18, 2024 following the next FOMC. Remember, falling rates may be good for consumers and businesses, but they aren’t necessarily good for defined benefit pension plans unless the fall in rates rallies markets to a greater extent than the drop in rates impacts the growth in pension liabilities.

“With markets falling from all-time highs and discount rates starting to show declines, pension funded status volatility is likely in the months ahead, underscoring the prudence of asset-liability matching strategies for plan sponsors”, said Zorast Wadia, author of the PFI. We couldn’t agree more with Zorast. As we’ve discussed many times, Pension America’s typical asset allocation places the funded status for DB pension on an uncomfortable rollercoaster. Prudent asset-liability strategies can significantly reduce the uncertainty tied to current asset allocation practices. Thanks, Milliman and Zorast, for continuing to remind the pension community of the impact that interest rates have on a plan’s funded status.