By: Russ Kamp, CEO, Ryan ALM, Inc.

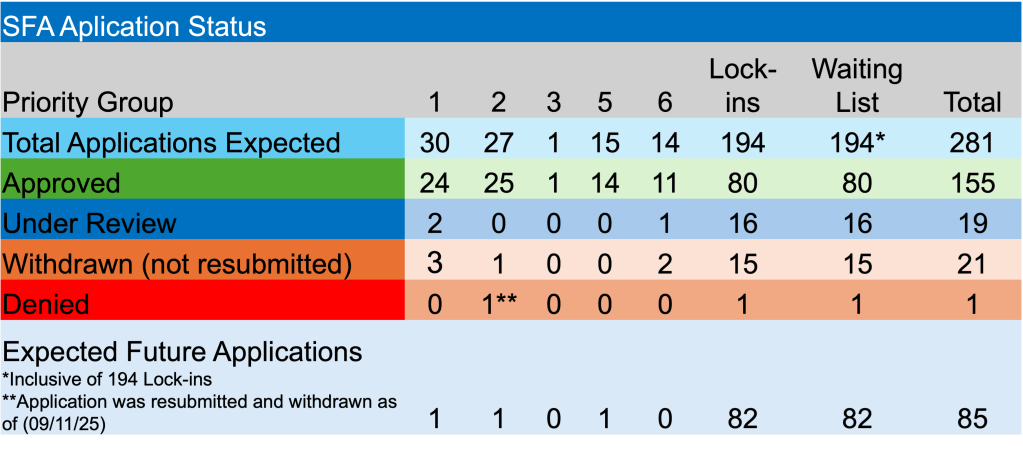

It looks like those of us in the Northeast will finally get some respite from the bitter cold, as temps will moderate this week and actually hit the 30s. However, those multiemployer pension plans currently sitting on the waitlist and classified as a Plan Terminated by Mass Withdrawal before 2020 Plan Year, continue to be frozen in place. According to the PBGC’s latest update, there are 80 plans that fall under the Mass Withdrawal classification. I’ll share more info on this subject later in this post.

Regarding last week’s activity, the PBGC is reporting that one fund, Operative Plasterers & Cement Masons Local No. 109 Pension Plan, a Troy, MI, construction union, will receive $13.7 million for the 1,439 plan members. In addition to the one approval, there was another fund that withdrew its initial application. Norfolk, VA-based International Association of Bridge, Structural, Ornamental and Reinforcing Ironworkers Local No. 79 Pension Fund was seeking $14.6 million in SFA for 462 participants in the plan.

There were no applications submitted for review. It appears that only one non-mass withdrawal plan, Plasterers Local 79 Pension Plan, remains on the waitlist. Fortunately, there were no plans asked to rebate a portion of the SFA grant due to census errors or any funds deemed no eligible.

Regarding the 80 mass withdrawal funds currently sitting on the waitlist, MEPs terminated by mass withdrawal under ERISA §4041A(a)(2) are explicitly ineligible for SFA under ARP/IRA rules, regardless of application timing. Furthermore:

No “initial application” option exists post-termination date.

Mass withdrawal means that all/substantially all employers completely withdraw leading to a plan termination.

PBGC SFA statute excludes §4041A(a)(2) terminated plans.

For the 80 funds sitting on the waitlist, it seems like a long shot that the APRA legislation will be amended to accommodate these funds seeking SFA. I’ll continue to monitor this situation in future posts.