By: Russ Kamp, CEO, Ryan ALM, Inc.

Talk about jumping out of the frying pan into the fire! I left New Jersey’s wonderful heat and humidity only to find myself in El Paso, TX, where the high temperature is testing the limits of a normal thermometer. Happy to be speaking at the TexPERS conference this week, but perhaps they can do an offsite in Bermuda the next time.

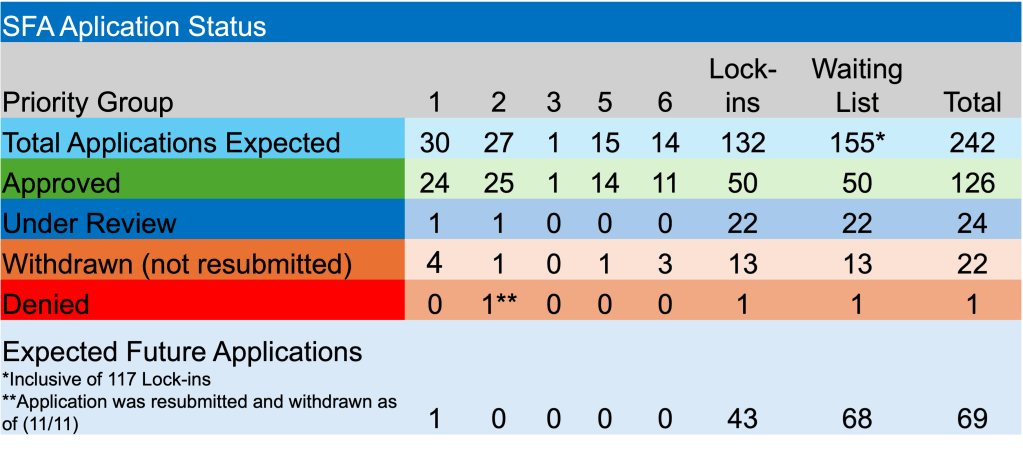

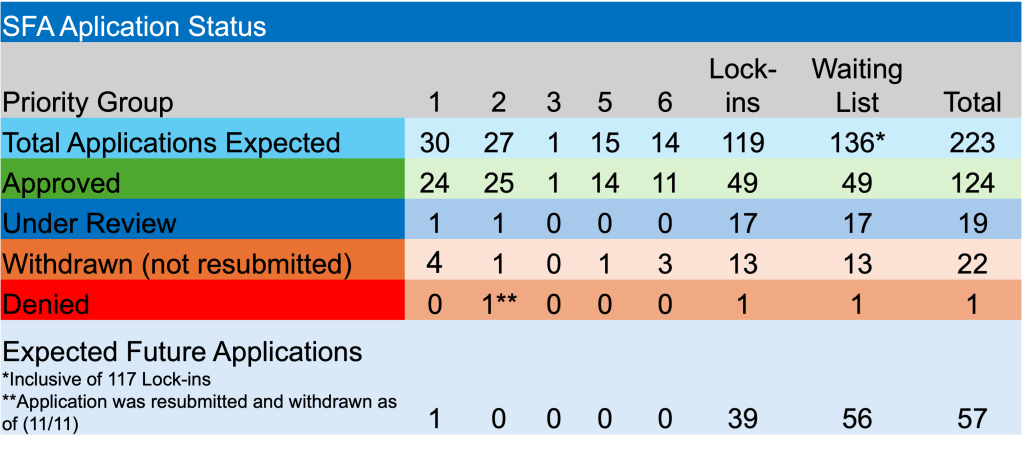

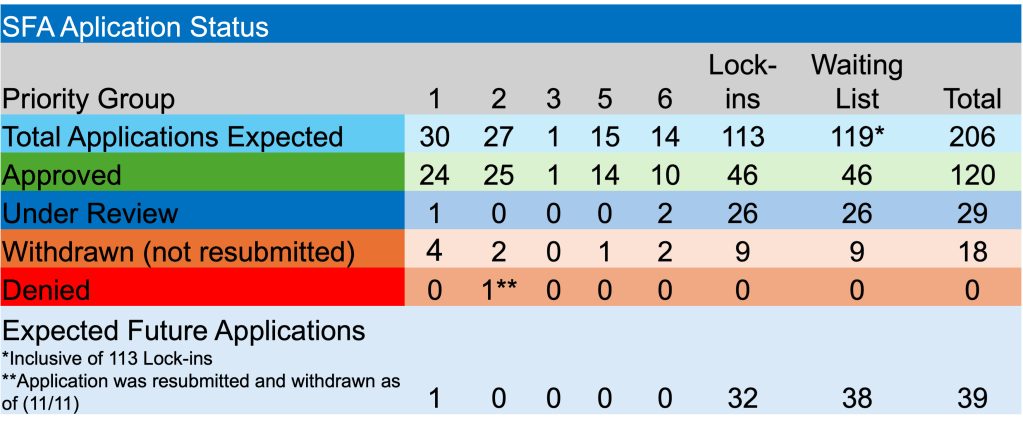

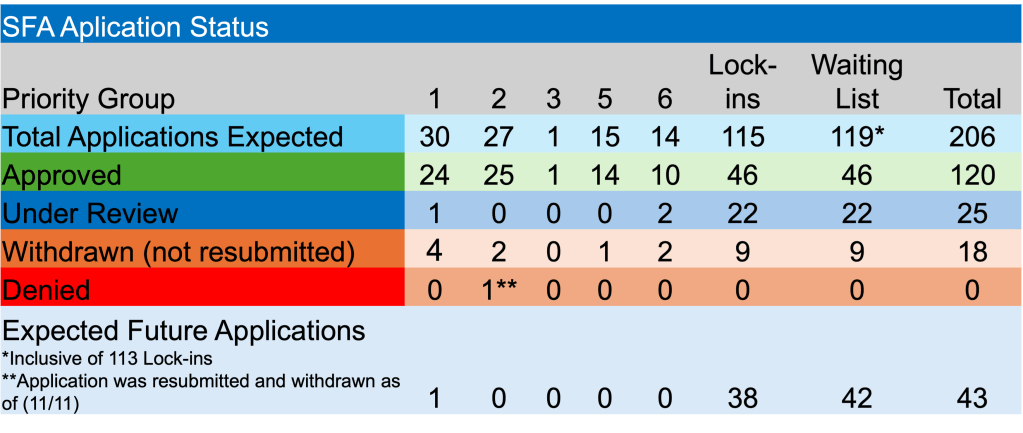

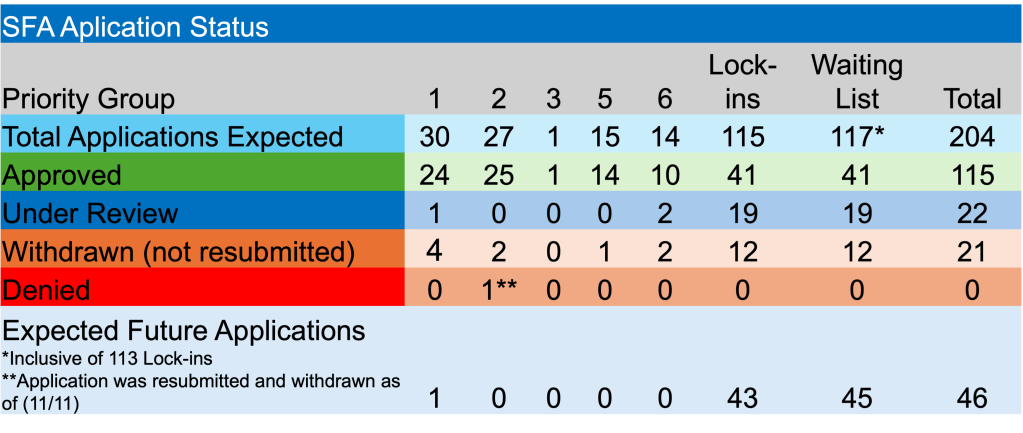

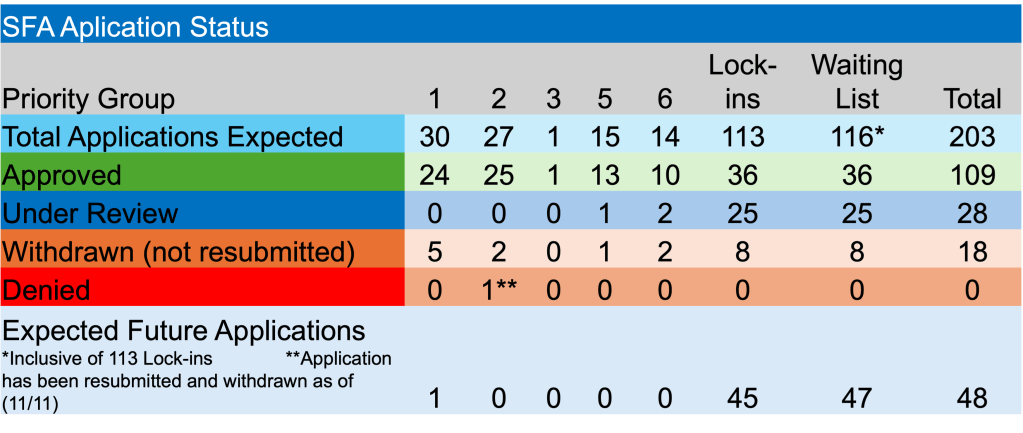

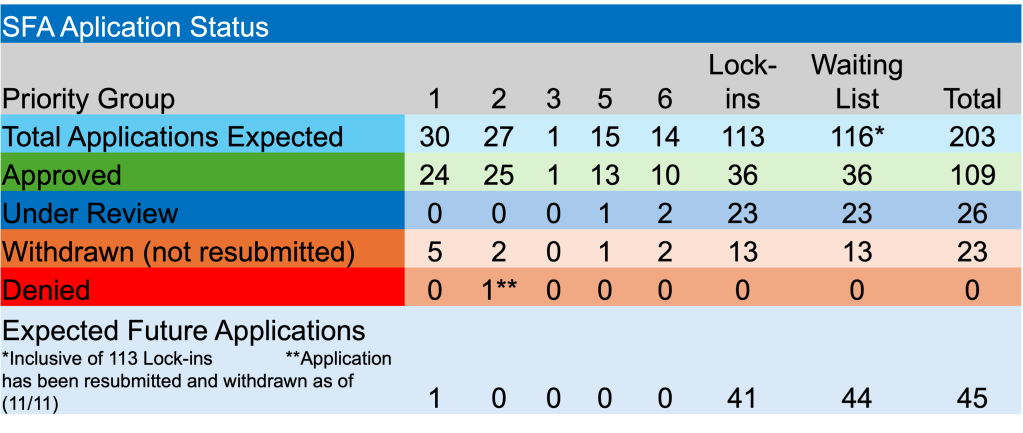

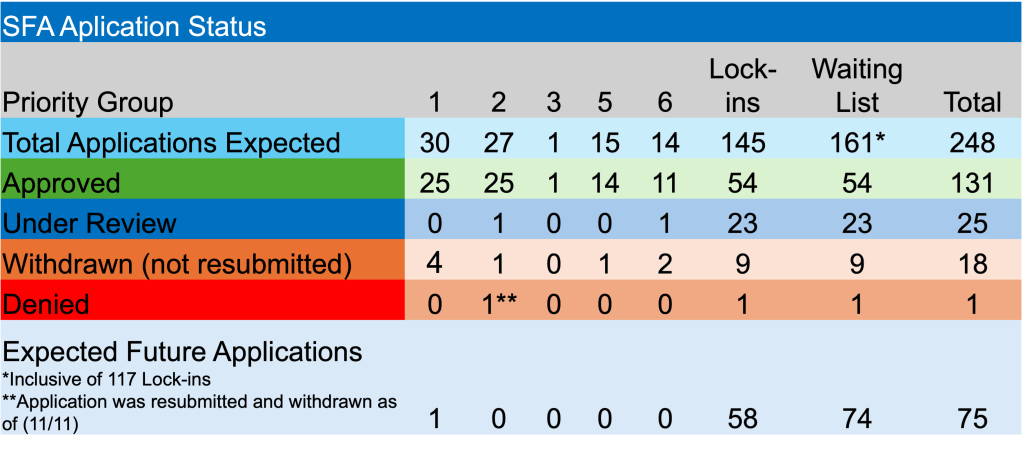

Regarding the ARPA legislation and the PBGC’s implementation of this critical pension program, we continue to see the PBGC ramp up its activity level. This past week witnessed five multiemployer plans submitting applications of which four were initial filings and the fifth was a revised offering. Another plan received approval, while one fund added its name to the waitlist. Finally, two funds have locked-in the measurement dates (valuation purposes).

Now the specifics: The four funds submitting initial applications were Colorado Cement Masons Pension Trust Fund, Iron Workers-Laborers Pension Plan of Cumberland, Maryland, Cumberland, Maryland Teamsters Construction and Miscellaneous Pension Plan, and Exhibition Employees Local 829 Pension Fund that collectively seek $50.8 million in SFA for their 1,260 plan participants. This week’s big fish, UFCW – Northern California Employers Joint Pension Plan, a Priority Group 6 member, is seeking $2.3 billion for its 138.5k members.

The plan receiving approval of its application for SFA is Laborers’ Local No. 130 Pension Fund, which will receive $33.3 million in SFA and interest for its 641 participants. In an interesting twist, Laborers’ Local No. 130 Pension Fund, has added the fund to a growing list of waitlist candidates. If the Laborers name seems to resemble the name of the recipient of the latest SFA grant you wouldn’t be wrong. I was as confused as you are/were until I realized that these entities have different that there are two different EIN #s.

Happy to report that there were no applications withdrawn, none denied, and no SFA recipients were asked to return a portion of the proceeds due to incorrect census information. However, there are still 119 funds going through the process. There is a tremendous amount of work left to be done at this time. This comes on the heels of 131 funds being approved for a total of $73.4 billion in SFA and interest supporting the retirements for 1.77 million American workers/retirees. What an incredible accomplishment!