By: Russ Kamp, Managing Director, Ryan ALM, Inc.

I suspect (can only hope) that you woke up yesterday morning just itching to see what news I was going to share as it related to ARPA and the PBGC’s implementation of that critical legislation. Sorry to have disappointed you. Like most everyone else, my day just got away from me.

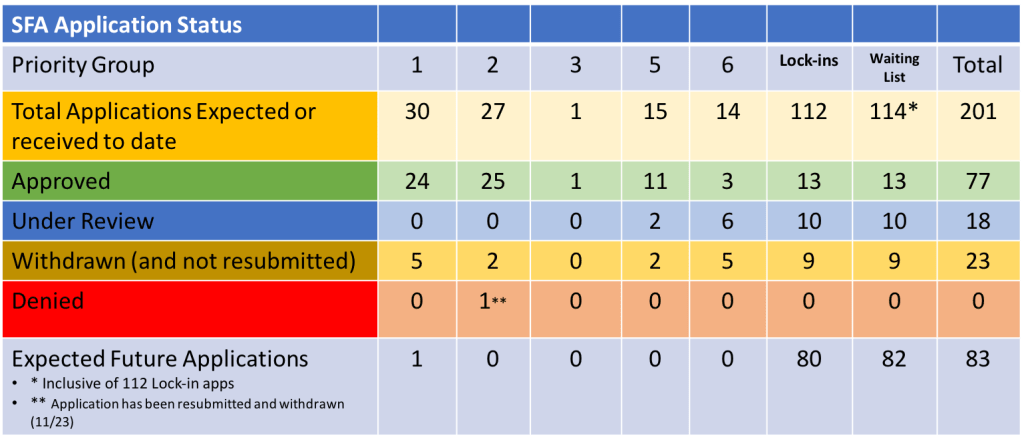

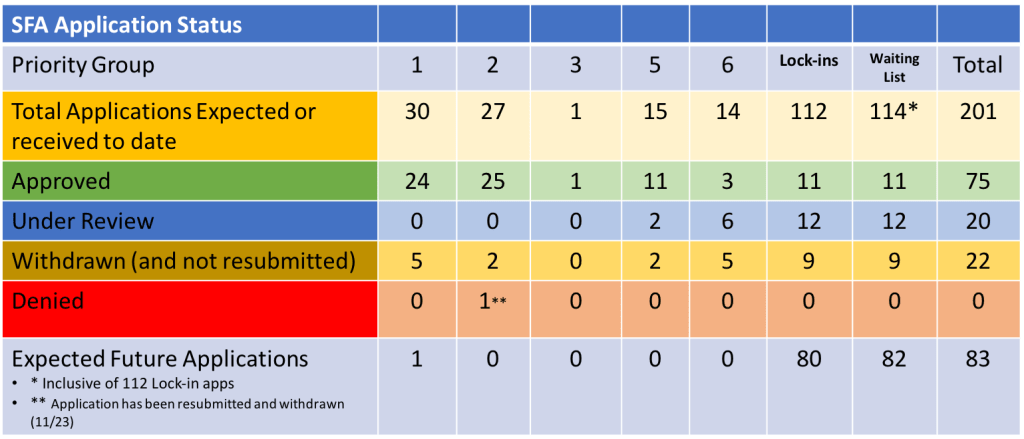

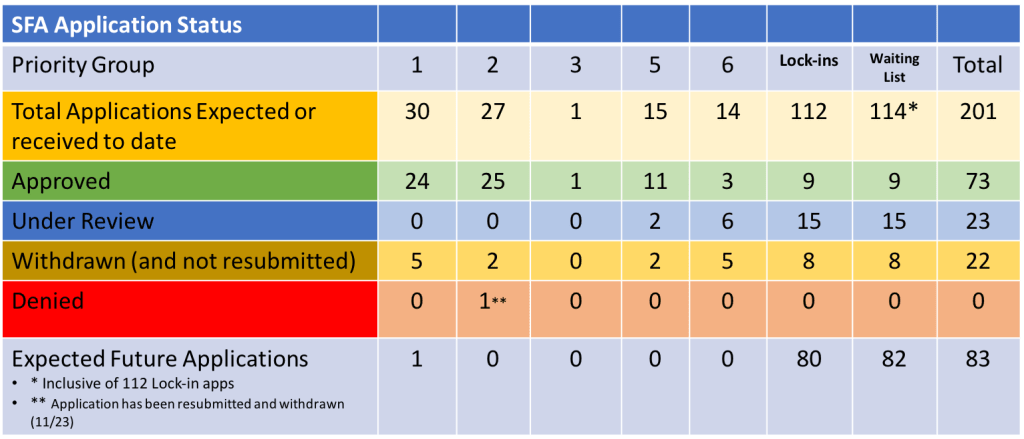

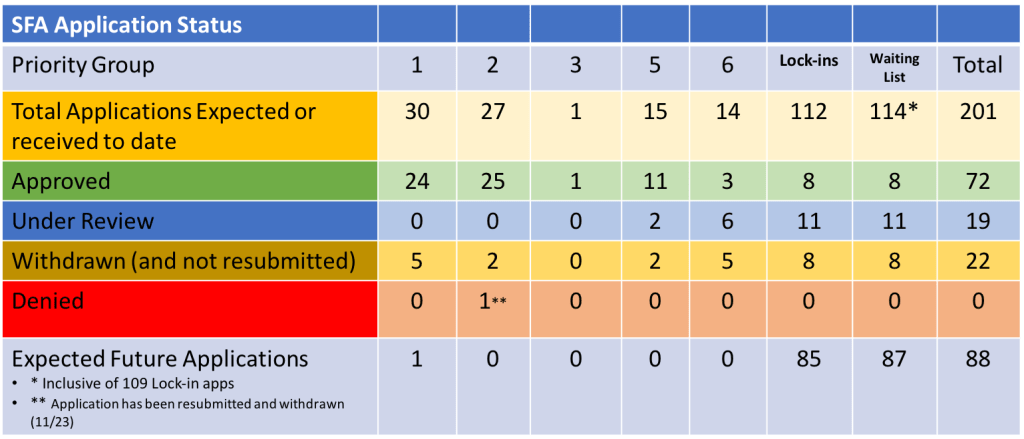

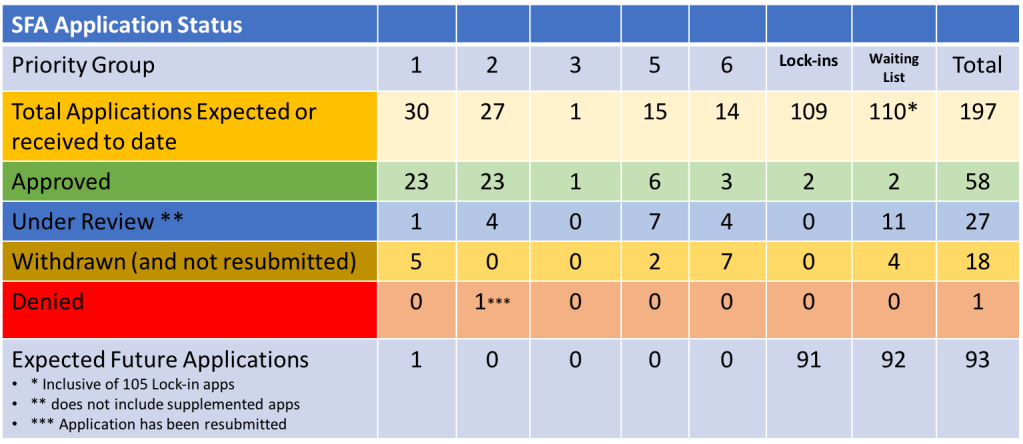

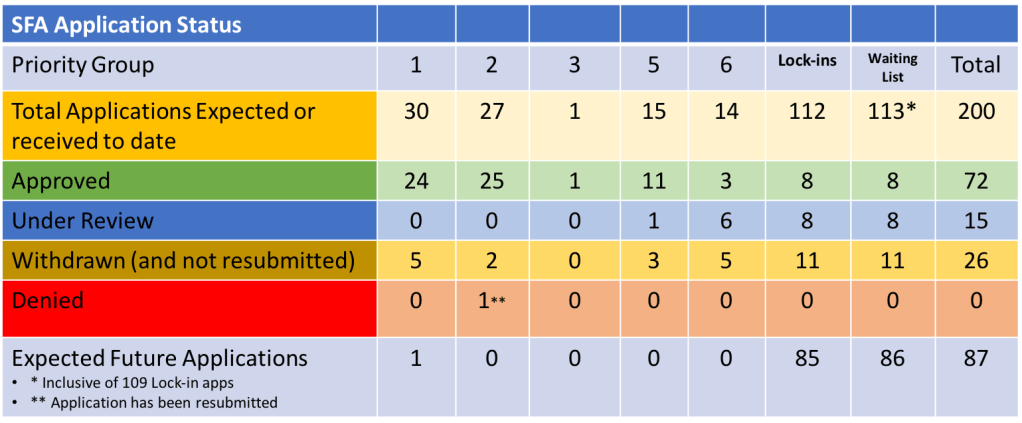

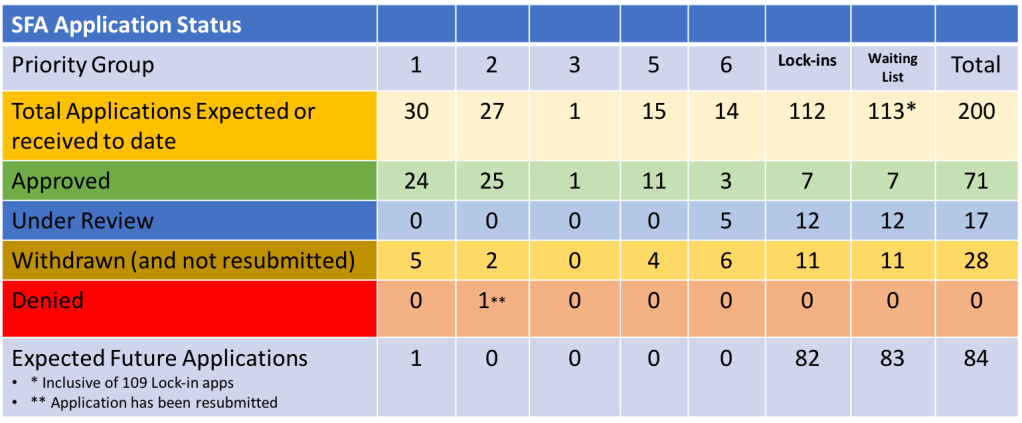

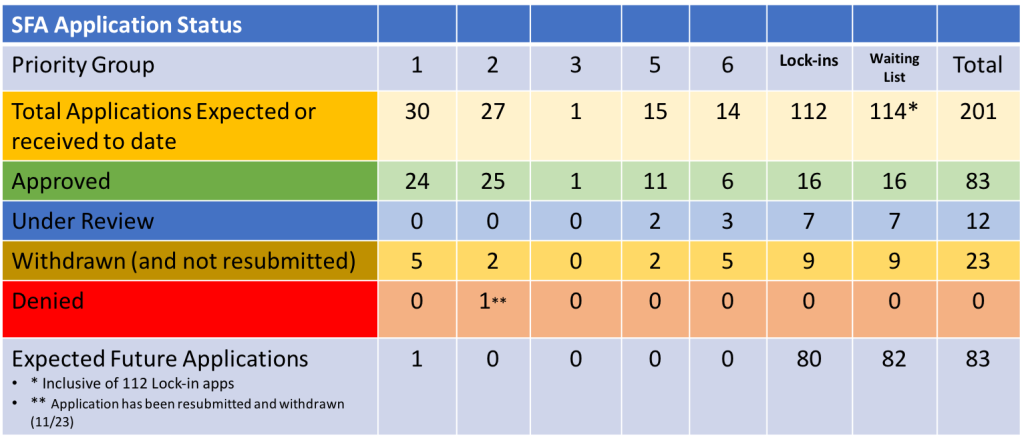

However, I do have some exciting news to share which might just make up for the disappointment of having to wait one day to get the weekly update. As we’ve been writing, the PBGC was running up against many application review and determination deadlines this month. As a result, they have announced that five funds had their applications approved for Special Financial Assistance (SFA). Terrific!

The five funds are the Retail, Wholesale and Department Store International Union and Industry Pension Plan, the Bakery and Confectionery Union and Industry International Pension Fund, United Food and Commercial Workers Unions and Employers Midwest Pension Plan, GCIU-Employer Retirement Benefit Plan, and the Pacific Coast Shipyards Pension Plan. These funds represent three Priority Group 6 members and two that came through the non-priority waitlist. In total, they will receive nearly $5.8 billion in SFA for just over 200k in plan participants. The Kansas Construction Trades Open End Pension Trust Fund is the last application that needs action in June. There are four that have July deadlines.

There were no new applications submitted to the PBGC, as the portal remains temporarily closed, no applications denied or withdrawn, and none of the plans that have received SFA were forced to return a portion of the proceeds as a result of overpayment identified through a death audit of the plan’s population.

Fortunately, the US interest rate environment and current economic conditions remain favorable for those potential SFA recipients to SECURE promised benefits far into the future without subjecting the grant proceeds to unnecessary risk associated with a non-cash flow matching assignment. Remember that the sequencing of returns is a critical variable when contemplating an asset allocation framework. If your SFA portfolio suffers significant losses in the early years, you negatively impact the coverage period. We’ll be happy to model your plan’s liabilities for free. Don’t hesitate to reach out to us if we can be a resource for you.