By: Russ Kamp, CEO, Ryan ALM, Inc.

Welcome to Columbus and Indigenous Peoples’ Day. Bond markets are closed and the equity markets remain open. Columbus Day remains a federal holiday, but with most federal employees already furloughed, it will not be a day to celebrate for many.

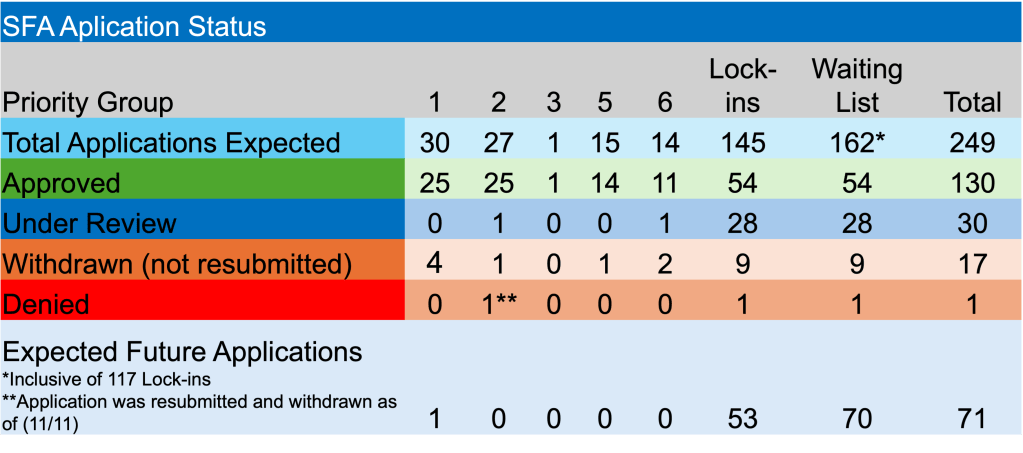

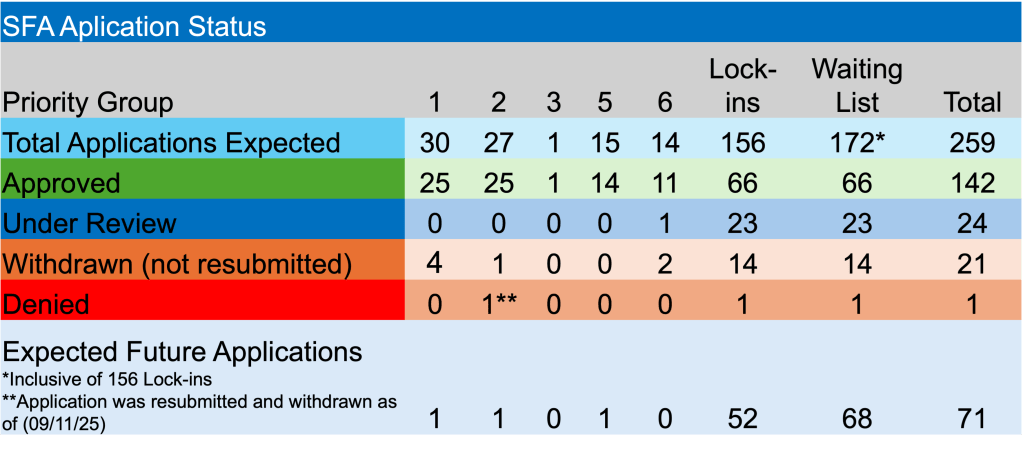

Regarding ARPA and the PBGC’s activity implementing this critical legislation, last week proved a busy one as there were three new applications received, two approved, and one withdrawn. There was also a plan added to the burgeoning waitlist. Happy to report that there were no applications denied or required to rebate a portion of the SFA as a result of census errors.

Now for the details. Ironworkers’ Local 340 Retirement Income Plan, Operative Plasterers & Cement Masons Local No. 109 Pension Plan, and Dairy Employees Union Local #17 Pension Plan, each a non-priority group member, filed their initial applications seeking a combined $60.4 million in SFA for nearly 3k plan participants. The PBGC has 120-days to act on these applications.

Pleased to report that two plans, Local 734 Pension Fund and the Retirement Plan of the Millmen’s Retirement Trust of Washington received approval for their initial applications, and they will receive $89.5 and $7.2 million, respectively for their combined 2,597 members. The PBGC has now awarded $74.3 billion in SFA grants to support the pensions for 1.828 million workers.

In other ARPA news, Pension Plan of the Pension Fund for Hospital and Health Care Employees – Philadelphia and Vicinity has withdrawn its initial application seeking $229.8 million in SFA that would support 11,084 members. Finally, the Buffalo Carpenters Pension Fund has added their name to the waitlist. They immediately secured the valuation date as July 31, 2025. Good luck to them as there are 67 plans currently on the waitlist that have yet to submit an application.

I’ve mentioned on several occasions the approaching deadline to file an initial application seeking SFA approval. I do hope that an extension of the filing deadline is approved. There are a lot of American workers who should be provided the full benefits that they have been promised and could secure through the ARPA legislation. This should be a bi-partisan effort.