By: Russ Kamp, CEO, Ryan ALM, Inc.

On March 25, 2020, I produced a post titled, “Why Pension Reform is Absolutely Necessary“. A few of you may recall that blog. I penned the post in reaction to a series of statistics that my friend John A. produced. John is a retired Teamster and an incredibly important driver behind efforts to reinstate benefits that had been cut under MPRA. John’s analysis was based on a survey that he conducted on multiemployer plans that had roughly 43,000 plan participants impacted by that misguided legislation. That universe of participants would grow to more than 75,000. What he discovered through his polling and outreach was shocking!

Their benefit reductions amounted to nearly $34,000,000 / month. (That is a ton of lost economic activity.)

95% were not able to work.

72% were providing primary care for an ailing loved one.

65% were not able to maintain healthcare insurance.

60% had lost their home.

55% were forced to file for bankruptcy.

80% were living benefit check to benefit check.

100% of the PBGC maximum benefit payout was inadequate ($12,870 for a retiree with 30-years of work).

50% of the retirees were U.S. service veterans.

Shocked? I certainly was and continue to be that our government allowed the benefits to be cut for hard working American workers who rightfully earned them through years of employment.

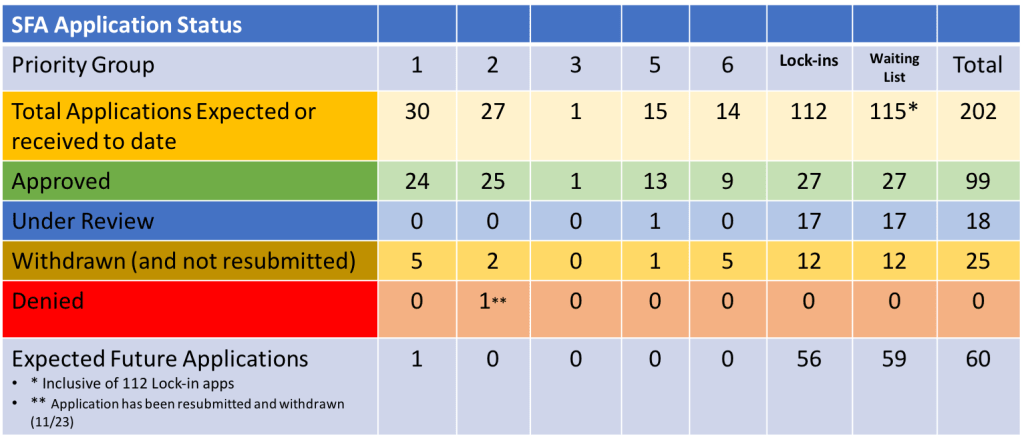

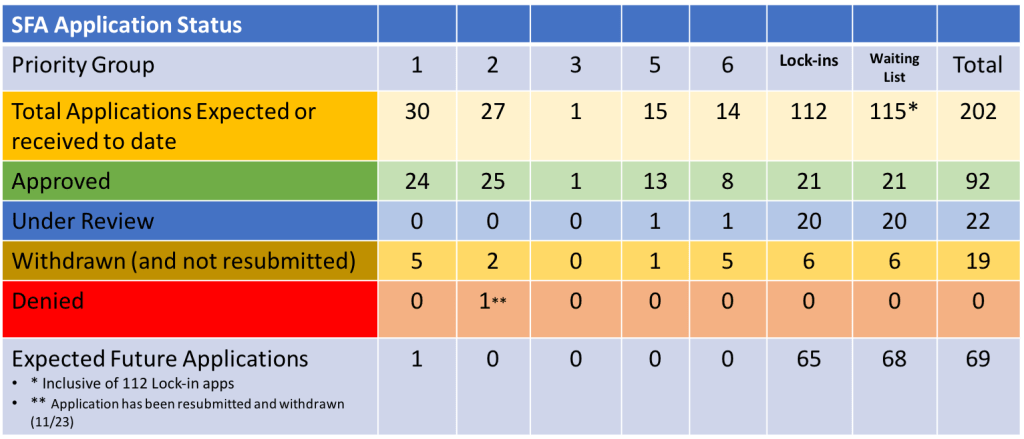

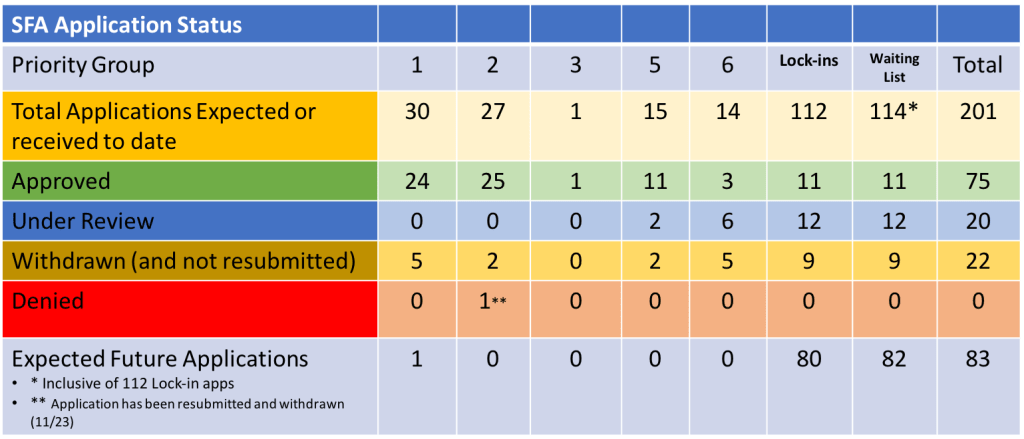

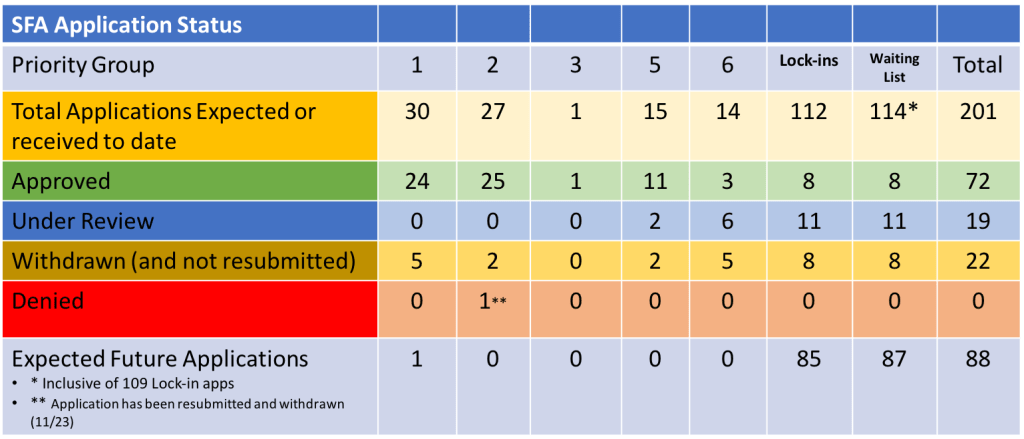

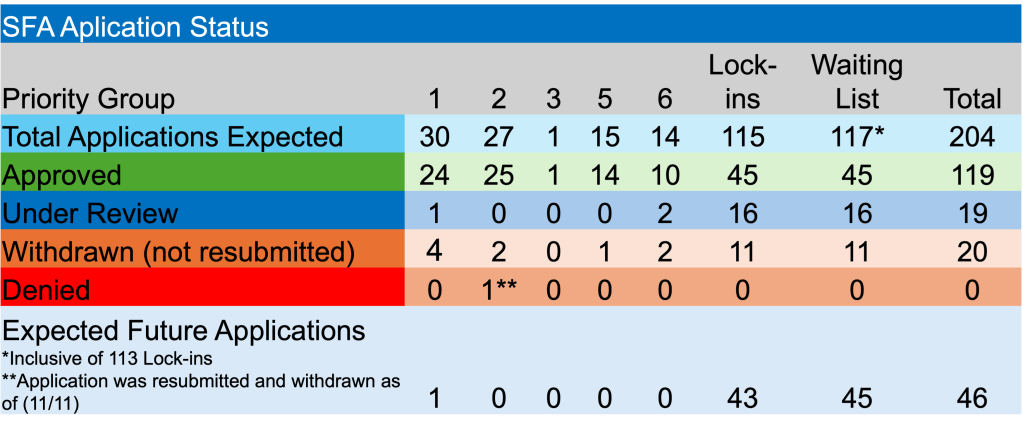

Where are we today? Fortunately, the got the passage of ARPA pension reform (originally referred to as the Butch Lewis Act) which was signed into law by President Biden in March 2021. Responsibility to implement the legislation fell to the Pension Benefit Guaranty Corporation (PBGC). In my original blog post, I referred to a potential universe of 125 multiemployer plans that might be eligible for Special Financial Assistance (SFA). That list would eventually become 204 plans (see below).

I’m extremely pleased to announce that 119 funds of the 204 potential recipients have received more than $71.6 billion in SFA and interest supporting the retirements of 1,555,460 plan participants. Awesome! There is still much to do, and hopefully, the sponsors of these funds will prove to be good stewards of the grant $s by conservatively investing the SFA and reserving the risk taking for the legacy assets that have time to wade through challenging markets.

What an incredible accomplishment! So many folks would have been subject to very uncertain futures. The securing of their benefits goes a long way to allowing them to enjoy their retirement years. Unfortunately, there are too many American workers that don’t have a defined benefit plan. In many cases they have an employer sponsored defined contribution plan, but we know how challenging it can be for those participants to fund, manage, and disburse that benefit. For many others, there is no employer sponsored benefit. Their financial futures are in serious jeopardy.

That said, what appeared to be a pipe dream once the U.S. Senate failed to take up the BLA legislation has become an amazing success story. Just think of all the economic activity that has been created through these monthly payments that certainly dwarf the $34 million/month mentioned above. Congrats to all who were instrumental in getting this legislation created and passed!