By: Russ Kamp, CEO, Ryan ALM, Inc.

Welcome to the first review of December 2025. We aren’t quite at the beginning of winter, but you could sure fool me, as New Jersey is gripped by cold front and we saw our first modest snowfall just in time for me to start decorating my house for Christmas. I hope that you had a wonderful weekend.

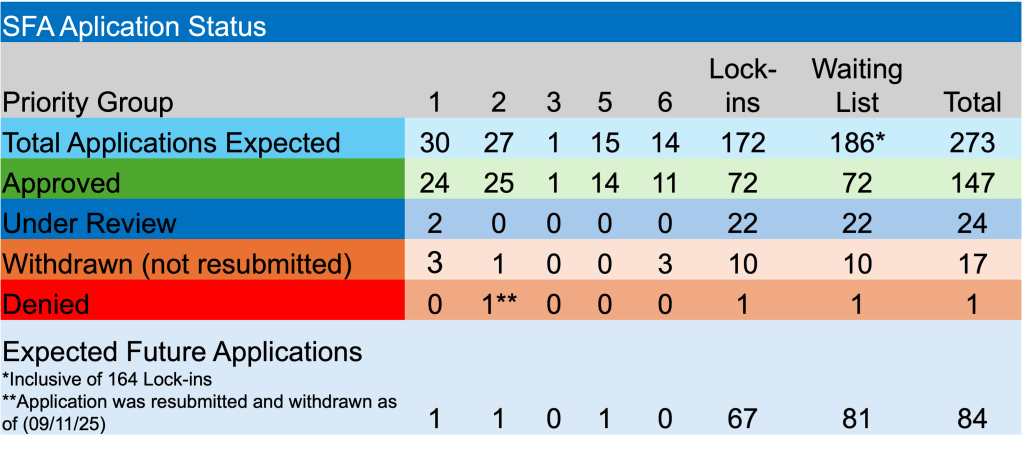

With regard to ARPA and the PBGC’s implementation of this critical legislation, there was a little reported activity last week, but certainly not enough to make a dent in the current waitlist. Unfortunately, the PBGC’s e-Filing portal remains temporarily closed. Despite that fact, pension plans continue to be added to the waitlist. USW District 10, Local 286 Pension Plan is the latest fund, making it the 186th non-priority group plan added since the start of the program. By my estimate, there are still 83 pension funds sitting on the waitlist hoping to get a chance to submit an application for SFA grant $.

In other APRA news, two pension funds received approval to receive the SFA. Teamsters Local 210 Affiliated Pension Plan and Local Union 1710 I.B.E.W. Pension Trust Fund, both non-priority plans, will receive a total of $149.2 million in SFA for just over 9,500 participants. As mentioned above, the PBGC’s e-Filing portal remains temporarily closed, so there were no additional applications received during the week. There are currently 24 applications in front of PBGC staff.

In addition, there were no plans asked to rebate a portion of their SFA grant due to census errors, and there haven’t been since mid-September. Fortunately, no plans were denied the ability to submit an application due to the lack of eligibility and no applications were withdrawn. However, there were six plans that locked-in a valuation date, as each chose 9/30/25 as the plan’s measurement date. There are still 14 plans on the waitlist that haven’t chosen to lock-in a valuation date.

With the two approvals from last week, there are now 147 plans that have or will soon receive Special Financial Assistance totaling $74.7 billion supporting the earned pensions for 1.85 million American workers and retirees. Outstanding! That is a lot of economic stimulus that helps more than just the recipient of the retirement benefit, but also the communities in which they reside.