By: Russ Kamp, Managing Director, Ryan ALM, Inc.

You have to be excited as a Mets fan given yesterday’s news that Juan Soto will be joining the organization on a massive contract. The $765 million is a staggering figure. Let’s see what happens to ticket prices and TV streaming services from a cost standpoint.

Since ARPA was passed in 2021 and signed into law in March of that year, there have been folks upset that the government is using “tax revenue” to rescue pensions for multiemployer plans. Well, in the latest update provided by the PBGC, we note that the Pressroom Unions’ Pension Plan, a non-priority group member, will receive $63.7 million to protect and preserve the promised pensions for 1,344 plan participants. That seems very reasonable since this grant will likely cover these benefit payments for roughly the same time frame that Soto will be a Met (15 years), at only $12.7 million more than just one year of Soto’s contract.

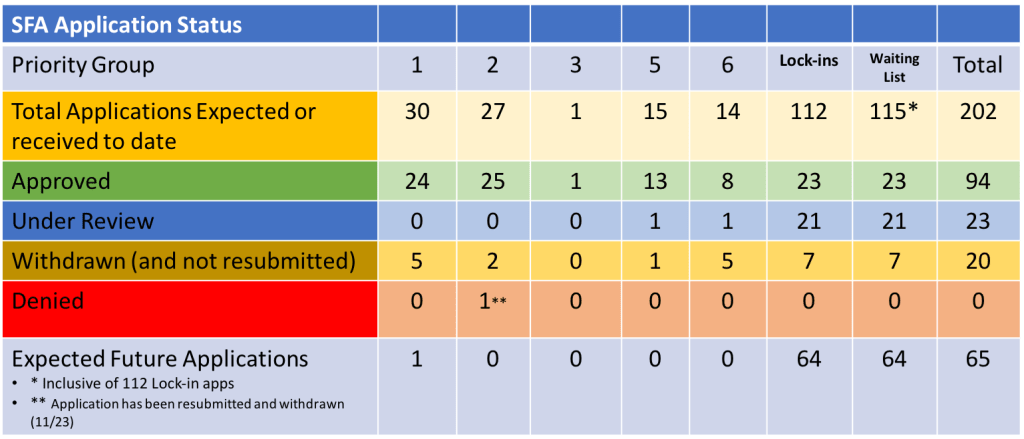

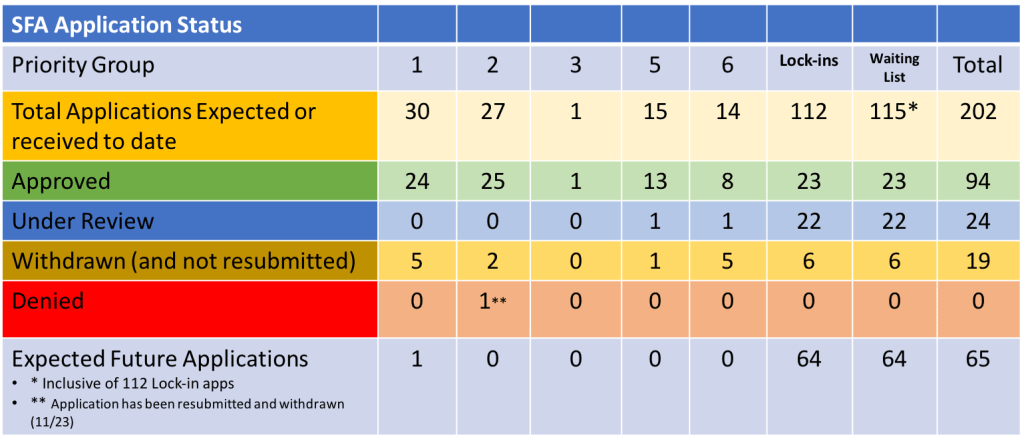

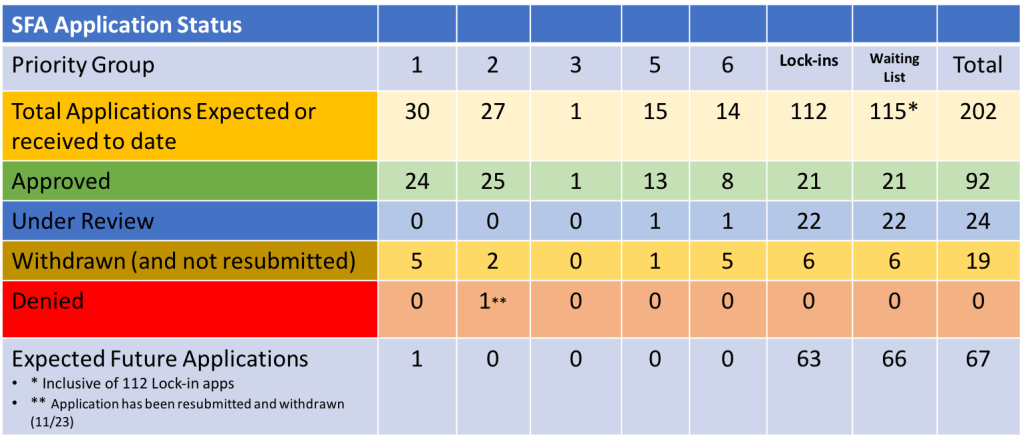

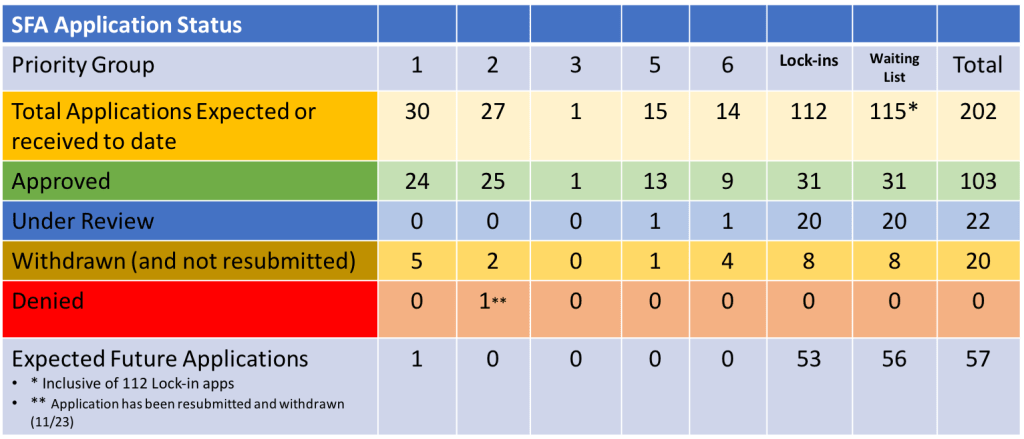

In other ARPA news, the e-filing portal is listed as “limited”, which according to the PBGC means that “the e-Filing Portal is open only to plans at the top of the waiting list that have been notified by PBGC that they may submit their applications. Applications from any other plans will not be accepted at this time.” PA Local 47 Bricklayers and Allied Craftsmen Pension Plan was the only plan to file an application (revised) last week. They are seeking $8.3 million in SFA for 296 members in the fund.

In other news, three funds, including Toledo Roofers Local No. 134 Pension Plan, Freight Drivers and Helpers Local Union No. 557 Pension Plan, and PACE Industry Union-Management Pension Plan, were asked to repay a total of $7 million in excess SFA due to census issues. The rebate represented 0.45% of the $1.6 billion received in SFA grants. Happy to report that there were no applications denied or withdrawn during the prior 7-day period.

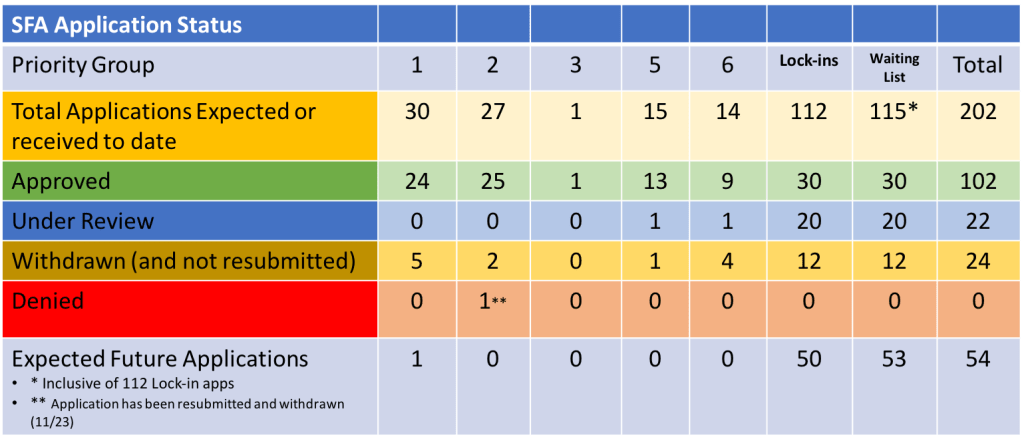

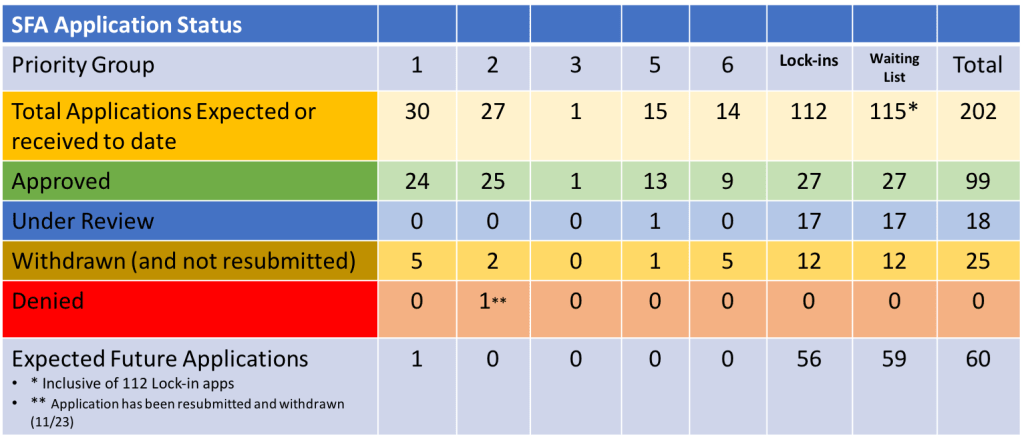

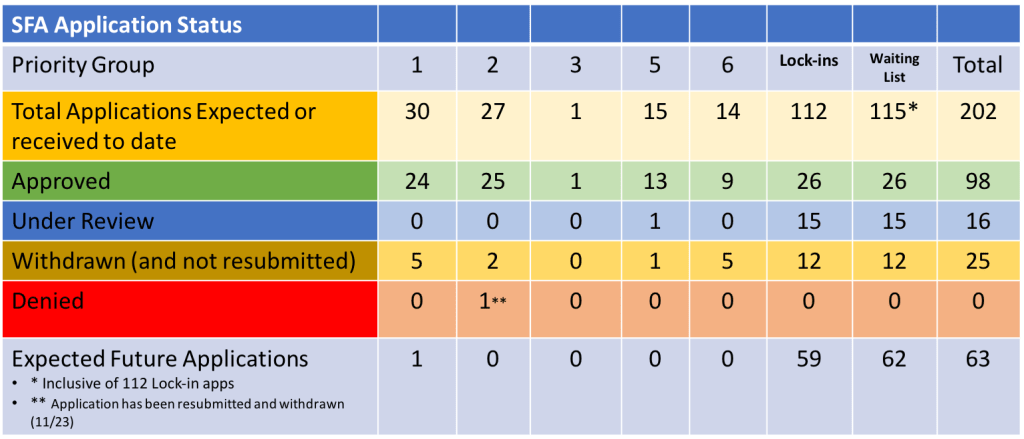

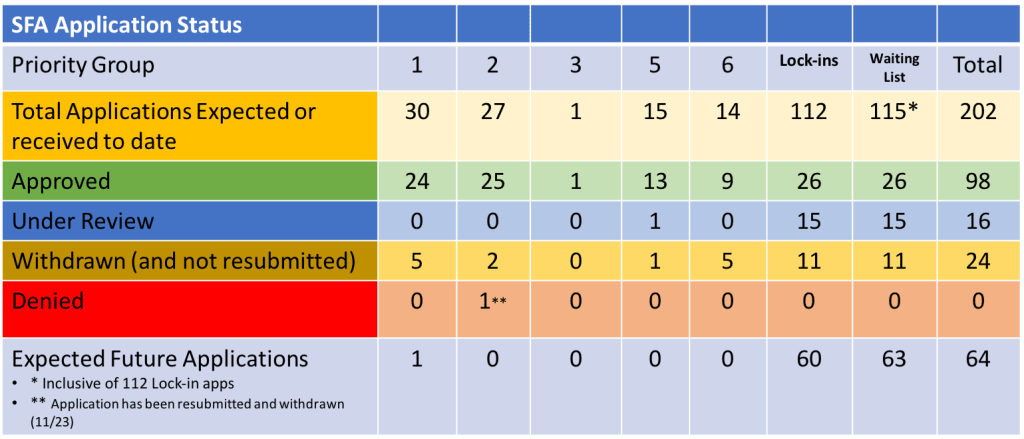

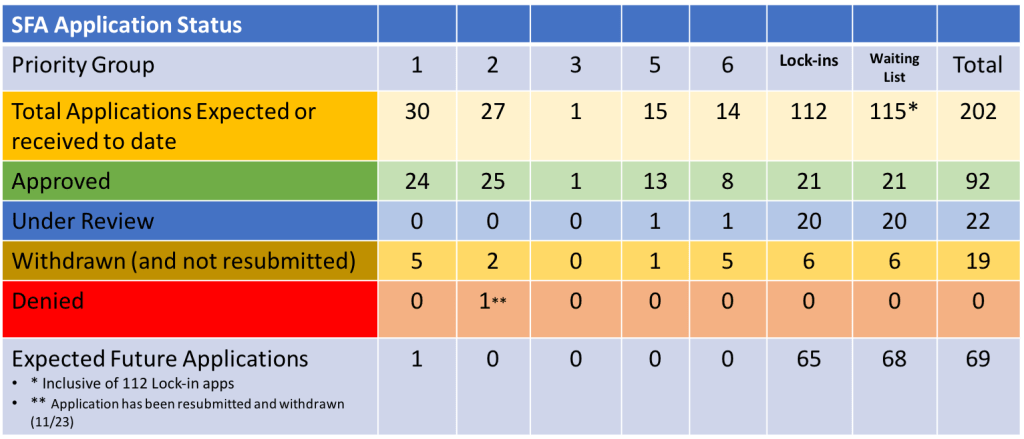

As the chart above highlights, there are still 57 plans that have yet to file an application seeking SFA support. Estimates range from another $10 – $20 billion being allocated to the remaining entities.