By: Russ Kamp, CEO, Ryan ALM, Inc.

P&I is running a story today about two U.S. Congressmen, Representatives Tim Walberg, R-Mich., and Rick Allen, R-Ga., who have produced a Feb. 20 letter to Attorney General Pam Bondi regarding excess Special Financial Assistance (SFA) payments to multiemployer plans under the ARPA pension legislation that has been implemented/overseen by the PBGC. They are demanding that the Justice Department look into the erroneous payments made to some of the SFA recipients base on incorrect census data.

This issue was first raised by the PBGC’s Office of Inspector General back in November 2023 when they found that while the agency required the pension fund to provide a list of all plan participants and proof of a search for deceased participants, “the PBGC did not cross-check that information with the Social Security Administration’s Death Master File — the source recommended by the Government Accountability Office for reducing improper payments to dead people.” Good catch, PBGC. Clearly, no one wants to see incorrect payments made, but for these Congressman to be encouraging a review at this time seems a little misplaced, as the repayment of excess funds has been ongoing since last April when Central States, Southeast & Southwest Areas Pension Plan repaid $126.7 million representing 0.35% of the SFA grant received.

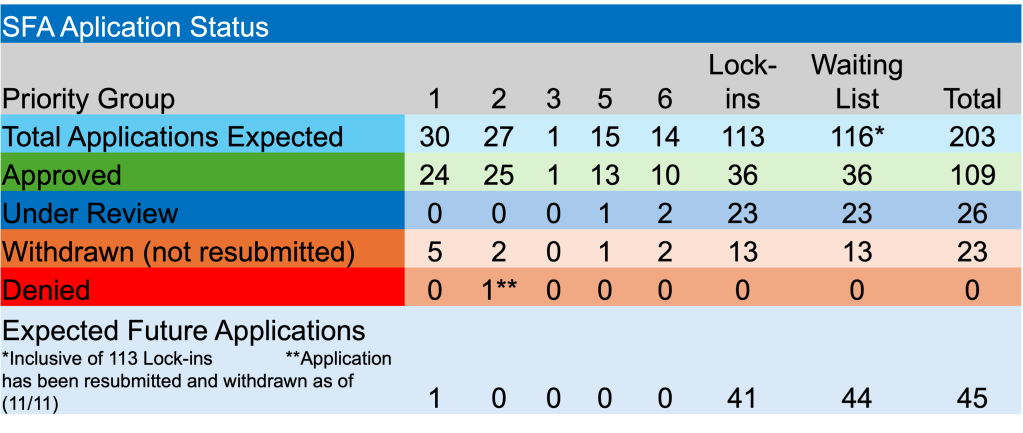

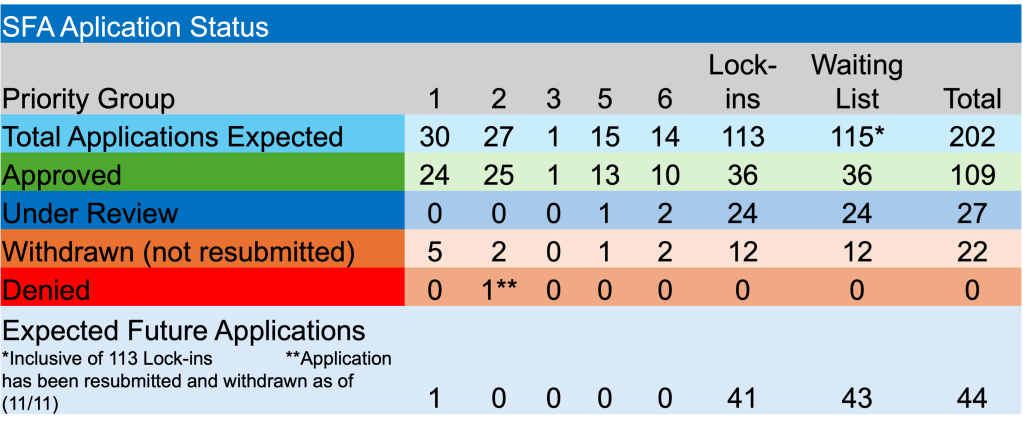

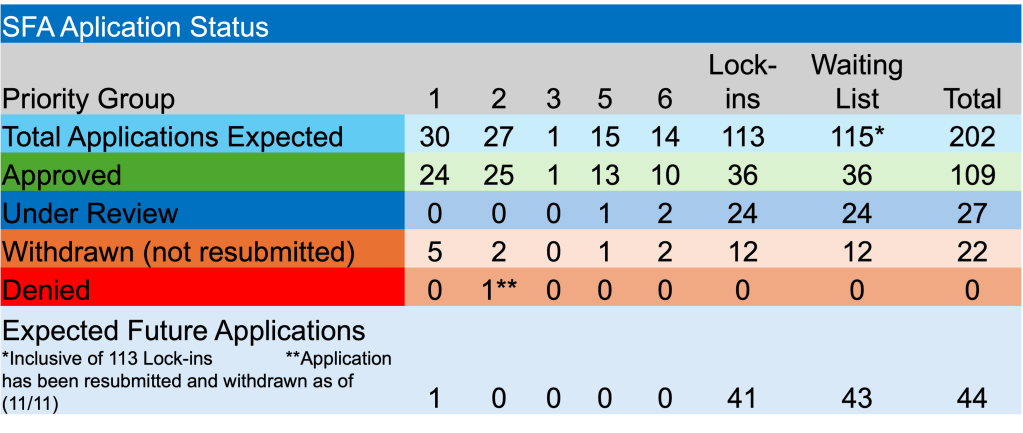

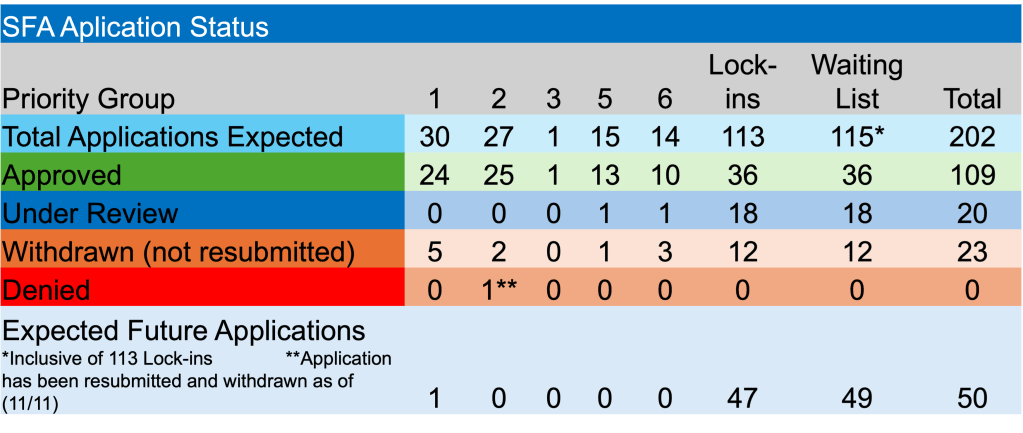

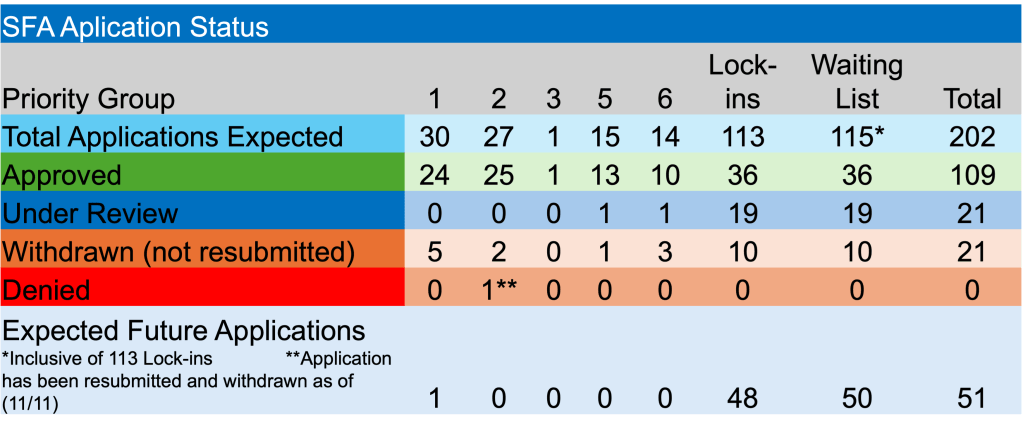

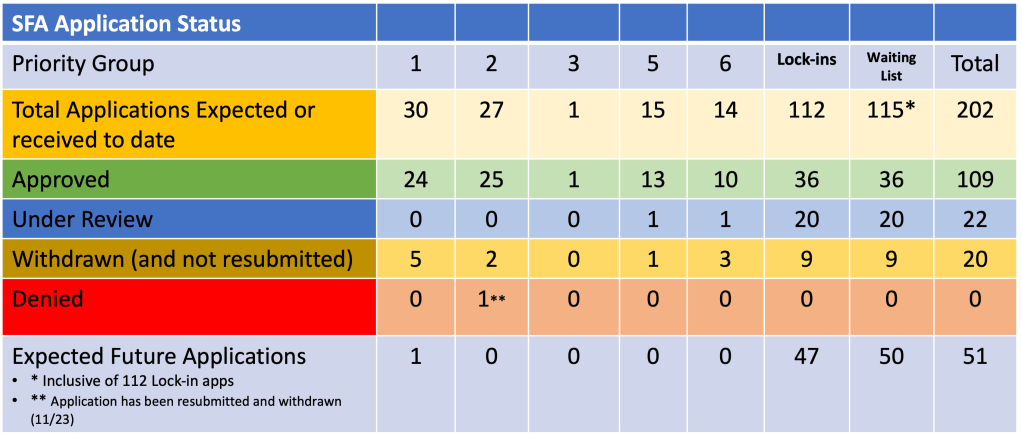

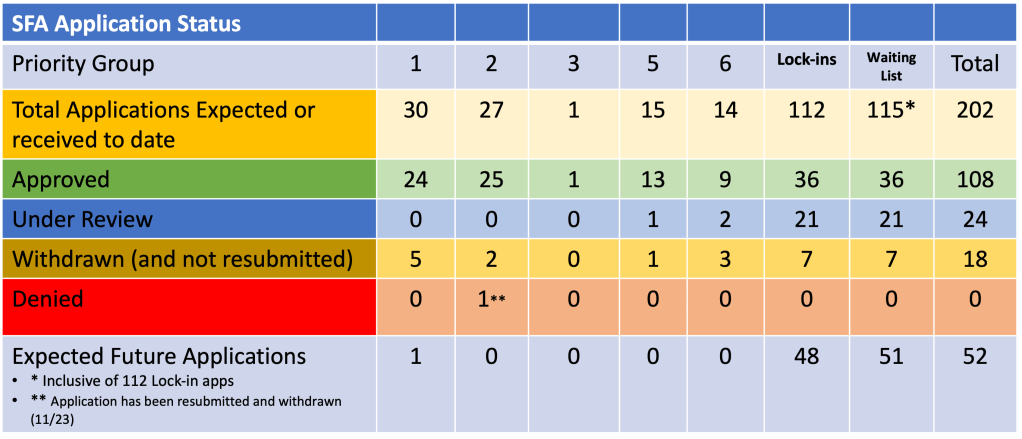

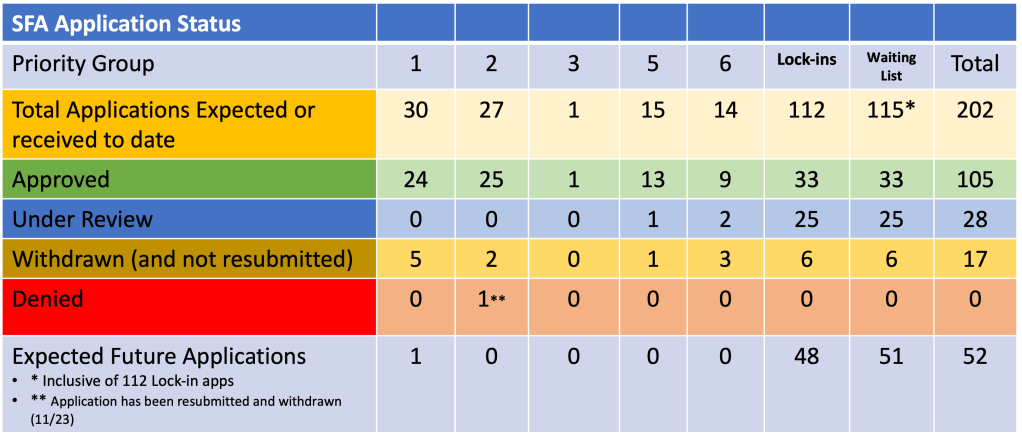

Since the repayment by Central States, the PBGC has worked diligently with 60 pension plans that received SFA prior to the use of the SSA’s DMF to make sure that any excess SFA is recaptured. As of February 21, 2025, 38 plans have repaid $180 million in excess SFA from total grants paid of $43.6 billion or 0.41%. The 38 plans represent 63% of the cohort that might have received excess grant money. Is the $180 million earth-shattering? No. Will it dramatically impact the Federal budget deficit running at roughly $2 trillion per year? Again, no. Might this unfortunate situation tarnish the huge success that ARPA has been? Unfortunately, it just might.

For these Congressman to only now seek to get the Justice Department involved seems misplaced as nothing more than a political hit job. Instead of creating waves, they should be celebrating the fact that ARPA has helped to secure the rightfully earned retirement benefits for 1.53 million American workers and retirees (oh, and they are taxpayers, too) through nearly $71 billion in SFA grants to date. The amount of economic activity created from these monthly benefits will support local businesses and jobs for years to come. Fortunately, there are still more than 90 multiemployer plans that might yet collect some SFA grant money. Let’s hope that they do.

None of the members of these plans ever wanted to be in a situation where their earned benefits might be slashed or worse, eliminated. Yet, that’s exactly where they found themselves following the passage of MPRA. Thank goodness that ARPA was signed into law in March 2021 before more damage was done to struggling multiemployer funds. I’m not sure that I can point to another piece of pension legislation enacted during my 43-year career that has had such a beneficial impact on our pensioners. Most of what I’ve witnessed is the whittling away of benefits.