By: Russ Kamp, CEO, Ryan ALM, Inc.

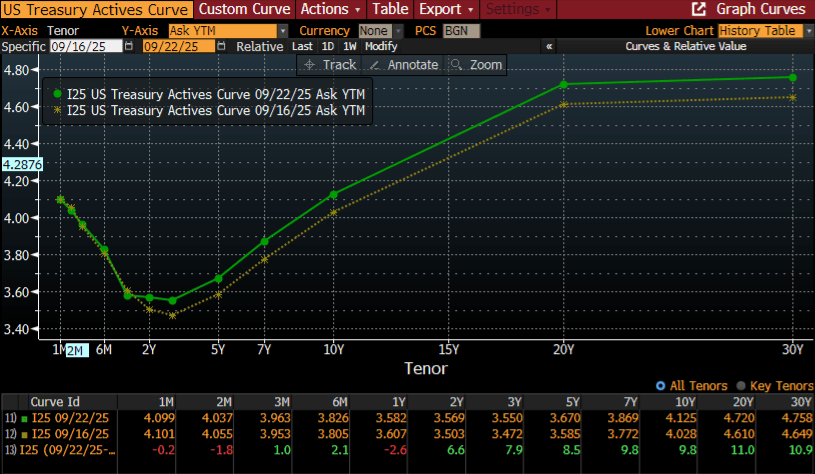

After 44-years in the investment industry I’ve pretty much heard most of the sayings, including the phrase “buy on the rumor and sell on the news”. I suspect that most of you have probably heard those words uttered, too. However, it isn’t always easy to point out an example. Here is graph that might just do the trick.

There had been significant anticipation that the U.S Federal Reserve would cut the Fed Funds Rate and last week that expectation was finally realized with a 0.25% trimming. However, it appears that for some of the investment community that reduction wasn’t what they were expecting. As the graph above highlights, the green line representing Treasury yields as of this morning, have risen nicely in just the last 6 days for most maturities 3 months and out, with the exception of the 1-year note. In fact, the 10- and 30-year bonds have seen yields rise roughly 10 bps. Now, we’ve seen more significant moves on a daily basis in the last couple of years, but the timing is what has me thinking.

There are still many who believe that this cut is the first of several between now and the end of 2025. However, there is also some trepidation on the part of some in the bond world given the recent rise in inflation after a prolonged period of decline. As a reminder, the Fed does have a dual mandate focused on both employment and inflation, and although the U.S. labor force has shown signs of weakening, is that weakness creating concerns that dwarf the potential negative impact from rising prices? As stated above, there may also have been some that anticipated the Fed surprising the markets by slicing rates by 0.50% instead of the 0.25% announced.

In any case, the interest rate path is not straight and with curves one’s vision can become obstructed. What we might just see is a steepening of the Treasury yield curve with longer dated maturities maintaining current levels, if not rising, while the Fed does their thing with short-term rates. That steepening in the curve is beneficial for cash flow matching assignments that can span 10- or more years, as the longer the maturity and the higher the yield, the greater the cost reduction to defease future liabilities. Please don’t let this attractive yield environment come and go before securing some of the pension promises.