By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Can you believe that a 1/3 of 2024 will soon be behind us? It is finally feeling like Spring in NJ today.

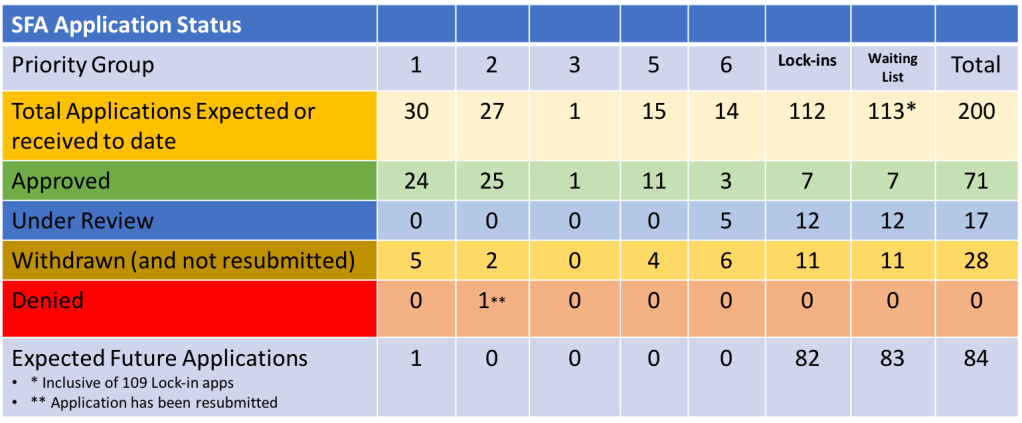

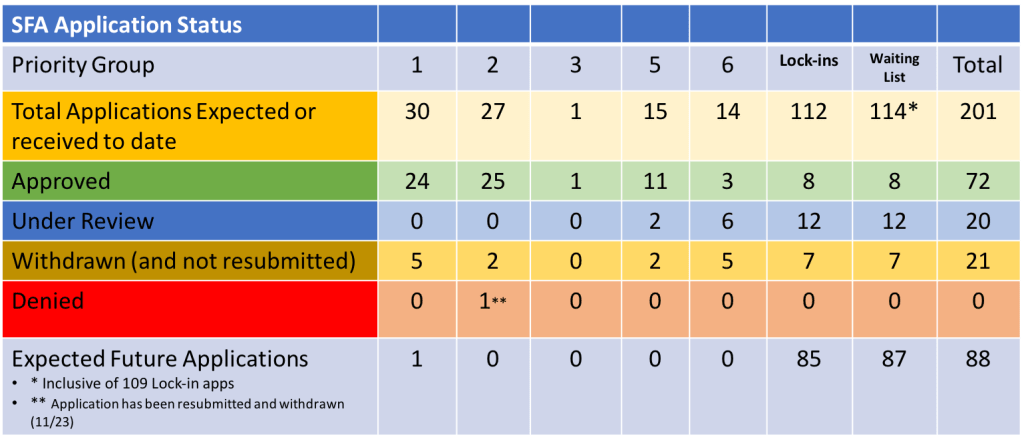

There is not much to discuss regarding the PBGC’s implementation of the ARPA pension legislation. According to the latest update, there were no new applications filed, approved, denied, or withdrawn. However, there was one fund that received the SFA. United Food and Commercial Workers Union Local 152 Retail Meat Pension Plan, a Mount Laurel, NJ, plan received SFA and interest in the amount of $279.3 million for the more than 10k plan participants.

There currently are 114 names on the waitlist. Of those, 27 have been invited to submit applications. As the data above reflects, 8 of those applications have been approved, 12 are currently under review, while another 7 have been withdrawn presumably to have the submission corrected and resubmitted. In addition to that activity, 112 of the 114 funds have locked-in a valuation date for SFA measurement (discount rate). Ninety-two percent of those chose 12/31/22, while 2 have no lock-up and the other 9 have chosen dates between December 31, 2022 and November 30, 2023. As a reminder, the SFA is based on a series of discount rates. The lower the rate, the greater the potential SFA. Using the 10-year Treasury yield as a proxy for the discount rate, those plans locking in an evaluation date as of year-end 2022 have done alright, as the yield at the end of 2022 was 3.88%, while it currently stands at 4.63% (4/29 at 3:39 pm).

We’ll have to see if the others have faired as well. In the meantime, the higher US interest rates have certainly helped from an investment standpoint, as the current environment is providing 5%+ YTM investment grade bond portfolios. The higher rates reduce the cost of those future promises while extending the coverage period to secure benefits through a cash flow matching investment strategy.