By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Welcome to November. I’m shocked by how quickly the year is flying by. I’m also thankful that the incessant political commercials will soon be behind us.

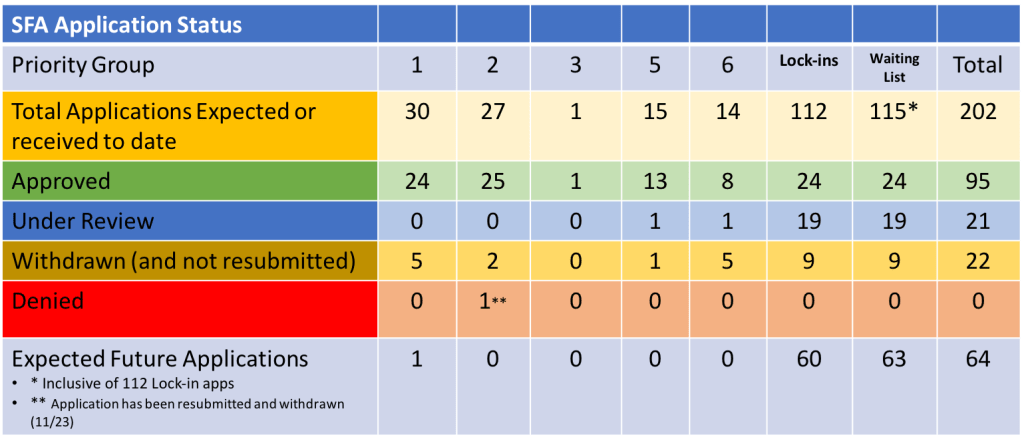

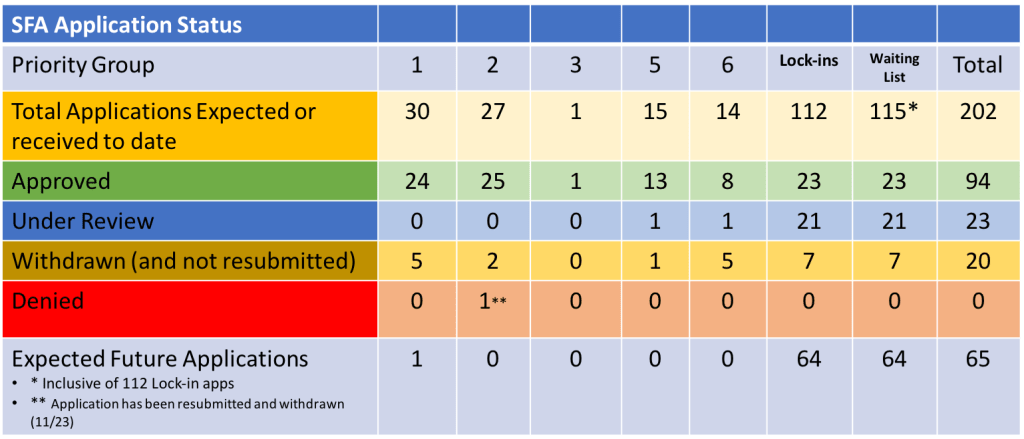

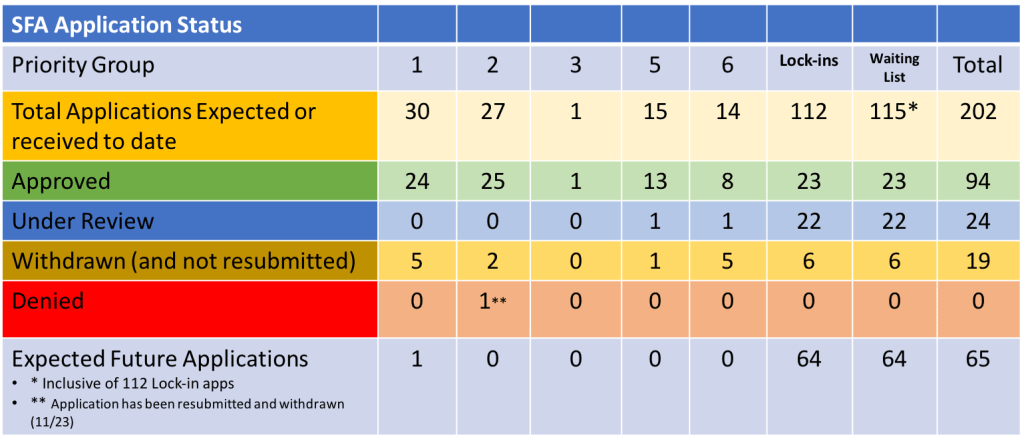

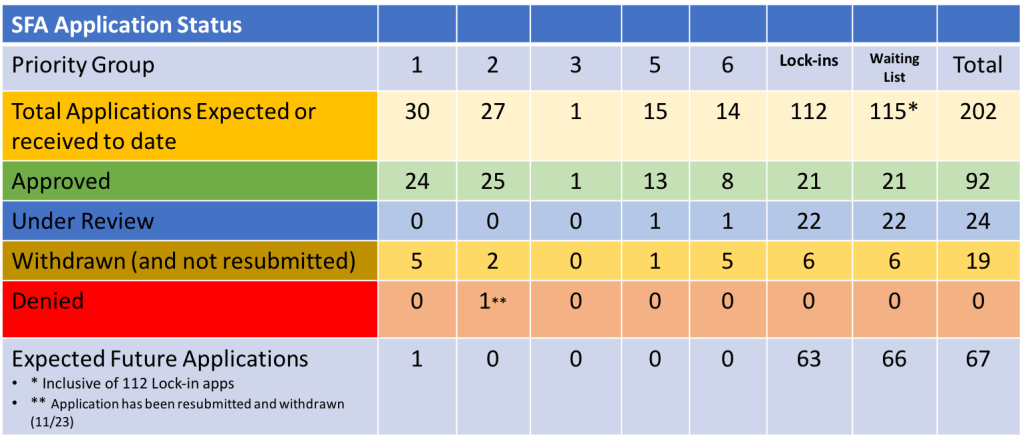

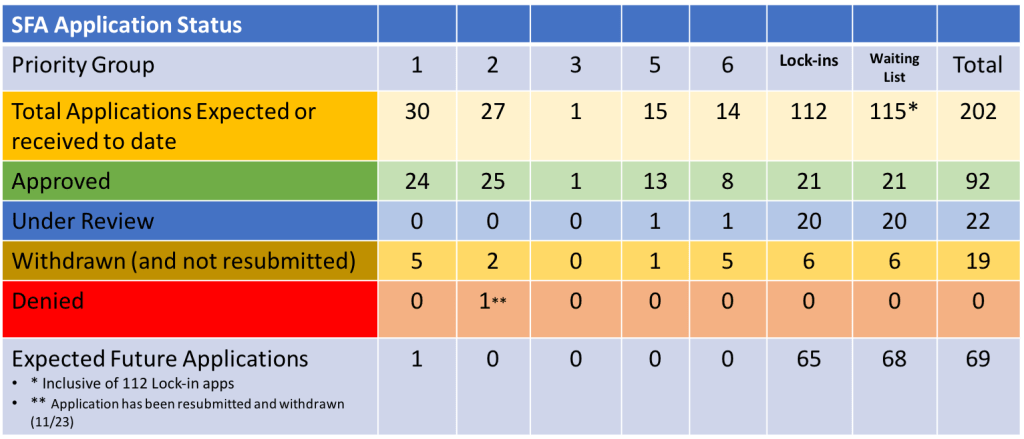

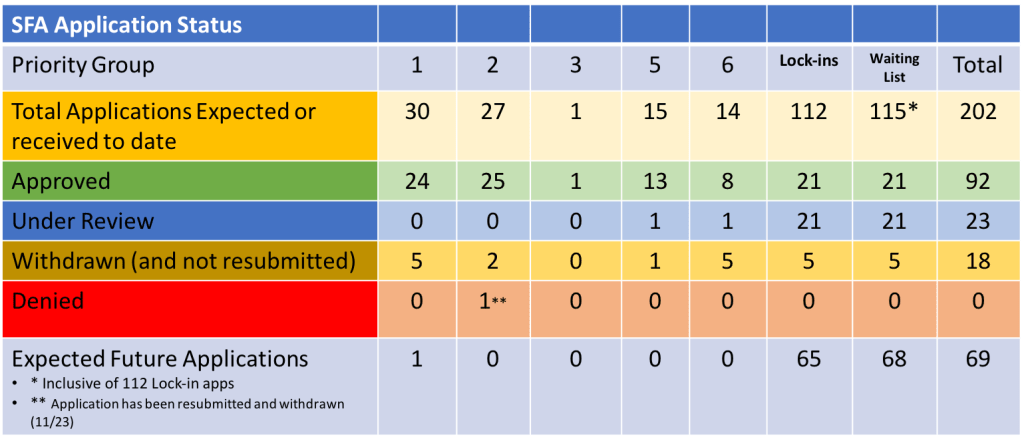

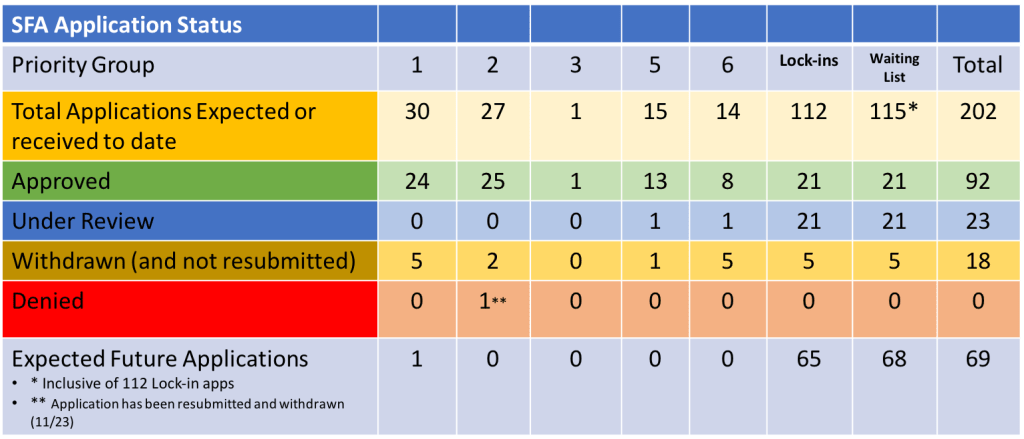

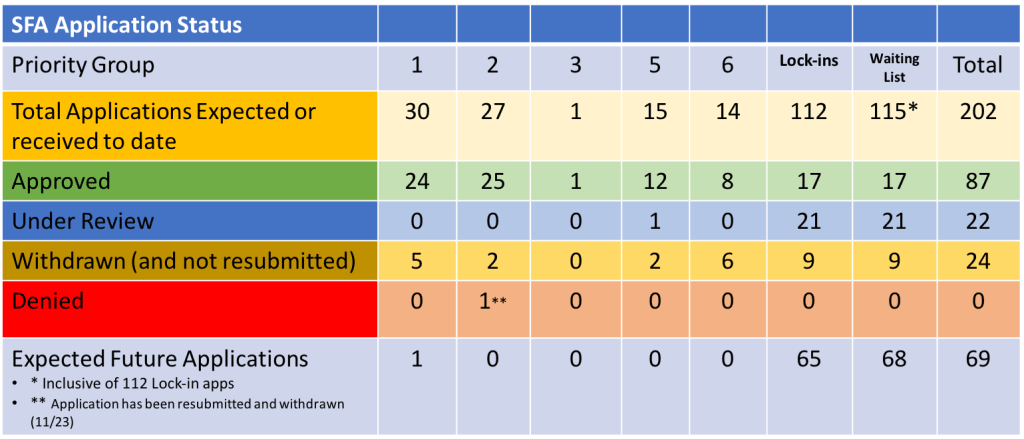

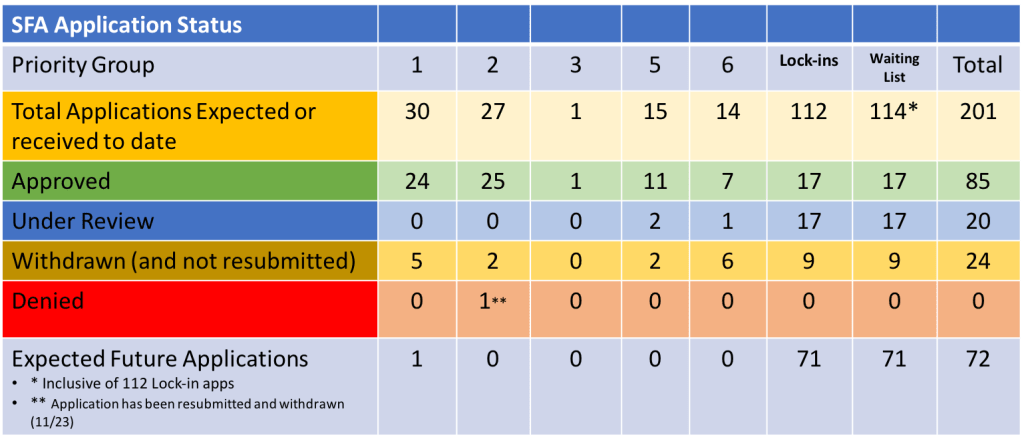

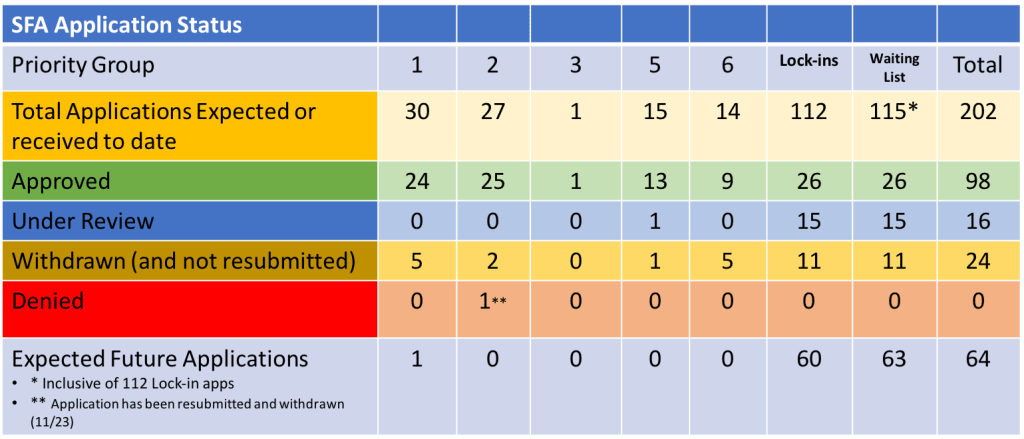

The PBGC had a very good and busy last week, as we witnessed quite a bit of activity in the implementation of the ARPA legislation. Always pleased to announce that three plans received approval for Special Financial Assistance, including the last member of the #6 priority group. Pension Plan of the Marine Carpenters Pension Fund (their initial application), United Food and Commercial Workers Union and Participating Food Industry Employers Tri-State Pension Plan (the Priority Group 6 member), and Local 111 Pension Plan were granted a total of $736.1 million for just over 32k participants.

In addition to the approvals, the eFiling portal was open to Lumber Industry Pension Plan and the Laborers’ Local No. 130 Pension Fund. In the case of the lumber Industry plan, it appears that they get to chop off some of the wait time for approval as their application indicates an expedited review. This plan is seeking $103.2 million for 5,834 members. Local No. 130 filed its initial application in which they are hoping to receive $32.1 million for 641 plan participants.

There were also four plans that withdrew initial applications for SFA. Alaska Plumbing and Pipefitting Industry Pension Plan, Lumber Industry Pension Plan, Upstate New York Engineers Pension Fund, and Pension Plan of the Automotive Machinists Pension Trust were collectively seeking $438.3 million for just under 22k participants. Each of these plans are non-priority funds. Only 15 of the original 87 Priority Group members have not received approval at this time.

Finally, there were no applications denied during the prior week and no funds rebated excess SFA on account of census errors. There were also no pension plans added to the waitlist which stands at 63 that haven’t seen any activity at this time. There hasn’t been a plan added to the waitlist since July 2024 with the addition of the Production Workers Pension Plan.