By: Russ Kamp, Managing Director, Ryan ALM, Inc.

There appears in the WSJ today an article stating that pension plans were pulling “hundreds of billions from stocks”. According to a Goldman analyst, “pensions will unload $325 billion in stocks this year, up from $191 billion in 2023″. We are told that proceeds from these sales will flow to both bonds and alternatives. First question: What is this estimate based on? Are average allocations now above policy normal levels necessitating a rebalancing? Are bonds more attractive given recent movements in yields?

Yes, equities have continued to rally through 2024’s first quarter, and the S&P 500 established new highs before recently pulling back. Valuations seem stretched, but the same argument could have been made at the end of 2023. Furthermore, US interest rates were higher heading into 2023’s fourth quarter. If bond yields were an attractive alternative to owning equities, that would have seemed the time to rotate out of equities.

The combination of higher interest rates and equity valuations have helped Corporate America’s pensions achieve a higher funded status, and according to Milliman, the largest plans are now more than 105% funded. It makes sense that the sponsors of these plans would be rotating from equities into bonds to secure that funded status and the benefit promises. Hopefully, they have chosen to use a cash flow matching (CFM) strategy to accomplish the objective. Not surprisingly, public pension plans are taking a different approach. Instead of securing the benefits and stabilizing the plan’s funded status and contribution expenses by rotating into bonds, they are migrating both equities and bonds into more alternatives, which have been the recipients of a major asset rotation during the last 1-2 decades, as the focus there remains one of return. Is this wise?

I don’t know how much of that estimated $325 billion is being pulled from corporate versus public plans, but I would suggest that much of the alternative environment has already been overwhelmed by asset flows. I’ve witnessed this phenomenon many times in my more than 40 years in the business. We, as an industry, have the tendency to arbitrage away our own insights by capturing more assets than an asset class can naturally absorb. Furthermore, the migration of assets to alternatives impacts the liquidity available for plans to meet ongoing benefits and expenses. Should a market correction occur, and they often do, liquidity becomes hard to find. Forced sales in order to meet cash flow needs only serve to exacerbate price declines.

Pension plans should remember that they only exist to meet a promise that has been made to the participant. The objective should be to SECURE those promises at a reasonable cost and with prudent risk. It is not a return game. Asset allocation decisions should absolutely be driven by the plan’s funded status and ability to contribute. They shouldn’t be driven by the ROA. Remember that alternative investments are being made in the same investing environment as public equities and bonds. If market conditions aren’t supportive of the latter investments, why does it make sense to invest in alternatives? Is it the lack of transparency? Or the fact that the evaluation period is now 10 or more years? It surely isn’t because of the fees being paid to the managers of “alternative” products are so attractive.

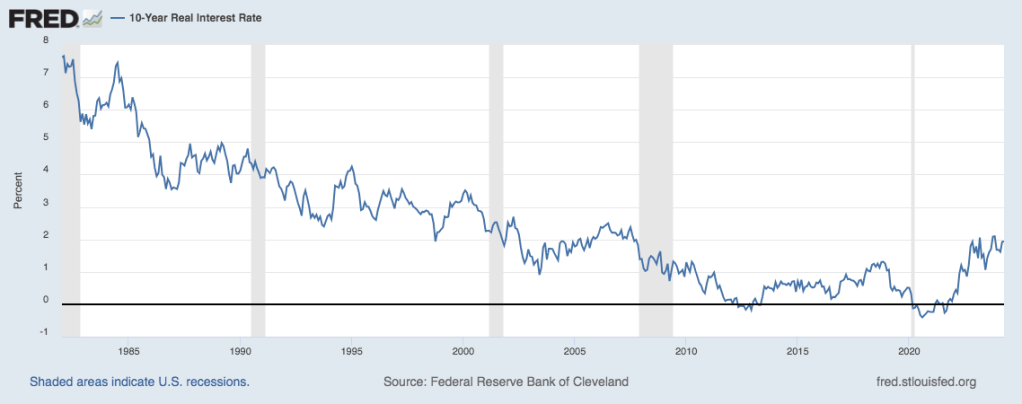

Don’t continue to ride the asset allocation rollercoaster that only ensures volatility, not success! The 1990’s were a great decade that was followed by the ’00s, in which the S&P 500 produced a roughly 2% annualized return. The ’10s were terrific, but mainly because stocks were rebounding from the horrors of the previous decade. I don’t know what the 2020s will provide, but rarely do we have back-to-back above average performing decades. Yes, the ’90s followed a strong ’80s, but that was primarily fueled by rapidly declining interest rates. We don’t have that scenario at this time. Why assume the risk?