By: Russ Kamp, CEO, Ryan ALM, Inc.

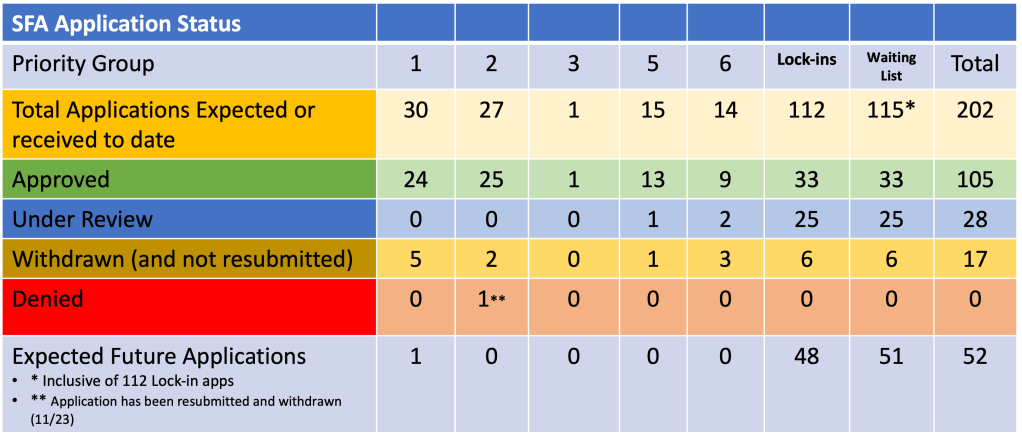

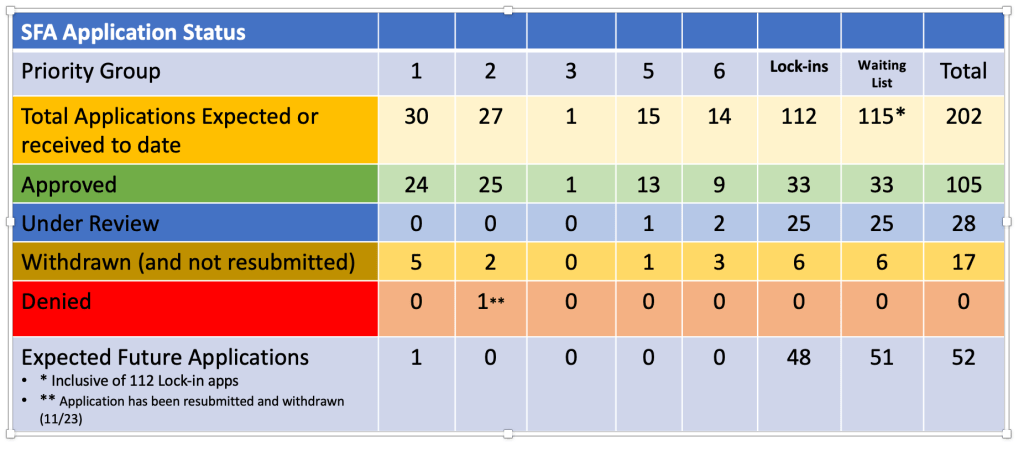

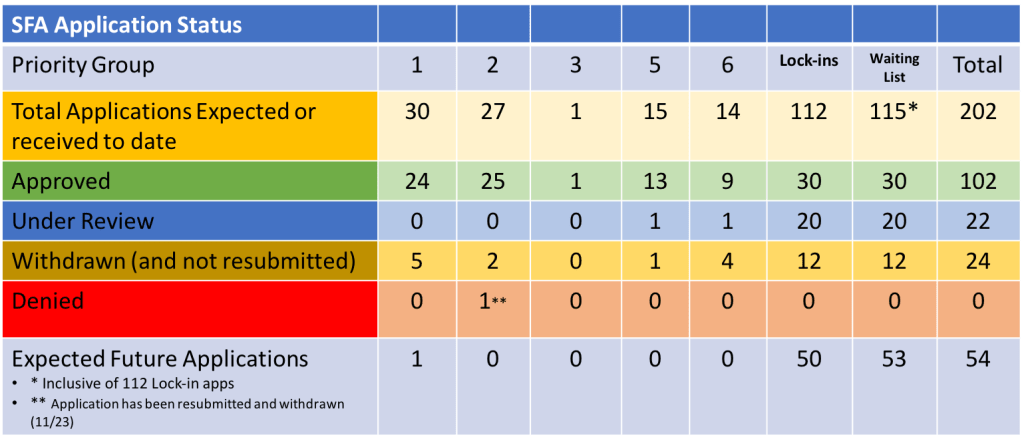

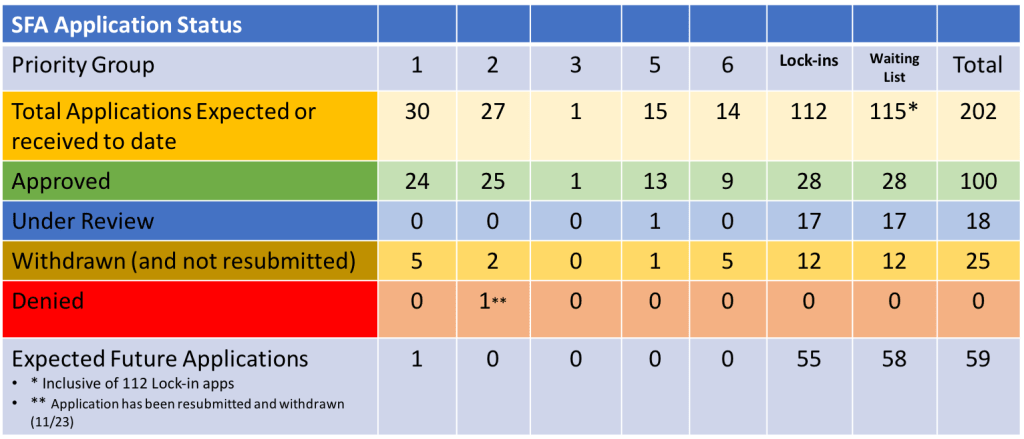

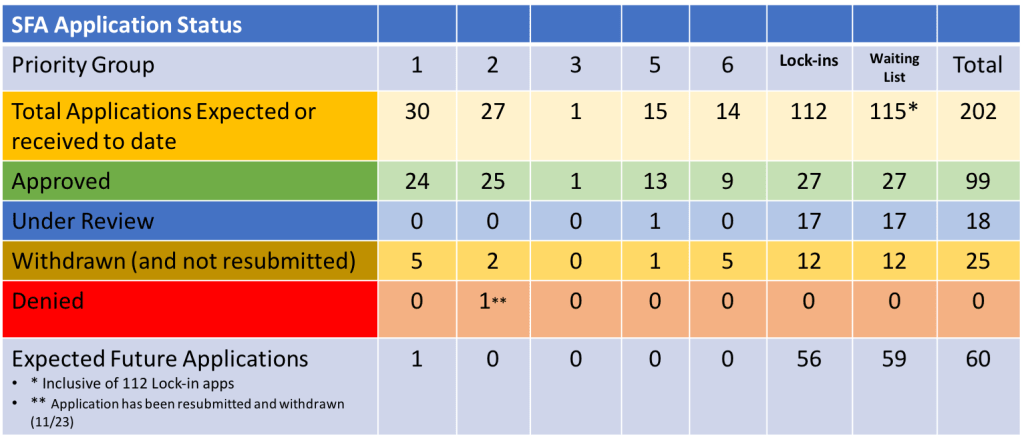

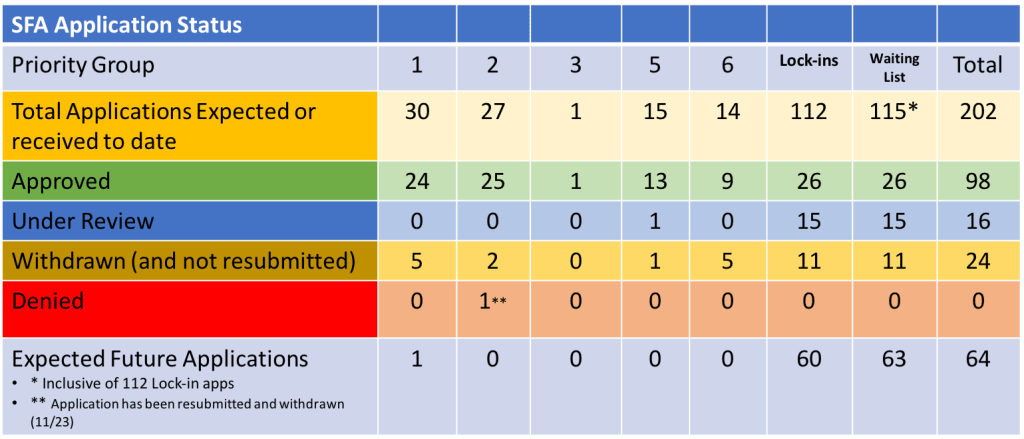

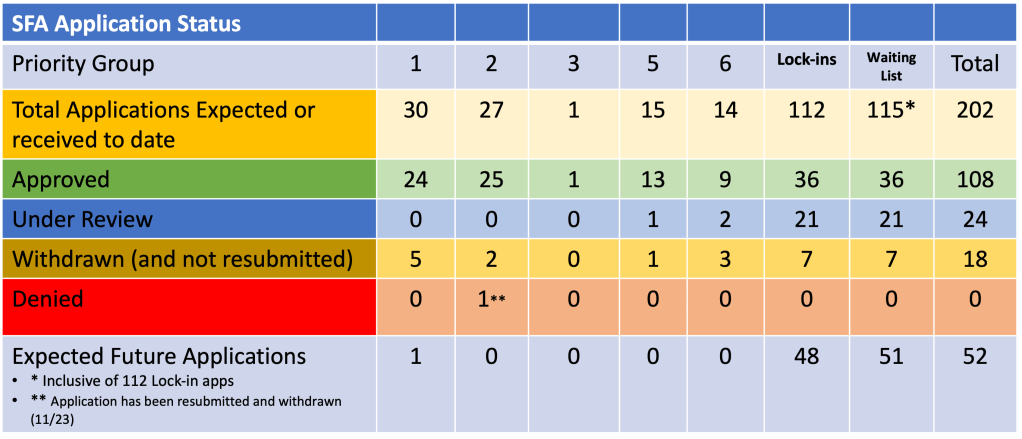

Welcome to the second full week of January. Although the PBGC’s efiling portal remains temporarily closed, there was still some good activity last week, including the approval of another three applications seeking Special Financial Assistance (SFA). Pleased to report that Laborers’ Local No. 265 Pension Plan, Local 734 Pension Plan, and Upstate New York Engineers Pension Fund each a non-priority group member received approval for their revised applications. In total, they will receive $244.6 million in SFA for the 11,374 plan participants. What an exciting way to begin 2025.

In other news, there was one application withdrawn, Warehouse Employees Union Local 169 and Employers Joint Pension Plan, from Elkins Park, PA, withdrew its initial application seeking nearly $90 million in SFA for just over 3,600 members of the plan.

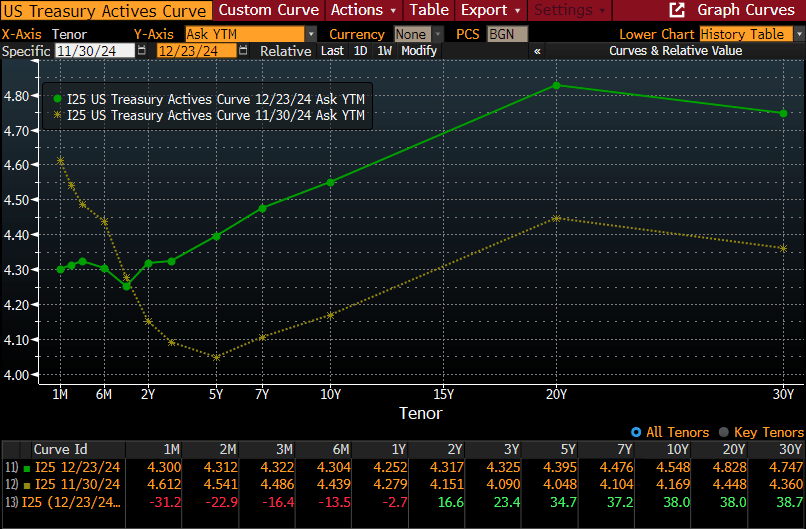

The 108 funds receiving SFA to date have been awarded grants exceeding $70 billion benefiting the quality of life for more than 1.4 million American workers. There is still much more to do (possibly another 94 funds will get SFA), but the program has already been an incredible success. Finally, US Treasury yields continue to rise, providing pension plans with the wonderful opportunity to further de-risk the SFA assets received and those to come. IG corporate bond yields exceeding 6% are not rare. Let us know how we can help you.