By: Russ Kamp, CEO, Ryan ALM, Inc.

Institutional Investor’s James Comtois has recently published an article that quoted several industry members on the near-term (10-years) return forecast for both public and private markets, which according to those asked are looking anemic. No one should be surprised by these forecasts given the incredible strength of public markets during the past three years and the fact that regression to the mean tendencies is not just theory.

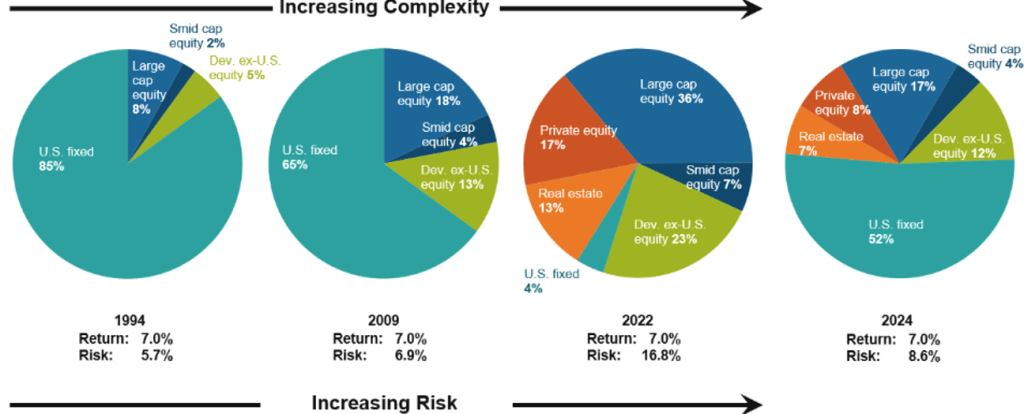

An equally, if not greater, challenge is liquidity. As the title above highlights, Jay Kloepfer, Director of Capital Markets Research at Callan, told II that “Liquidity has become a bigger issue,” He went on to say that “Everybody’s looking under every rock.” Not surprising! Given the migration of assets from public markets to private during the last few decades. The rapid decline in U.S. interest rates certainly contributed to this asset movement, but expectations for “outsized” gains from alternatives also fueled enthusiasm and action. The Callan chart below highlights just how far pension plans have migrated.

I’ve written a lot on the subject of liquidity. Of course, the only reason that pension plans exist is to fund a promise that was made to the participants of that fund. Those promises are paid in monthly installments. Not having the necessary liquidity can create significant unintended consequences. No one wants to be a forced seller in a liquidity challenged market. It is critical that pension plans have a liquidity policy in place to deal with this critical issue. Equally important is to have an asset allocation that captures liquidity without having to sell investments.

Cash flow matching (CFM) is such a strategy. It ensures that the necessary liquidity is available each and every month through the careful matching of asset cash flows (interest and principal) with the liability cash flows of benefits and expenses. No forced selling! Furthermore, the use of CFM extends the investing horizon for those growth assets not needed in the CFM program. Those investments can just grow unencumbered. The extended investing horizon also allows the growth assets to wade through choppy markets without the possibility of being sold at less than opportune times.

So, if you are concerned about near-term returns for a variety of assets and with creating the necessary liquidity to meet ongoing pension promises, don’t rely on the status quo approach to asset allocation. Adopt a bifurcated asset allocation that separates plan assets into liquidity and growth buckets. Your plan will be in much better shape to deal with the inevitable market correction.