By: Russ Kamp, CEO, Ryan ALM, Inc.

The demise of the defined benefit (DB) plan, most notably within the private sector, is harming the American worker and significantly reducing the odds of a dignified retirement. The Federal government should be doing everything that it can to protect the remaining pensions, including keeping fees low to ensure that these critically important retirement vehicles continue to operate. But unfortunately that doesn’t seem to be the case in this particular situation.

I have been very impressed with and supportive of the PBGC’s effort implementing the ARPA pension legislation, but I question the need to raise premium rates for 2026, which the PBGC has just announced. Why? As of fiscal year-end 2024, the PBGC’s single employer insurance program had a $54.1 BILLION surplus, as assets totaled $146.1 billion and liabilities stood at $92.0 billion. Despite these significant excess resources, the PBGC is increasing rates for the “flat rate premium per participant” in single-employer plans to $111 per participant in 2026 from $106. This 4.7% increase was described in a Chief Investment Officer article as modest! That increase doesn’t seem modest anyway you look at it, but certainly not when one remembers that $54 billion surplus. What is the justification? The rate per $1,000 in “unvested benefits”, not subject to indexing, was frozen by Congress in Section 349 of the SECURE 2.0 Act of 2022 and therefore remains $52. Seems like we need more legislation to freeze the flat-rate premium.

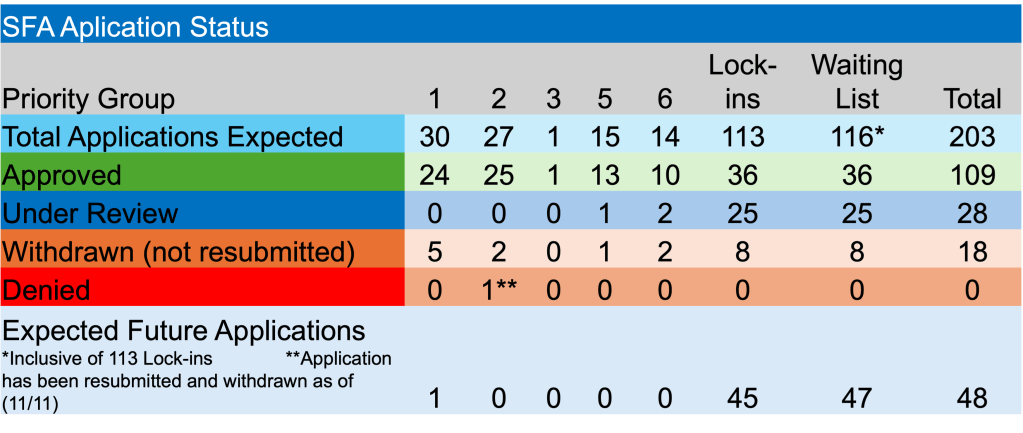

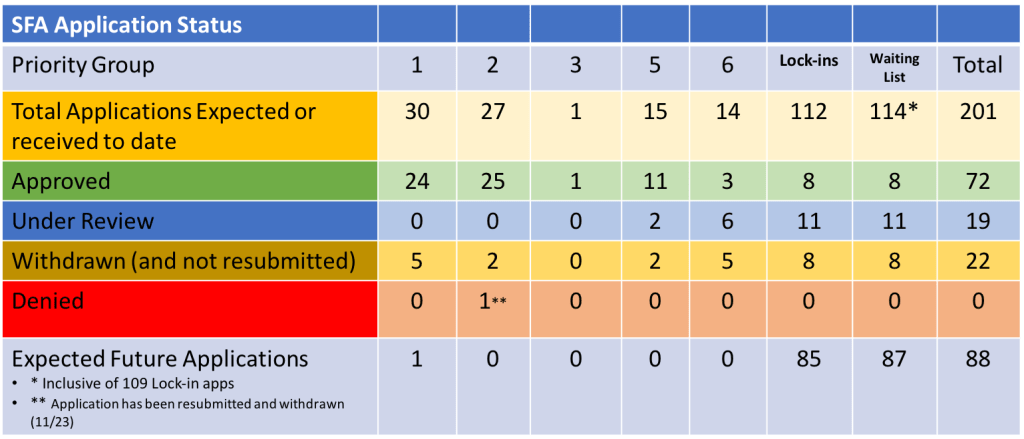

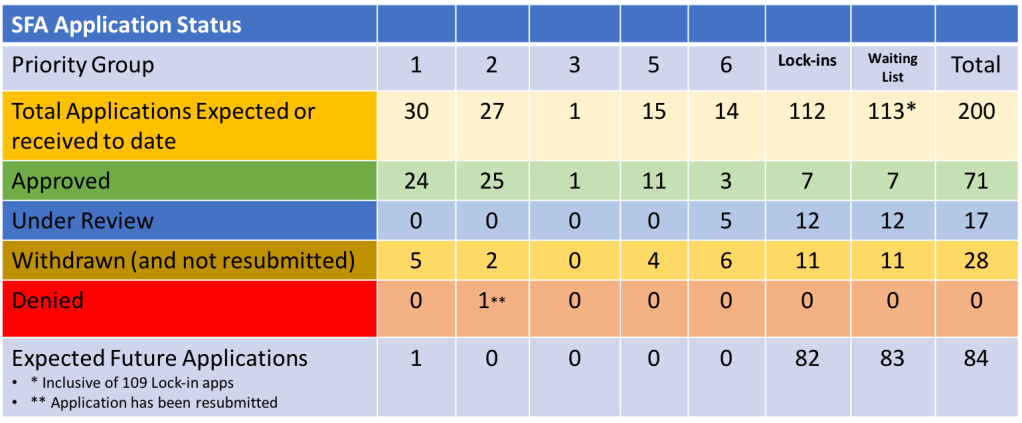

Despite the significant improvement in the multiemployer pension program due to the Special Financial Assistance (SFA) related to ARPA pension reform, that insurance pool is still underwater. As a result, multiemployer plans that only pay a per-participant premium will see the per-participant rate for flat rate premiums rise to $40 from $39 next year. That amounts to an increase of 2.6%. So, the program that is underwater sees a premium increase of 2.6%, while the insurance pool with the massive surplus gets an outsized 4.7% increase? I guess one must work for the government to understand that decision.

Again, we need to do much more to protect DB pensions for all American workers. Asking untrained individuals to fund, manage, and then disburse a “retirement benefit” with little to no disposable income, low investment knowledge, and no crystal ball to help with longevity considerations is just poor policy doomed to failure. We are the wealthiest country in the world, yet we can’t seem to figure out how to control costs associated with retirement, healthcare, education, childcare, etc. and in the process, we are crippling a majority of American families. It isn’t right!