By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Did you know that there exists an oversight body for the Pension Benefit Guaranty Corporation (PBGC)? The 1988 amendments to the Inspector General Act of 1978 created the PBGC Office of the Inspector General (OIG) of the PBGC. They are responsible for providing independent and objective audits, inspections, evaluations, and investigations to help Congress, the PBGC Board of Directors, and the PBGC itself to protect pension benefits for both multiemployer and private plans.

The latest report, covering the period April 1-September 30, 2024, has been sent to Congress. The PBGC has received mostly positive results. As a reminder, the PBGC ensures the pension benefits of more than 31 million American workers and retirees who participate in more than 24,500 private-sector pension plans through its single-employer and multiemployer insurance programs. Quite the effort!

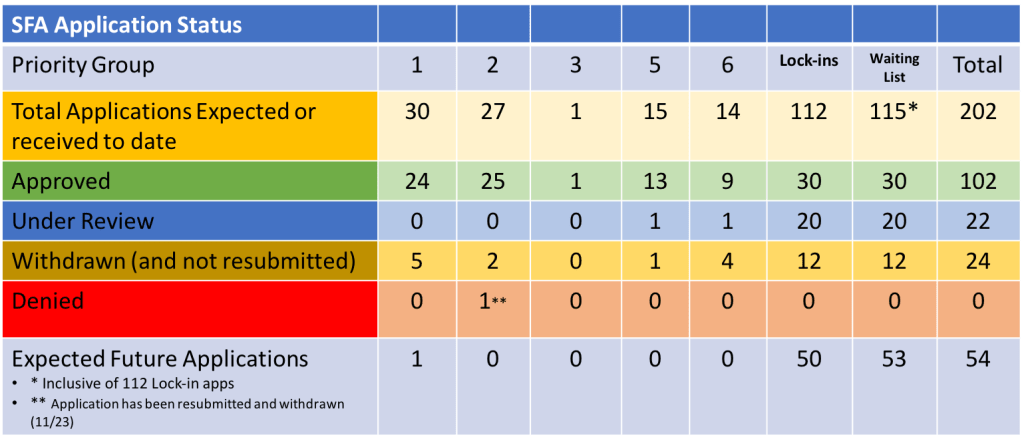

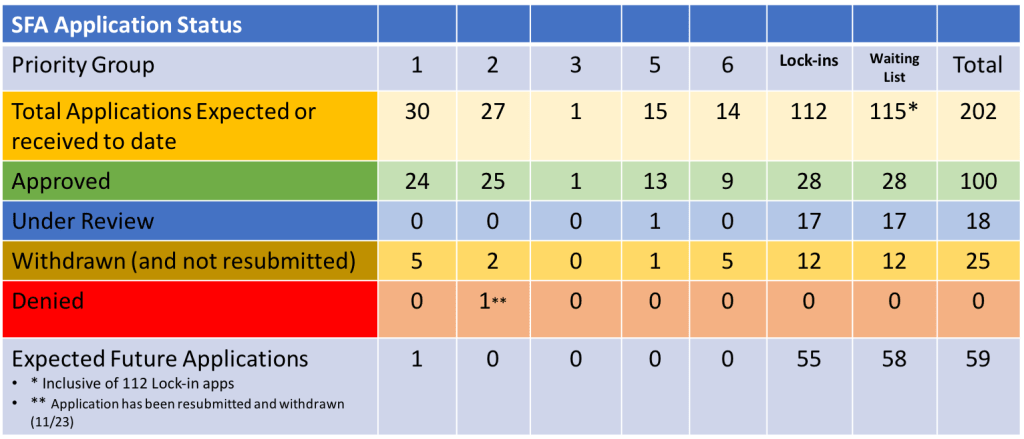

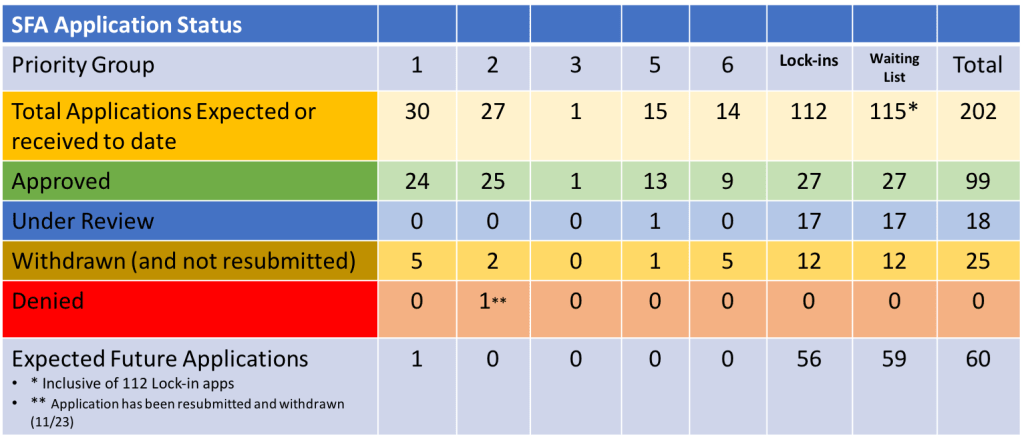

Furthermore, as regular readers of this blog know, the PBGC has been engaged since 2021 in implementing the Special Financial Assistance (SFA) program, that was housed in the ARPA legislation. As of September 30, 2024, the report highlights the following stats regarding the PBGC’s effort:

- received 165 SFA applications requesting $76 billion;

- approved 127 of the SFA applications; (includes supplemental applications of which there were 35)

- provided $68 billion in SFA; and

- was reviewing 22 SFA applications, requesting a total of $2.5 billion.

One area of concern, which seems to have been corrected, was the census data possibly being wrong in the various applications leading to overpayment of SFA grants. According to the OIG report, there could be incorrect census data on applications leading to as much as $250 million in overpayments. To date, the PBGC has recouped $144 million from 19 plans. This sum is a small percentage (<0.5%) of what has been paid out to date.

The OIG says it “determined that the PBGC’s SFA procedures were generally sufficient to ensure that increases in projected benefit payments were (1) consistently identified, (2) evaluated against appropriate criteria, and (3) documented. In addition, the OIG reports that the PBGC responded to its findings and recommendations regarding the SFA program, which is says has significantly improved the PBGC’s SFA procedures.”

According to our analysis, there are potentially 202 applicants seeking SFA grants. With 102 funds having received approval to date, there remains much work is left to be done. There is no time to sit on one’s laurels!